Casual sandwich chain Potbelly (NASDAQ:PBPB) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 7.3% year on year to $116.6 million. Its non-GAAP profit of $0.13 per share was 92.6% above analysts’ consensus estimates.

Is now the time to buy Potbelly? Find out in our full research report .

Potbelly (PBPB) Q4 CY2024 Highlights:

Bob Wright, President and Chief Executive Officer of Potbelly Corporation, commented, “We are pleased with what we have accomplished in 2024 as our team did a tremendous job executing against our five-pillar strategy. From re-igniting unit growth with 23 new shop openings and adding 115 shops to our open and committed shop total, to driving a 15% increase in Adjusted EBITDA and developing strong growth drivers with the enhancement of our perks loyalty program and significant menu innovation work, we believe we have taken yet another step toward achieving Potbelly’s long-term growth objectives. As we look ahead, we will continue to drive comp sales growth through menu innovation and investments in customer-facing digital assets, accelerate unit growth with a strong unit development pipeline and modernize our footprint, and exercise smart cost management to further improve profitability. We believe we have positioned Potbelly well for growth in 2025 and beyond.”

Company Overview

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ:PBPB) today is a chain known for its toasty sandwiches.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $462.6 million in revenue over the past 12 months, Potbelly is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

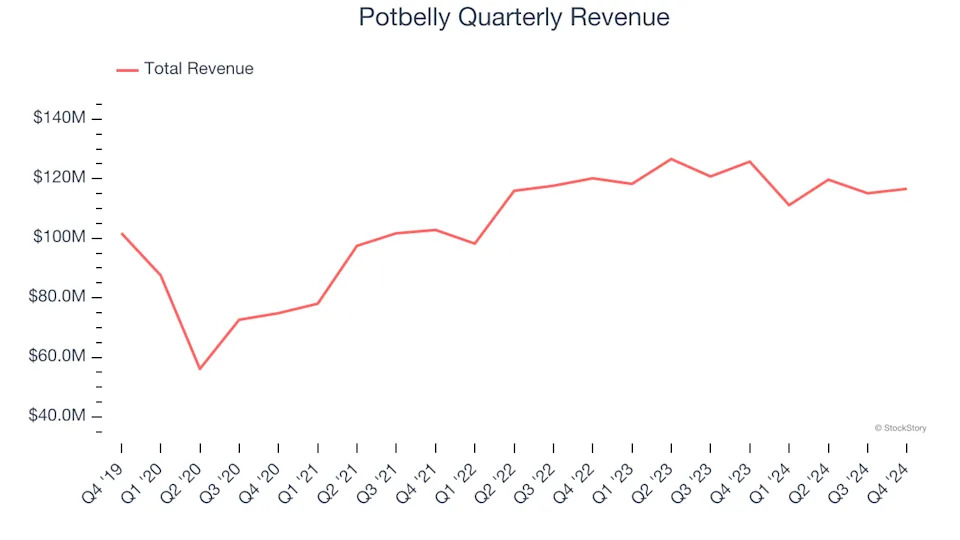

As you can see below, Potbelly’s 2.5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was weak, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Potbelly reported a rather uninspiring 7.3% year-on-year revenue decline to $116.6 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, similar to its five-year rate. Although this projection implies its newer menu offerings will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Restaurant Performance

Number of Restaurants

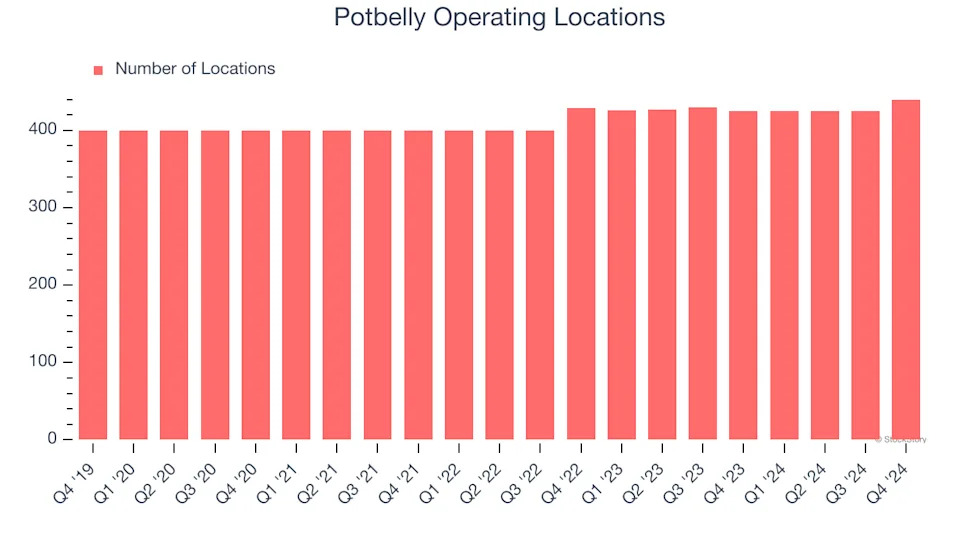

Potbelly sported 440 locations in the latest quarter. Over the last two years, it has opened new restaurants quickly, averaging 2.7% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

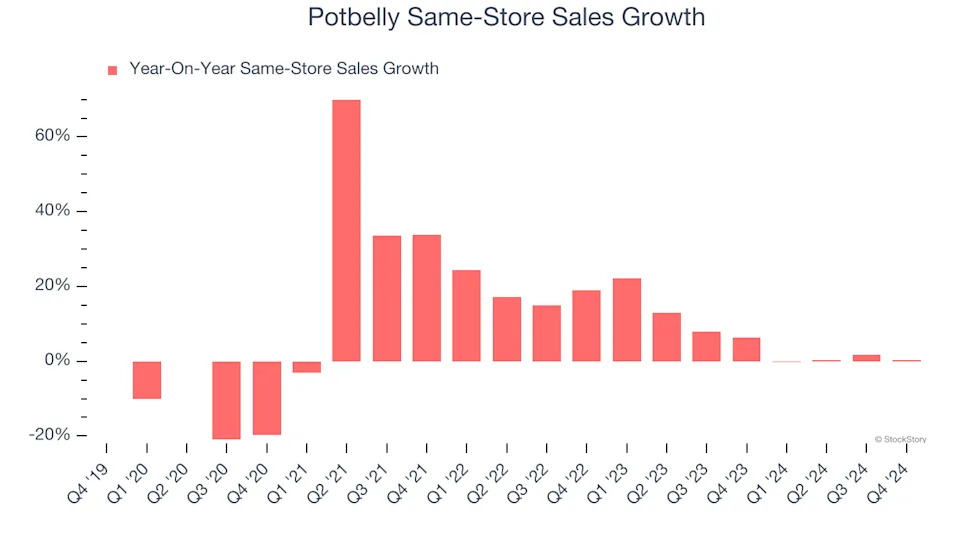

Potbelly has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6.5%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Potbelly multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Potbelly’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Potbelly can reaccelerate growth.

Key Takeaways from Potbelly’s Q4 Results

We were impressed by how significantly Potbelly blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its same-store sales guidance for Q1 fell short. Zooming out, we think this was a mixed quarter. The areas below expectations seem to be driving the move, and shares traded down 7.1% to $10.99 immediately following the results.

So should you invest in Potbelly right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .