Missouri Representative Ben Keathley introduced House Bill 1217, which proposes the creation of a Bitcoin Strategic Reserve Fund to diversify the state’s investment portfolio.

On Feb. 6, Keathley filed HB 1217, proposing the US state of Missouri diversify its portfolio to include Bitcoin

Bitcoin hodl strategy for Missouri

In the introductory bill, Keathley recommended establishing a Bitcoin Strategic Reserve Fund to be overseen by the state treasurer. The Bitcoin fund would also be able to collect Bitcoin via gifts and donations from governmental entities and Missouri residents.

It would also require all government entities in Missouri to accept cryptocurrency in uses approved by the Department of Revenue, which would include taxes, fees, fines and other eligible payments. However, payees would be required to cover transaction fees.

Additionally, Keathley’s HB 1217 proposed a long-term Bitcoin hodl strategy for the state:

“The treasurer shall store all Bitcoin collected under sub-section 2 of this section for a minimum of five years from the date that the Bitcoin enters the state’s custody.”

Authority to invest in Bitcoin using state funds

The legislation would grant the Missouri state treasurer the authority to invest, purchase and hold Bitcoin using state funds.

The proposed effective date for HB 1217 is set for Aug. 28 and is subject to change based on further discussions. The second hearing for the bill was not scheduled at the time of writing.

Check out Cointelegraph’s analysis to learn more about Bitcoin reserves and sovereign wealth funds in the US .

Related: US Senator Hagerty introduces ‘GENIUS’ stablecoin bill

Missouri’s bill follows a similar initiative in Utah , where House Bill 230 advanced through the House on Feb. 6 and is now heading to the Senate.

Utah Representative Jordan Teuscher introduced the bill on Jan. 21. The bill proposed to give the state’s treasurer authority to allocate up to 5% of certain public funds to buy “qualifying digital assets,” such as BTC, high-cap crypto assets and stablecoins.

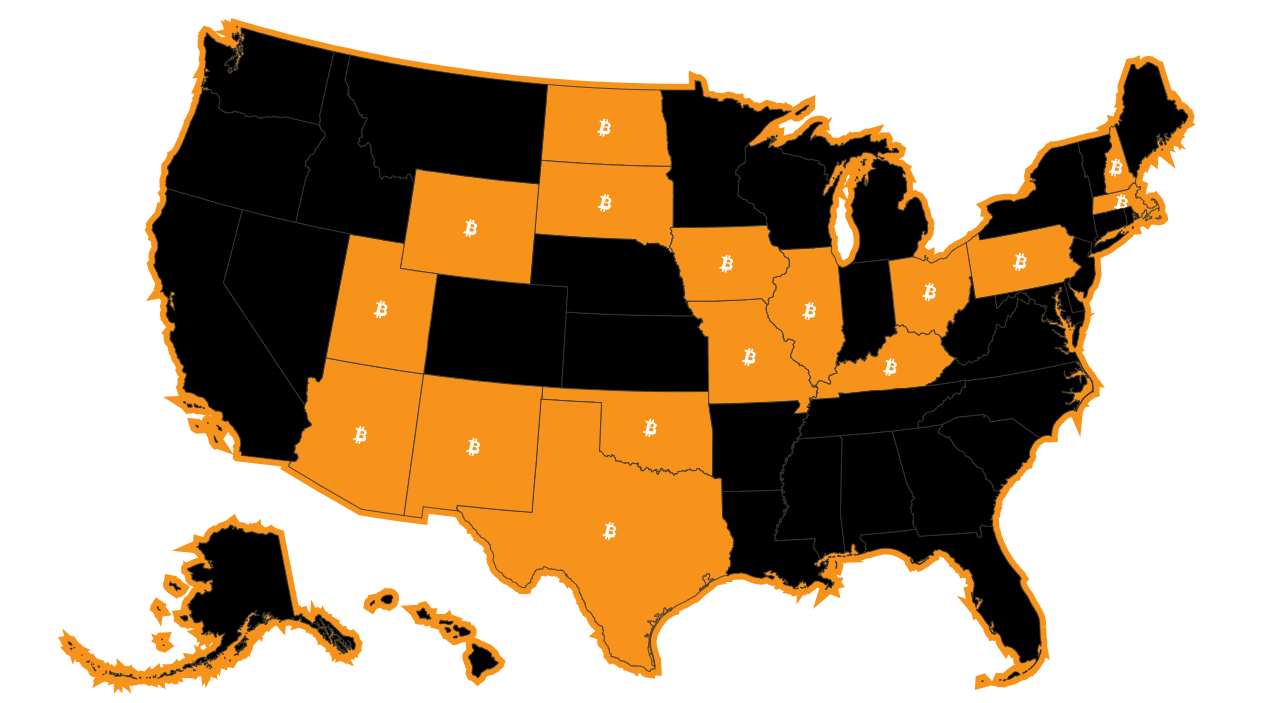

As of Feb. 7, 17 of the 50 US states have begun discussions on establishing Bitcoin strategic reserves, according to data from bitcoinlaws.io.

Utah has made the most progress, standing just two steps away from the bill’s enactment. Other states considering similar legislation include Arizona , Kentucky, New Hampshire, North Dakota , Wyoming and South Dakota, among others.

Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions