Upward of $1 billion worth of BlackRock’s Bitcoin

Analysts predict BTC’s price will keep rising now that Trump, a cryptocurrency-friendly Republican, is slated to start his second term as US president on Jan. 20.

Valuation models suggest “a $100,000 Bitcoin is quite possible by the time the 47th U.S. President heads to the Capitol for inauguration,” Fadi Aboualfa, head of research at Copper.co — a crypto custodian — told Cointelegraph in an email.

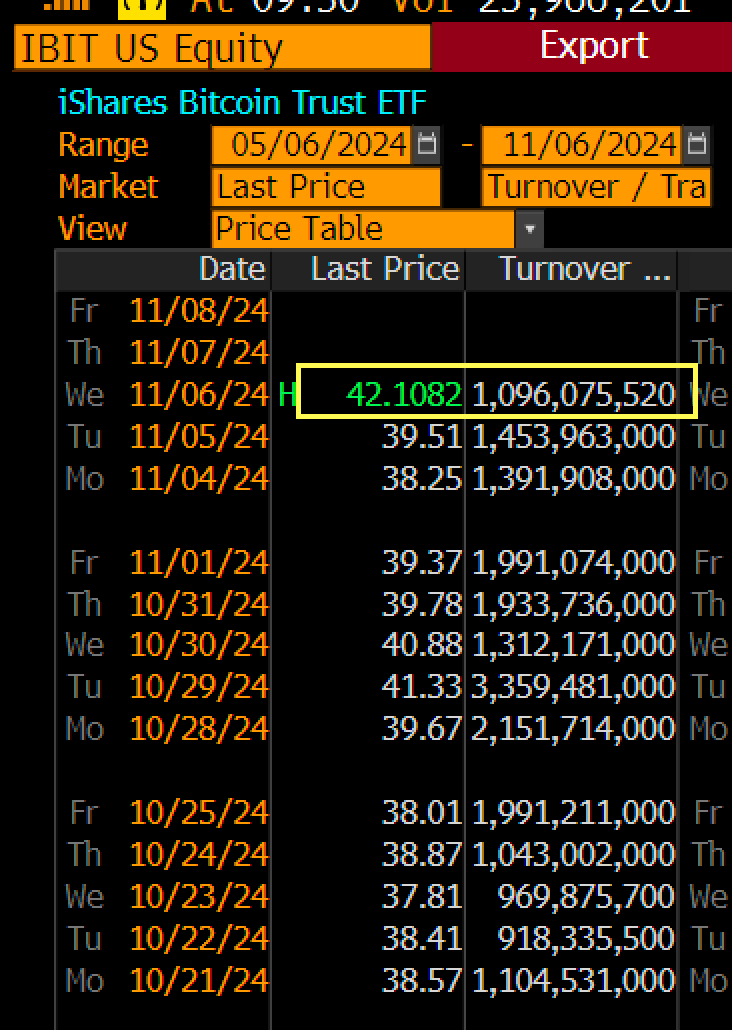

On Nov. 6, BlackRock’s iShares Bitcoin Trust (IBIT) saw nearly $1.1 billion in trading volume in the first 20 minutes after the market opened, Bloomberg ETF analyst Eric Balchunas said in a post on the X platform.

“IBIT has seen $1b in volume in the first 20min- that’s about what it does in full day,” Balchunas said. “Other bitcoin ETFs in same boat, crazy volume.”

Related:

These crypto ETFs are ‘call options’ on the US elections

The election pitted Trump — who has said he wants to make America “the crypto capital of the world” — against Democrat Kamala Harris, who has been comparatively quiet on the industry.

Under President Joe Biden — Vice President Harris’ boss — the US Securities and Exchange Commission has taken an aggressive regulatory stance toward crypto, bringing upward of 100 regulatory actions against industry companies.

Trump won the Nov. 5 election with more than 270 Electoral College votes and a majority of the popular vote. Some votes are still being tallied, but the election has been called in Trump’s favor.

Bitcoin has dominated the ETF landscape this year, accounting for six of the top 10 most successful launches in 2024, Nate Geraci said in an X post .

In 2024, asset managers submitted a flurry of regulatory filings to list ETFs holding altcoins, including Solana

Issuers are also waiting on approval for several planned crypto index ETFs designed to hold diverse baskets of tokens.

In effect, these filings are “ call options on a Trump victory ” in the US presidential race, Balchunas said on Oct. 25.

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift