Asset manager REX Financial has launched an exchange-traded fund (ETF) designed to earn income from writing options against cryptocurrency stocks, according to a Sept. 18 announcement.

The REX Crypto Equity Premium Income ETF executes a “covered call” strategy, holding a basket of 25 crypto stocks and writing out-of-the-money options against them to earn income from the options premiums.

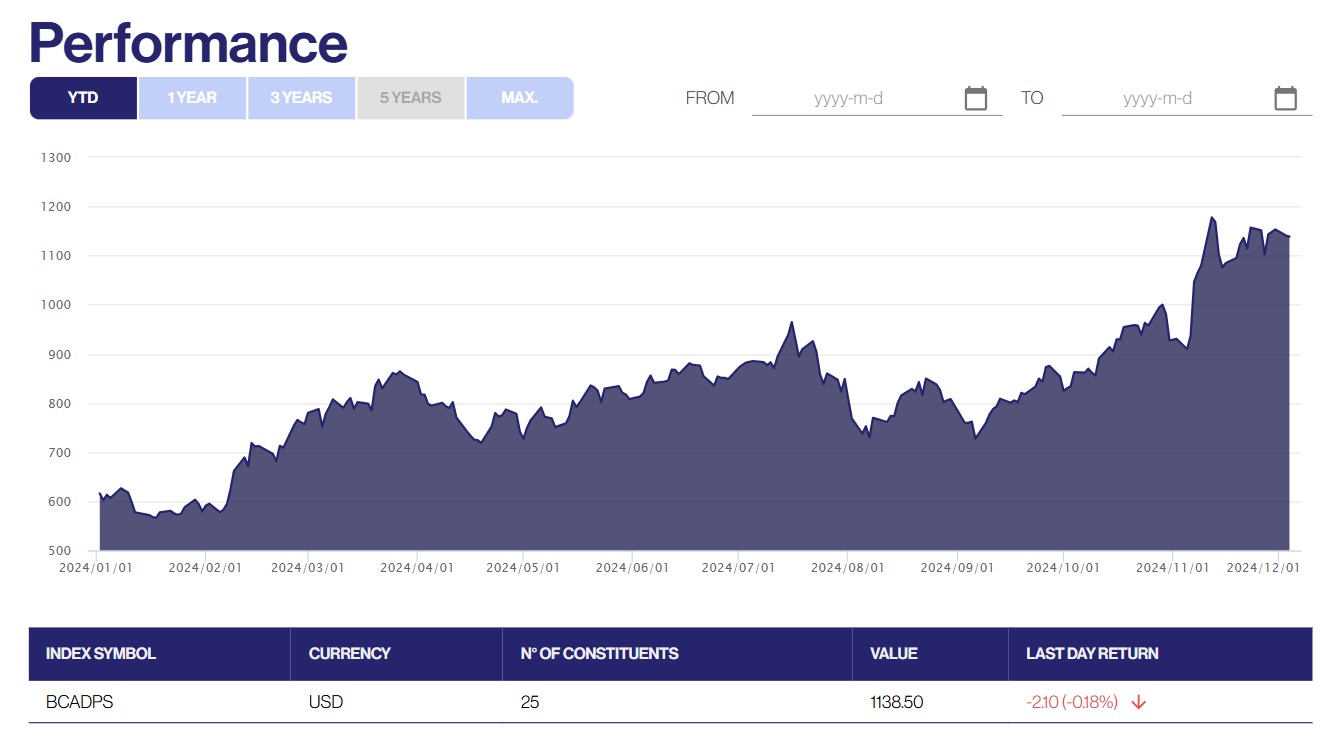

The ETF holds the stocks in the BITA Crypto Assets & Digital Payments Index, including “those that operate in crypto mining, trading, custody, blockchain technology development, and the creation of digital payment solutions,” REX said .

“Crypto is transforming financial ecosystems, [and] we’re applying our targeted covered call strategy to the sector’s most disruptive companies,” Greg King, REX’s CEO, said in a statement.

Related: REX Shares, Tuttle launch 2X long, short MicroStrategy ETFs

The BITA index has returned more than 80% this year, partly because crypto-related stocks soared after Donald Trump won the Nov. 5 United States presidential election.

This is REX’s third covered call ETF. The asset manager launched similar ETFs for Nasdaq and artificial intelligence stocks.

It has previously launched other crypto-related ETFs, including T-REX 2X Long MSTR Daily Target ETF (MSTU), which aims to offer 2x leveraged exposure to famed Bitcoin

Options are contracts granting the right to buy or sell — “call” or “put,” in trader parlance — an underlying asset at a certain price.

Covered calls earn income by agreeing to sell an asset at a certain price, earning an upfront premium but forfeiting potential upside.

Proliferating crypto ETFs

US regulators have softened their stance on crypto oversight after Trump — who has promised to turn the US into the “world’s crypto capital” — prevailed in the US elections.

Now, more than a half dozen proposed cryptocurrency ETFs are anticipating a green light from regulators .

Industry analysts say crypto index ETFs are the next big focus for issuers after ETFs holding BTC and Ether

On Dec. 2, Bernstein Research said US ETH ETFs may soon feature staking yield .

Magazine: Bitcoin dominance will fall in 2025: Benjamin Cowen, X Hall of Flame