Modular home and building manufacturer Skyline Champion (NYSE:SKY) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 15.3% year on year to $644.9 million. Its non-GAAP profit of $1.04 per share was 27.8% above analysts’ consensus estimates.

Is now the time to buy Skyline Champion? Find out in our full research report .

Skyline Champion (SKY) Q4 CY2024 Highlights:

“Champion’s strong performance this quarter reflects our ability to earn new customers and deliver profitable growth across our family of brands,” said Tim Larson, President and Chief Executive Officer of Champion Homes.

Company Overview

Founded in 1951, Skyline Champion (NYSE:SKY) is a manufacturer of modular homes and buildings in North America.

Home Builders

Traditionally, homebuilders have built competitive advantages with economies of scale that lead to advantaged purchasing and brand recognition among consumers. Aesthetic trends have always been important in the space, but more recently, energy efficiency and conservation are driving innovation. However, these companies are still at the whim of the macro, specifically interest rates that heavily impact new and existing home sales. In fact, homebuilders are one of the most cyclical subsectors within industrials.

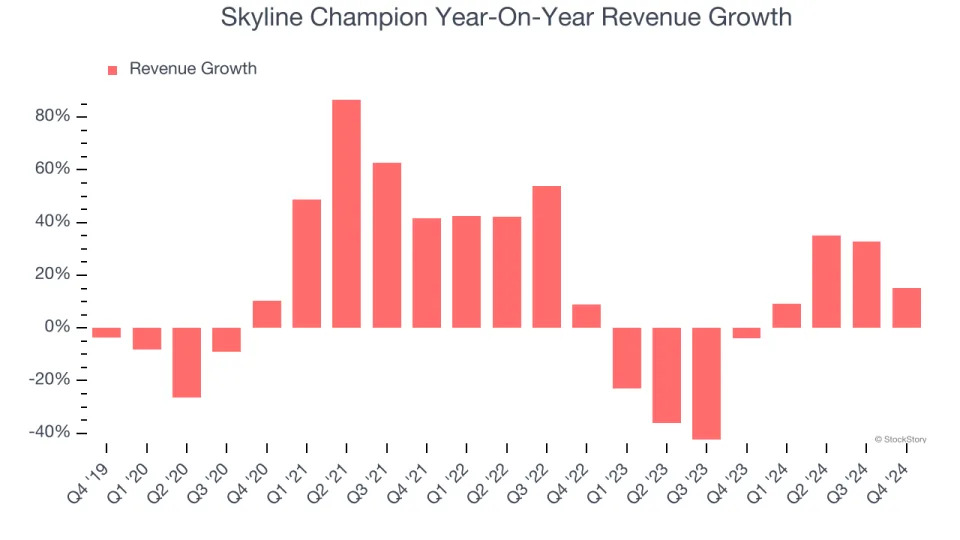

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Skyline Champion’s sales grew at an impressive 11.7% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Skyline Champion’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.1% over the last two years.

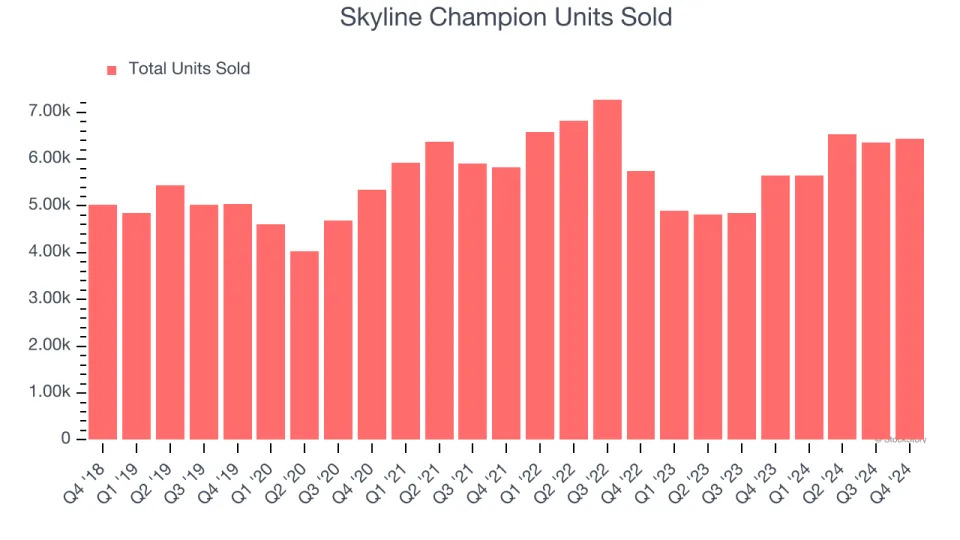

We can better understand the company’s revenue dynamics by analyzing its units sold, which reached 6,437 in the latest quarter. Over the last two years, Skyline Champion’s units sold were flat. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Skyline Champion reported year-on-year revenue growth of 15.3%, and its $644.9 million of revenue exceeded Wall Street’s estimates by 9.2%.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

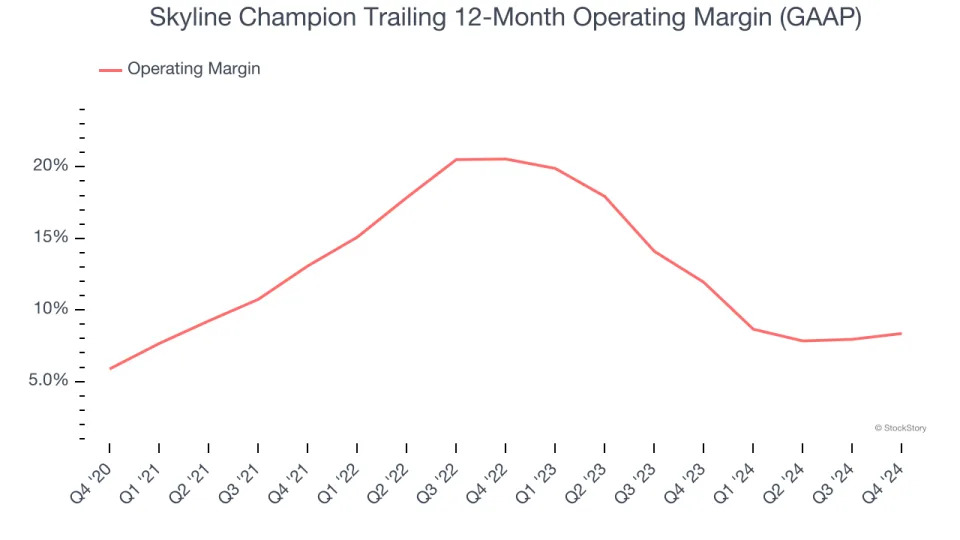

Adjusted Operating Margin

Skyline Champion has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Skyline Champion’s operating margin rose by 2.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Skyline Champion generated an operating profit margin of 11.3%, up 1.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

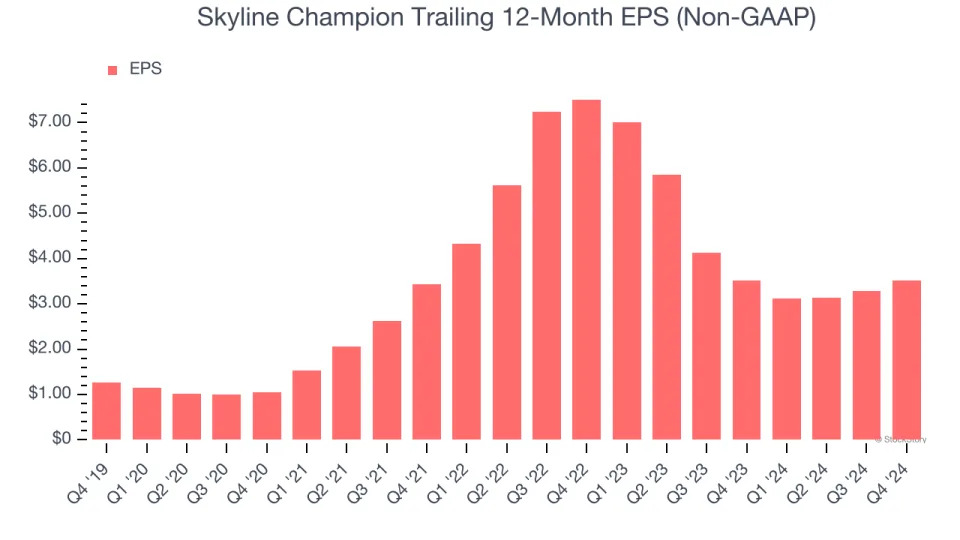

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Skyline Champion’s EPS grew at an astounding 22.5% compounded annual growth rate over the last five years, higher than its 11.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Skyline Champion’s earnings can give us a better understanding of its performance. As we mentioned earlier, Skyline Champion’s operating margin expanded by 2.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Skyline Champion, its two-year annual EPS declines of 31.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Skyline Champion can return to earnings growth in the future.

In Q4, Skyline Champion reported EPS at $1.04, up from $0.82 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Skyline Champion’s full-year EPS of $3.51 to grow 6.8%.

Key Takeaways from Skyline Champion’s Q4 Results

We were impressed by how significantly Skyline Champion blew past analysts’ sales volume expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 5.4% to $97.80 immediately after reporting.

Indeed, Skyline Champion had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .