PayPal’s Xoom has started settling cross-border payments using its stablecoin, PayPal USD

The payment giant aims to expand access to PYUSD in Asian and African markets and let PayPal settle cross-border transactions outside of traditional banking hours, PayPal said .

Xoom, a PayPal subsidiary, is working with Cebuana Lhuillier and Yellow Card to handle PYUSD disbursements.

“[S]tablecoins like PYUSD are changing the payments landscape, and by integrating our technology, they will be able to move money in the most effective way possible thanks to our stablecoin and payments infrastructure,” Chris Maurice, Yellow Card’s CEO, said in a statement.

Related: Anchorage Digital adds PayPal stablecoin yield to custody platform

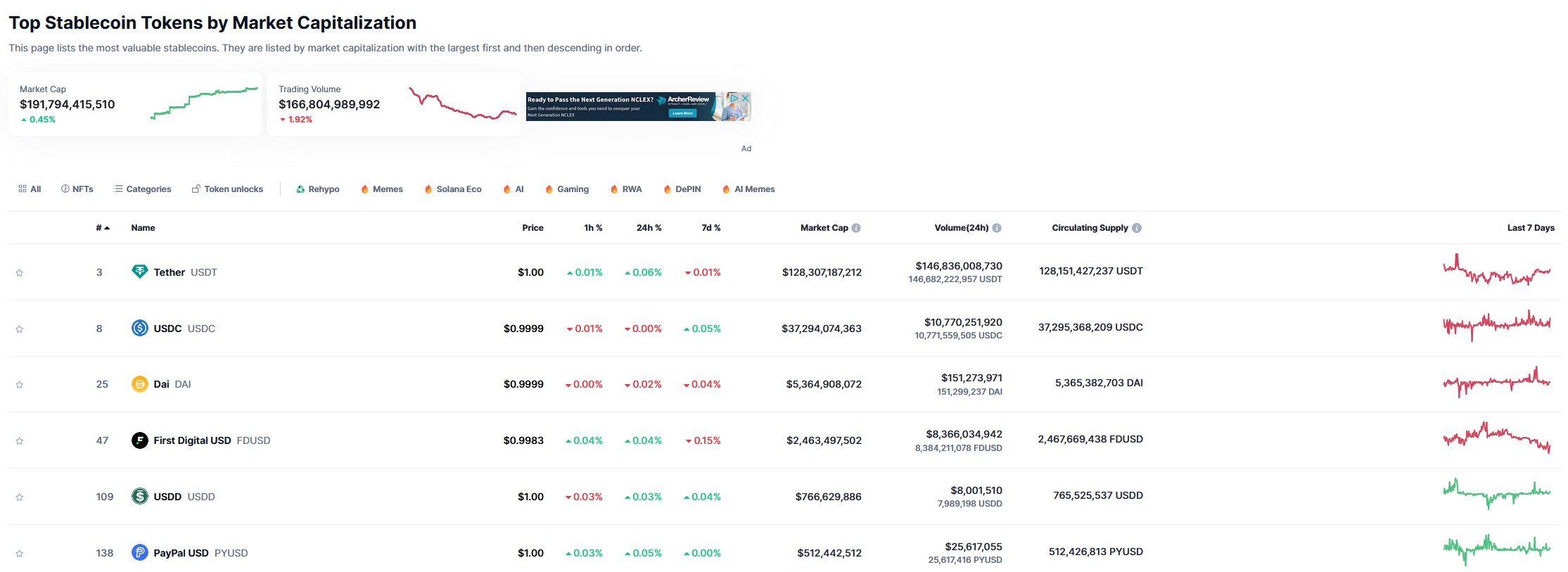

Launched in 2023, PYUSD is backed 1:1 by US dollars and is issued by Paxos Trust Company, a United States-regulated crypto custodian. It competes with other regulated, dollar-backed stablecoins, such as Circle Internet Financial’s USD Coin

An Ethereum-compatible ERC-20 token, PYUSD is the only stablecoin supported on PayPal’s payment rails. It is designed to be “available to an already large and growing community of external developers, wallets and Web3 applications” and easily onboarded by cryptocurrency exchanges, according to PayPal.

PayPal has been taking steps to expand PYUSD’s accessibility, including working with Anchorage Digital to launch a rewards program for clients who custody PayPal USD stablecoins with the crypto custodian.

In May, PayPal launched PYUSD on Solana, partnering with Crypto.com, Phantom and Paxos to on-ramp users onto the blockchain network.

It also partnered with Web3 infrastructure provider MoonPay to buy cryptocurrency using a PayPal account. That partnership extended to on-ramping users to crypto betting platform Polymarket in July.

Coinbase, which also has an institutional custody arm, incentivizes users to hold stablecoins on its platform as well. It currently offers approximately 5.2% annual percentage yield on USDC. Coinbase owns an equity stake in Circle.

Despite its recent successes, PYUSD still greatly lags behind dollar-pegged stablecoins USDt

Magazine: Saylor doubts $60K Bitcoin retrace, BTC ETF options, and more: Hodler’s Digest, Nov. 10–16