Glass and windows manufacturer Tecnoglass (NYSE:TGLS) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 23.1% year on year to $239.6 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $980 million at the midpoint. Its non-GAAP profit of $1.05 per share was 2.7% above analysts’ consensus estimates.

Is now the time to buy Tecnoglass? Find out in our full research report .

Tecnoglass (TGLS) Q4 CY2024 Highlights:

José Manuel Daes, Chief Executive Officer of Tecnoglass, commented, “I am thrilled with our performance in 2024, as we delivered another year of record results driven by market share gains in our single-family residential business, continued momentum in multi-family/commercial demand, and the operational advantages of our vertically integrated business model. Our investments in automation and capacity enhancements continue to yield significant returns, driving operational efficiencies and enabling us to swiftly adapt to growing demand for our innovative products. Despite currency headwinds in the first half of the year, we maintained industry-leading margins while generating record operating and free cash flow, demonstrating the resilience of our business model. Our strong capital position enabled us to achieve a net cash position at year end while also returning significant capital to shareholders throughout the year. With a record backlog and our strategic growth initiatives gaining momentum, we remain confident in our ability to drive further value creation through continued market share gains and operational discipline.”

Company Overview

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE:TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Sales Growth

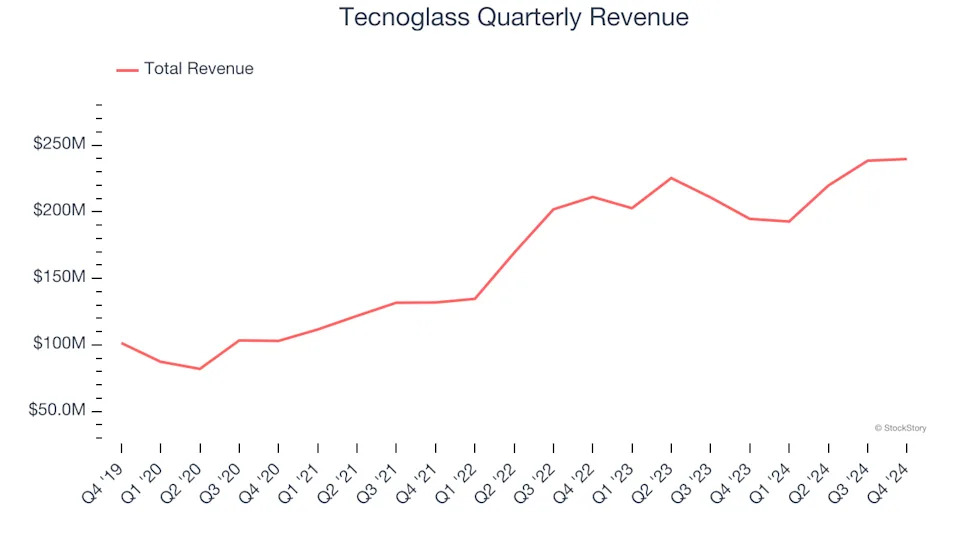

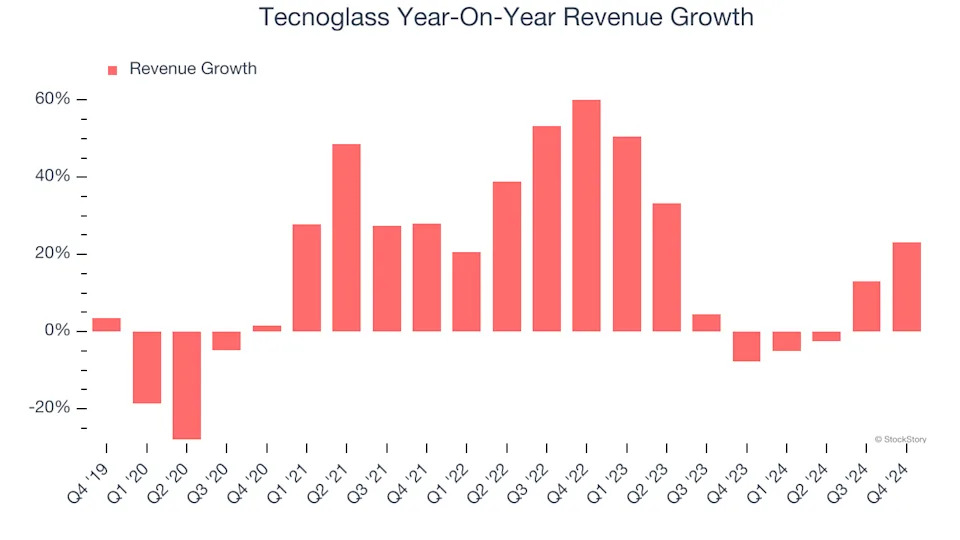

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Tecnoglass’s 15.6% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tecnoglass’s annualized revenue growth of 11.5% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Tecnoglass’s year-on-year revenue growth of 23.1% was excellent, and its $239.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.3% over the next 12 months, similar to its two-year rate. Despite the slowdown, this projection is admirable and suggests the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

