Dredging and coastal protection company Great Lakes Dredge & Dock (NASDAQ:GLDD) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 11.6% year on year to $202.8 million. Its GAAP profit of $0.29 per share was 27.9% above analysts’ consensus estimates.

Is now the time to buy Great Lakes Dredge & Dock? Find out in our full research report .

Great Lakes Dredge & Dock (GLDD) Q4 CY2024 Highlights:

Lasse Petterson, President and Chief Executive Officer, commented, “Great Lakes had an outstanding 2024, with strong project performance and exceptional financial results. We capped off the year with another strong quarter and ended 2024 with revenue of $762.7 million, net income of $57.3 million, and Adjusted EBITDA of $136.0 million, the latter two metrics being the second-highest in Great Lakes’ history. The bid market for 2024 hit a historic level of $2.9 billion of which Great Lakes won 33%. This further added to our substantial dredging backlog which as of the end of 2024 stood at $1.2 billion, with an additional $282.1 million in low bids and options pending award, providing expected revenue visibility well into 2026. At the end of the year, capital and coastal protection projects accounted for 94% of our backlog, which typically yield higher margins. The largest capital project bid in the year was the Sabine-Neches Contract 6 Deepening project, won by Great Lakes, with awarded base and open options totaling $235 million.

Company Overview

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

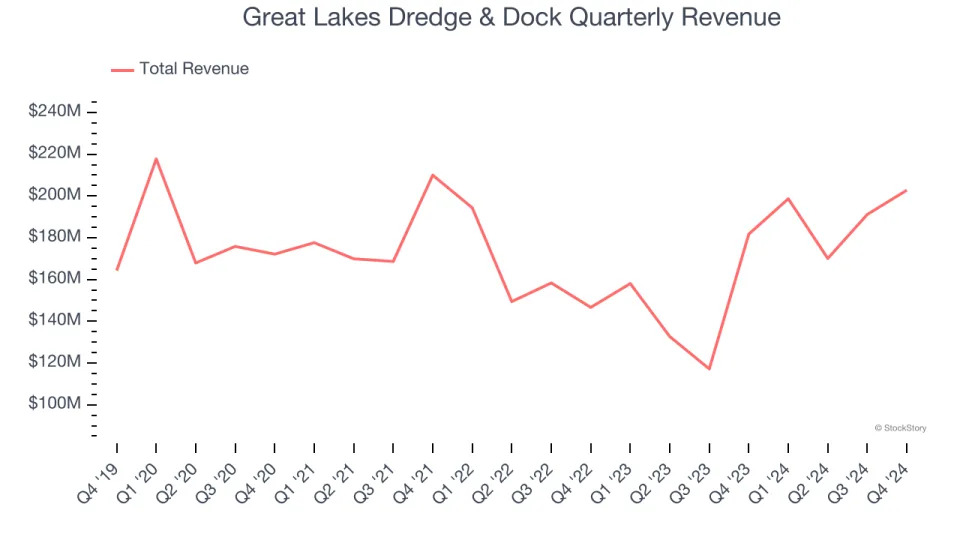

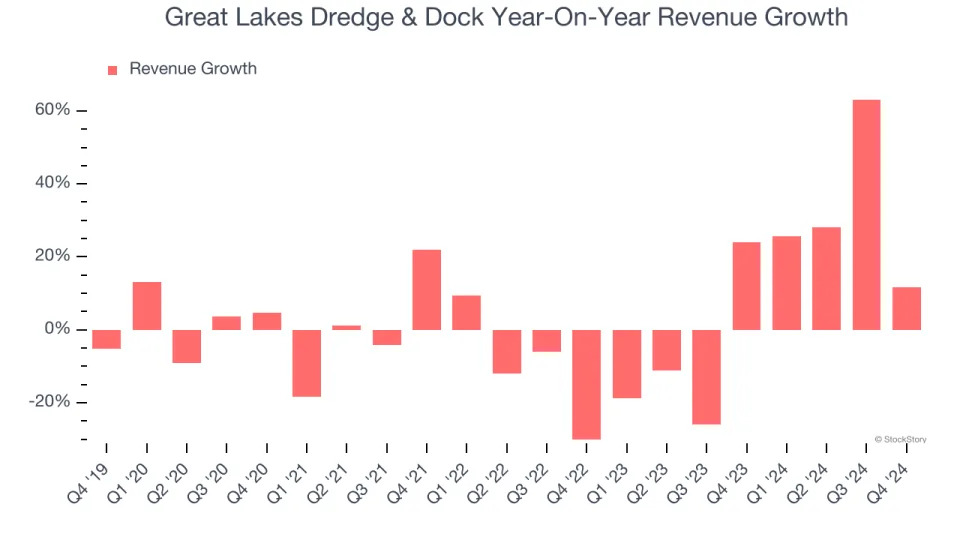

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Great Lakes Dredge & Dock’s sales grew at a weak 1.4% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Great Lakes Dredge & Dock’s annualized revenue growth of 8.4% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Great Lakes Dredge & Dock’s revenue grew by 11.6% year on year to $202.8 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and suggests its newer products and services will help sustain its recent top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

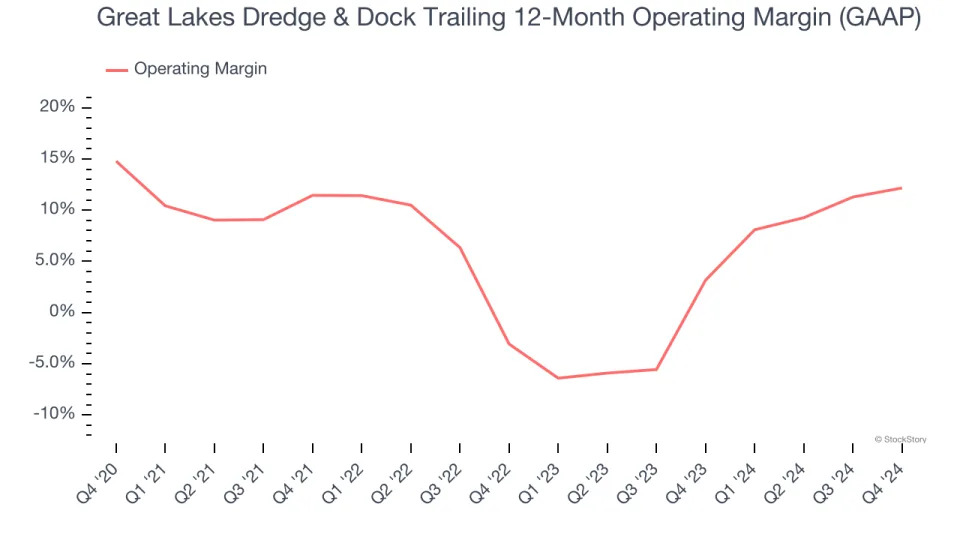

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Great Lakes Dredge & Dock has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.2%, higher than the broader industrials sector.

Looking at the trend in its profitability, Great Lakes Dredge & Dock’s operating margin decreased by 2.6 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Great Lakes Dredge & Dock become more profitable in the future.

In Q4, Great Lakes Dredge & Dock generated an operating profit margin of 14.8%, up 3.3 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

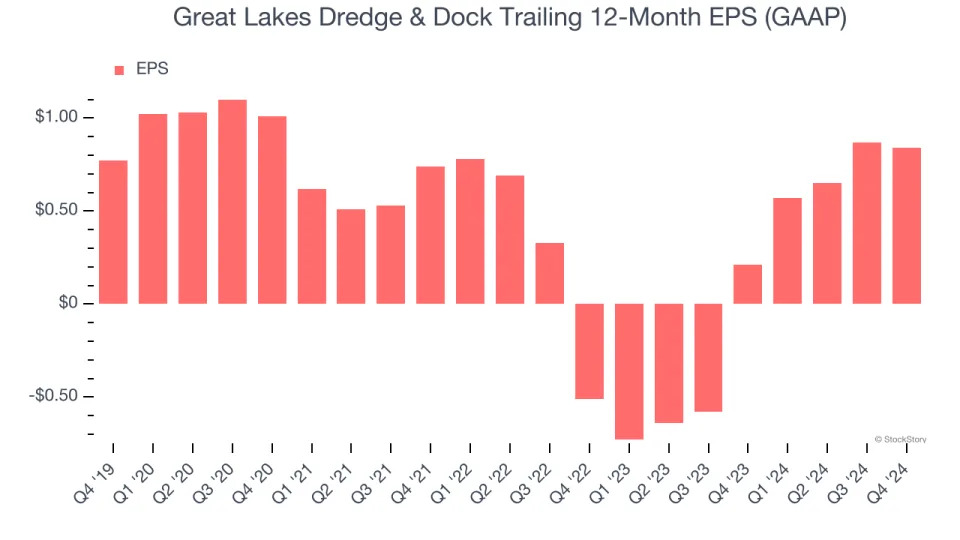

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Great Lakes Dredge & Dock’s weak 1.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Great Lakes Dredge & Dock, its two-year annual EPS growth of 91% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Great Lakes Dredge & Dock reported EPS at $0.29, down from $0.32 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Great Lakes Dredge & Dock’s full-year EPS of $0.84 to shrink by 3.6%.

Key Takeaways from Great Lakes Dredge & Dock’s Q4 Results

We liked that Great Lakes Dredge & Dock beat analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue missed. The stock traded up 1.1% to $11.12 immediately after reporting.

Great Lakes Dredge & Dock had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .