A Bitcoin strategic reserve in the US could be a “net negative” for the industry, as it could be used as a “political weapon” and even reversed if Democrats win the election in 2028 and decide to sell the stockpile, according to an industry executive.

“Broadly speaking, many misguided crypto folks wish for the US government to print dollars and purchase Bitcoin as part of a national stockpile [...] I believe these folks are asking for the wrong things,” said Maelstrom Fund chief investment officer Arthur Hayes in a Feb. 6 blog.

Hayes argued that the potential Bitcoin stockpile would simply be another financial asset that could be both bought and sold.

“There would be 1 million Bitcoin just sitting there, ready to be sold; it just takes a signature on a piece of paper,” said Hayes.

It turns a Bitcoin

Hayes, who was one of the founders of the BitMEX crypto exchange, acknowledged that a Bitcoin reserve would initially make Bitcoin’s price go “nuts” but said whether the US buys or sells more of it would be “primarily for political, and not financial, gains.”

If US President Donald Trump fails to slow inflation, stop wars and fix the food supply by 2026, the Democrats could build political momentum, win the House majority and potentially even “punish” crypto investors who supported the “Orange Man” in the 2024 election, Hayes said.

Others have been more optimistic about the prospect of a national Bitcoin stockpile.

Asset management firm VanEck recently predicted that a Bitcoin reserve could reduce America’s national debt by 35% by 2049, while Strategy’s executive chairman Michael Saylor believes it could strengthen the US dollar and help the US lead the world in the “21st-century digital economy.”

Hayes acknowledged that, in theory, Bitcoin would serve as a better treasury asset than most, highlighting the network’s immutable code, permissionless access, and it being the “purest monetary energy derivative humanity has imagined.”

Related: Inside Trump’s crypto agenda: Memecoins, SEC task force and Bitcoin reserve plans

Speculation for a Bitcoin reserve strengthened when Trump announced a sovereign wealth fund, which US Senator Cynthia Lummis — who introduced the Bitcoin reserve bill — later claimed was a “₿ig deal.”

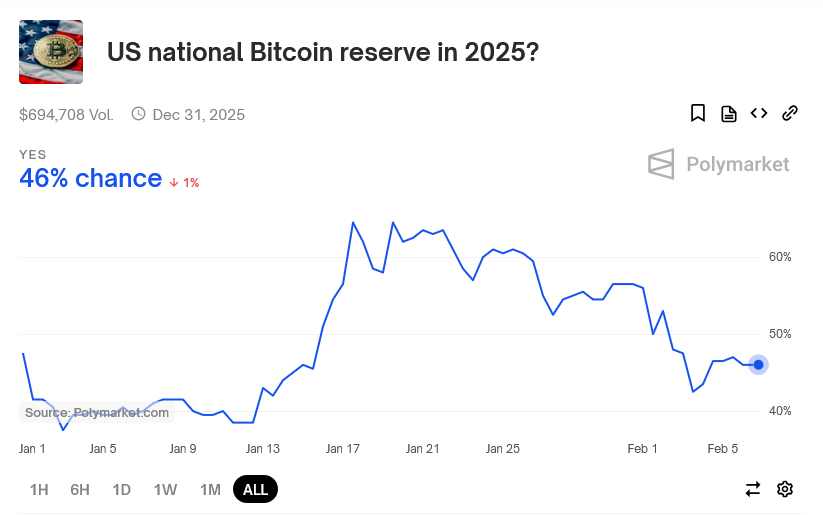

A strategic Bitcoin reserve under the Trump administration is still under consideration.

Prediction market platforms Polymarket and Kalshi have the odds of a Bitcoin reserve by 2025 as 46% and 58%, respectively.

In late 2023, Hayes also strongly opposed the spot Bitcoin exchange-traded funds before they were approved in January 2024. He argued that they could “completely destroy” Bitcoin as the funds would be vacuumed up into a vault, drying up transaction activity and thus disincentivizing miners to stay online.

“The end result is miners turn off their machines as they can no longer pay for the energy required to run them. Without the miners, the network dies, and Bitcoin vanishes.”

Magazine: How crypto laws are changing across the world in 2025