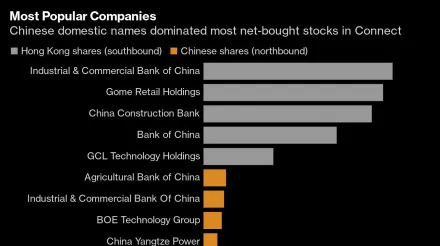

Investors Eye IPO Access as Hong Kong Stock Link Turns 10

(Bloomberg) -- A decade after China opened up its exchanges to a broad swath of international investors through a trading link with Hong Kong, investors are craving deeper access.Most Read from BloombergIn Cleveland, a Forgotten Streetcar Bridge Gets a Long-Awaited LiftAmtrak Wins $300 Million to Fix Its Unreliable NJ-to-NYC ServiceA Bug’s Eye View of Mexico City’s Modernist ArchitectureNYC Congestion Pricing Plan With $9 Toll to Start in JanuaryZimbabwe City of 700,000 at Risk of Running Dry by