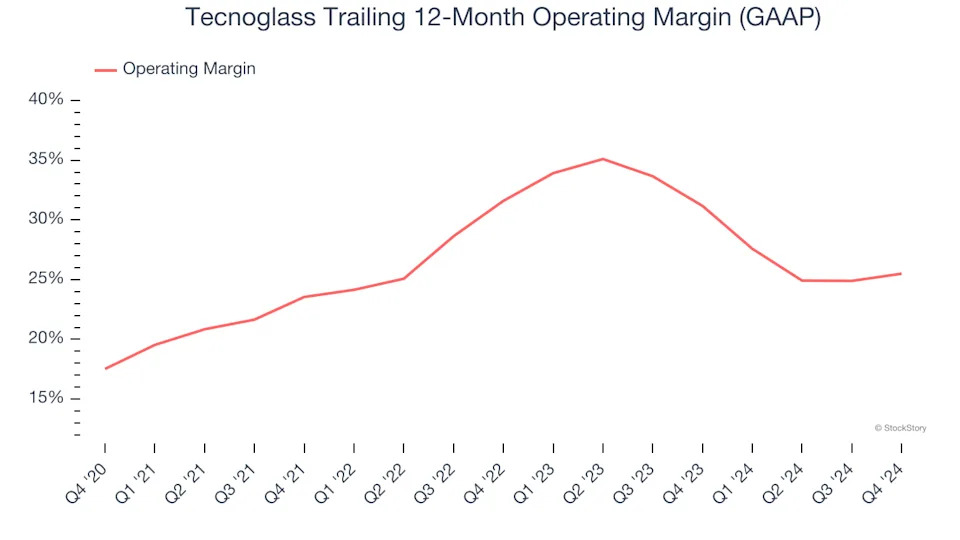

Tecnoglass has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Tecnoglass’s operating margin rose by 8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Tecnoglass generated an operating profit margin of 28%, up 2 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

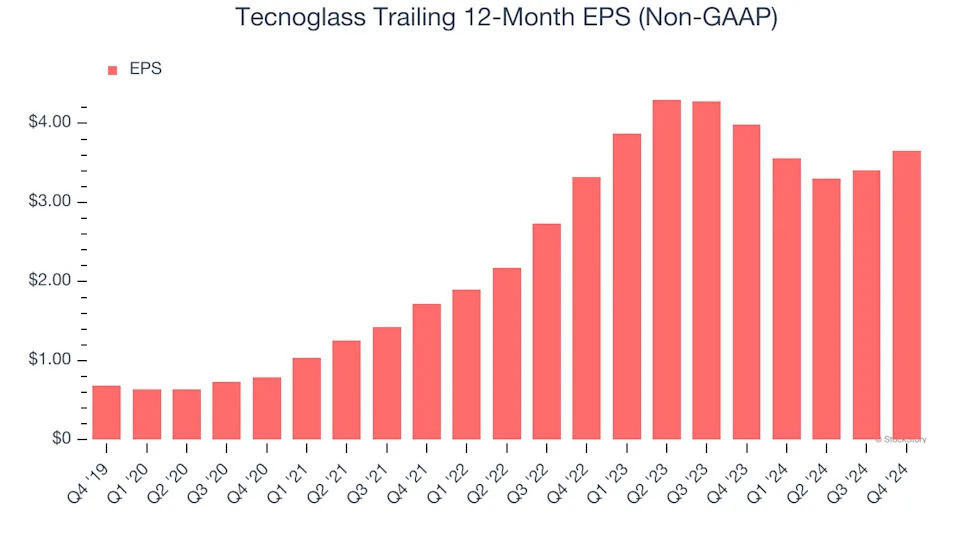

Tecnoglass’s EPS grew at an astounding 39.8% compounded annual growth rate over the last five years, higher than its 15.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Tecnoglass’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Tecnoglass’s operating margin expanded by 8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Tecnoglass, its two-year annual EPS growth of 4.8% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Tecnoglass reported EPS at $1.05, up from $0.80 in the same quarter last year. This print beat analysts’ estimates by 2.7%. Over the next 12 months, Wall Street expects Tecnoglass’s full-year EPS of $3.65 to grow 16.5%.

Key Takeaways from Tecnoglass’s Q4 Results

It was good to see Tecnoglass top analysts’ EBITDA and EPS expectations this quarter. On the other hand, its full-year EBITDA guidance slightly missed and its revenue was in line with Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 5.3% to $73.59 immediately after reporting.

Is Tecnoglass an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .