The Direxion Daily Semiconductor Bull 3X Shares (SOXL) jumped 6% on Thursday amid a wider rally in tech stocks a day after mildly optimistic remarks by U.S. central bank Chair Jerome Powell calmed jittery markets.

SOXL's gains recovered some ground lost—it is down 21% over the past month—as the largest holdings in its portfolio swooned, including Nvidia Corp., Advanced Micro Devices Inc., Broadcom Inc. and Qualcomm Inc.

SOXL, consistently among the most actively-traded ETFs, seeks three times daily exposure from an index of 30 of the largest U.S.-listed semiconductor companies, including manufacturers and providers of equipment and services focused on the industry. The fund's index uses market cap-weighting, with the top five securities capped at 8% and the remaining securities at 4%.

Until the start of April, those companies soared over the past year as demand for chips used in artificial intelligence technology mushroomed, sweeping up funds focused on semiconductors. Despite its recent dip, SOXL has skyrocketed more than 187% over the past year, according to etf.com data. The single stock T-Rex 2X Long NVIDIA Daily Target ETF (NVDX) was the best-performing ETF in the first quarter of 2024, with a massive 205% return.

SOXL and Chipmakers' Recent Struggles

But the sector has struggled more recently as many investors took profits, including a sell-off of semiconductor stocks. Nvidia, the AI chip manufacturing giant, has fallen 3.5% over the past month to trade at $858 per share. Less than six weeks ago, it hit an all-time high over $950. Advanced Micro Devices (AMD) has plunged more than 19% since early April, despite rising more than 1% on Thursday. SOXL's holdings in each are the largest in its portfolio.

On Tuesday, the sector offered the latest evidence of its cooling with AMD reporting disappointing guidance for second quarter earnings and Super Micro Computer, which has gained significantly from the AI boom, falling short of analysts' projections for Q1 revenues. But other signs were more encouraging with Korean manufacturer and Nvidia supplier, SK Hynix, reporting that it had sold out of its high-bandwidth memory chips used in AI for 2024 and almost for 2025.

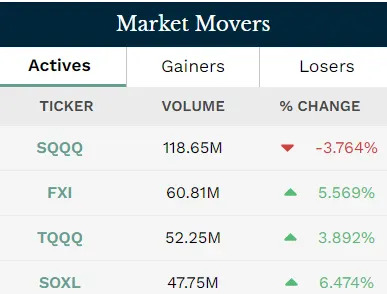

Active ETFs May 2

etf.com Senior Analyst Sumit Roy noted that "s emiconductor stocks took a breather in April after a rip-roaring AI-fueled rally sent them to record highs earlier this year."

"A disappointing earnings report from Intel and a tepid earnings report from AMD gave investors an excuse to take profits on chip stocks," he said. "But still, excitement over AI will likely keep a bid under these stocks, especially with the juggernaut in the space, Nvidia, due to report earnings later this month."

Permalink | © Copyright 2024 etf.com. All rights reserved