Galaxy Digital, a cryptocurrency trading firm, clocked the biggest trading day of the year on Nov. 5 as Donald Trump’s victory in the United States presidential race sparked a surge of interest in crypto, Bloomberg reported on Nov. 7.

“[O]ur franchise was operating at full boar — trading with counterparties both in the US and abroad, lending, the derivative desk,” Michael Novogratz, Galaxy’s CEO, reportedly told Bloomberg.

“It really felt like an affirmation of everything we’ve been working for,” Novogratz said.

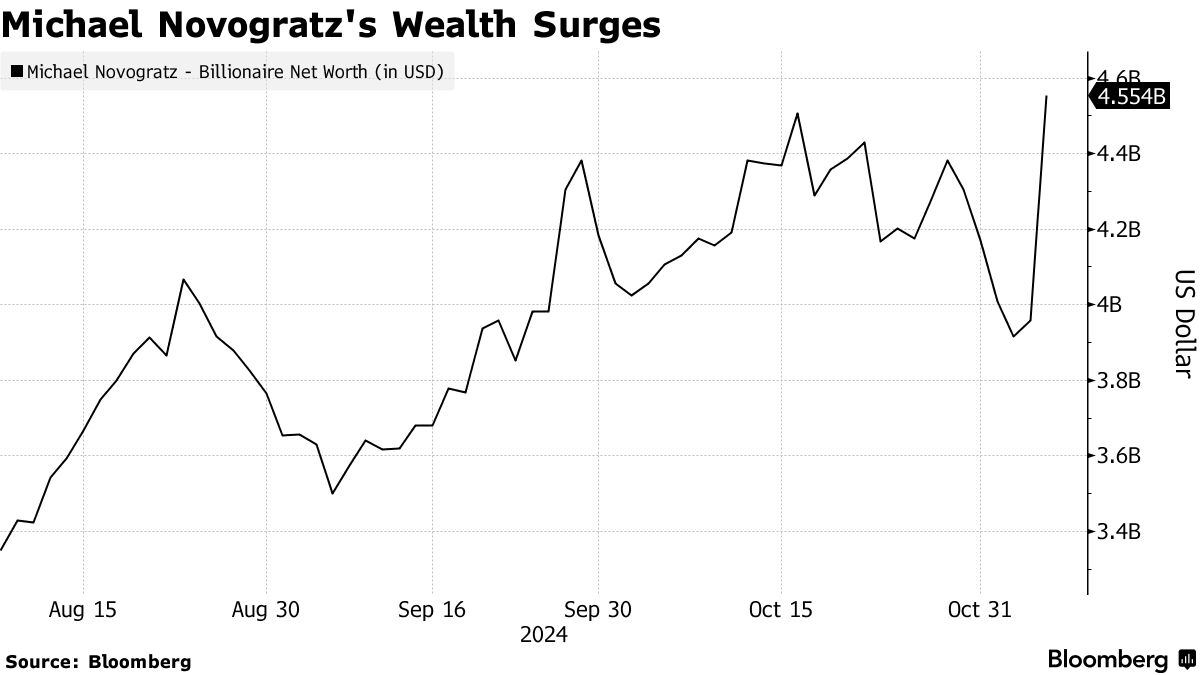

Novogratz’s net worth surged about 15%, or by around $600 million, to $4.6 billion on Nov. 5, according to the Bloomberg Billionaires Index.

Related: The influence of the 2024 US elections on the crypto market: Report

The crypto market surged following Trump’s victory in the US presidential election, as many believe his win will have a significant impact on the industry, Cointelegraph Research said .

Bitcoin

In a Nov. 6 post to X, Bloomberg ETF analyst Eric Balchunas said iShares Bitcoin Trust (IBIT) saw its “ biggest volume day ever ” on the same day, with over $4.1 billion in daily trading volume.

Meanwhile, Ether

US crypto stocks also saw massive gains — most at double digits — after Trump’s sweeping win.

Bitcoin’s nearly eight months of “re-accumulation” after March’s old all-time highs may now fuel a raging bull run , Rekt Capital suggests.

“Once again, the rules are that a Weekly Candle Close above ~$71500 would kickstart the breakout from the Re-Accumulation Range,” Rekt Capital said.

“I didn’t publicly support Donald Trump as President,” Novogratz reportedly told Bloomberg. “I was actually on the other side. But I was always pro-crypto and I thought, let’s do the best we can to have a bipartisan agreement.”

Magazine: Saylor falls for fake Trump news, Kraken restructures, and more: Hodler’s Digest, Oct. 27–Nov. 2