Over the past six months, Expeditors’s shares (currently trading at $113) have posted a disappointing 9.5% loss, well below the S&P 500’s 10.3% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Expeditors, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why we avoid EXPD and a stock we'd rather own.

Why Do We Think Expeditors Will Underperform?

Expeditors (NYSE:EXPD) offers air and ocean freight as well as brokerage services.

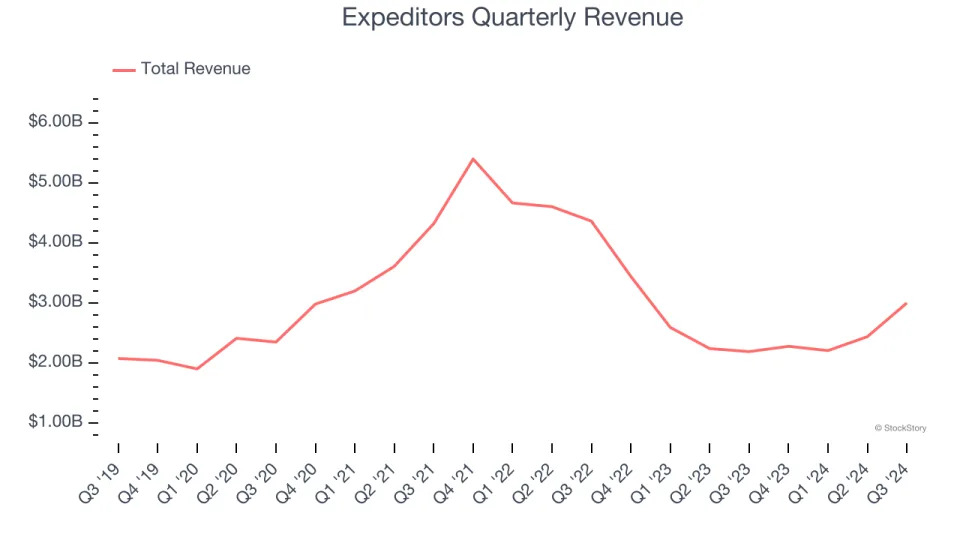

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Expeditors’s sales grew at a sluggish 3.5% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

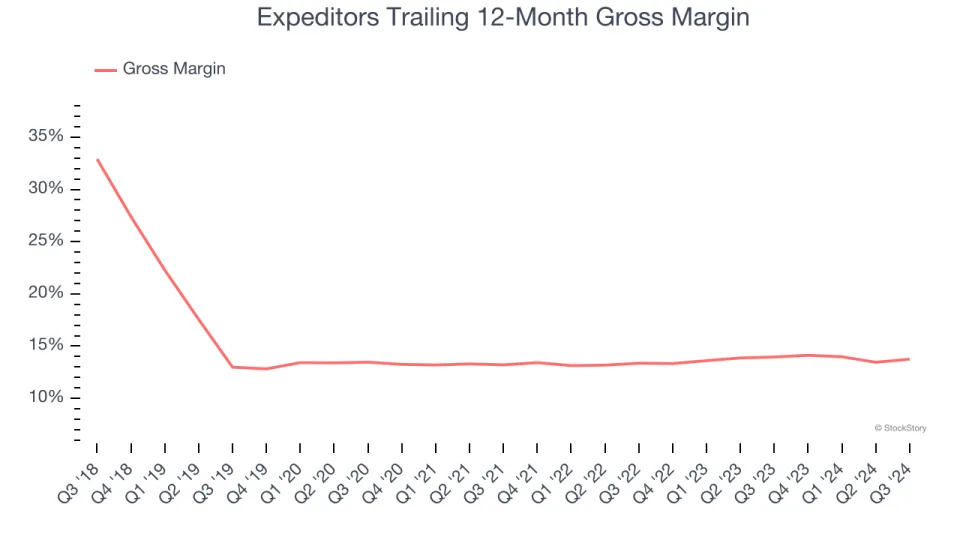

2. Low Gross Margin Reveals Weak Structural Profitability

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Expeditors has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.5% gross margin over the last five years. Said differently, Expeditors had to pay a chunky $86.50 to its suppliers for every $100 in revenue.

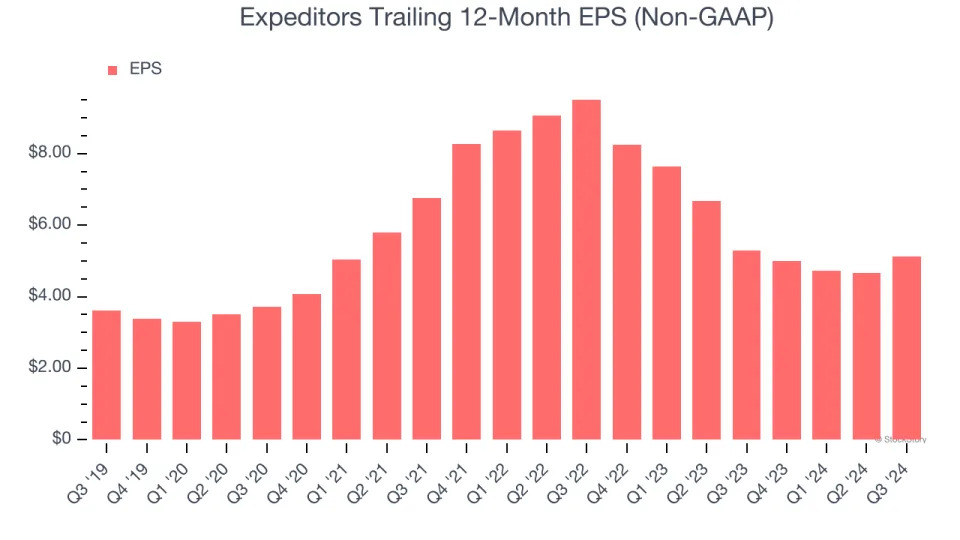

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Expeditors’s EPS grew at an unimpressive 7.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.5% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Expeditors doesn’t pass our quality test. Following the recent decline, the stock trades at 22.1× forward price-to-earnings (or $113 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce .

Stocks We Like More Than Expeditors

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .