Key Takeaways

Among the companies feeling the impact of President Donald Trump's tariffs announced over the weekend is alcoholic beverage giant Constellation Brands ( STZ ).

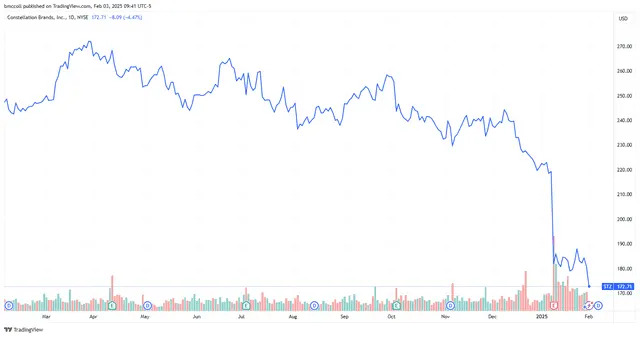

Shares of the firm that imports Modelo and Corona beers from Mexico fell 4% Monday morning after the White House imposed a 25% tariff on imports from that country and Canada, and a 10% tariff on products from China.

The potential impact of the sanctions led Piper Sandler to downgrade the stock to "neutral" from "overweight," and slash the price target to $200 from $245, according to reports.

Mexican beer sales have been a big driver of Constellation Brands' recent results. Its Modelo Especial overtook Anheuser-Busch InBev's ( BUD ) Bud Light as the U.S.'s best-selling beer in 2023 following a boycott over the latter's relationship with transgender social media influencer Dylan Mulvaney.

Last month, Constellation Brands reported a 3% year-over-year rise in beer sales in its fiscal 2025 third-quarter results, but wine and spirits revenue slumped 14%. It also lowered its full-year outlook, warning that it sees more "normalized spending" by consumers in the future.

Constellation Brands shares sank to their lowest level in more than four years.

Read the original article on Investopedia