The United States presidential election on Nov. 5 may determine the fate of more than a half dozen proposed cryptocurrency exchange-traded funds (ETFs) waiting on a green light from regulators.

In 2024, asset managers submitted a flurry of regulatory filings to list ETFs holding altcoins, including Solana

Issuers are also waiting on approval for several planned crypto index ETFs designed to hold diverse baskets of tokens.

In effect, these filings are “ call options on a Trump victory ” in the US presidential race, Eric Balchunas, an ETF analyst at Bloomberg Intelligence, said on Oct. 25.

The election pits Republican nominee Donald Trump — who has said he wants to make America “the crypto capital of the world” — against Democrat Kamala Harris, who has been comparatively quiet on the industry.

Under President Joe Biden — Vice President Harris’s boss — the US Securities and Exchange Commission (SEC) has taken an aggressive regulatory stance toward crypto, bringing upward of 100 regulatory actions against industry companies.

“If you see a Trump victory, watch this space, and if you see a Harris victory, just forget about it for a couple of years,” Balchunas said during the Plan B Forum conference in Lugano, Switzerland.

Here’s what to expect from crypto ETF issuers if Trump wins on Nov. 5.

Altcoin ETFs

In June, fund issuers VanEck and 21Shares each filed an S-1 to register SOL ETFs with the SEC.

On Oct. 30, crypto asset manager Canary Capital followed suit , filing for a SOL ETF of its own.

The SEC greenlighted spot Bitcoin

Even so, “it’s unlikely that the approval of ETH will result in a large wave of approvals” for other types of crypto ETFs, Ophelia Snyder, co-founder and president of 21.co, told Cointelegraph in June . 21.co is the owner of crypto ETF issuer 21Shares.

The SEC has repeatedly asserted that SOL — unlike BTC and ETH — is a security, but plans for a SOL ETF listing are “ still in play ,” Matthew Sigel, VanEck’s head of digital assets research, said in August.

“VanEck believes SOL is a commodity, much like BTC and ETH,” Sigel said. “We remain committed to advocating this position […] to the appropriate regulators.”

Meanwhile, in October and November, Canary Capital, Bitwise and 21Shares each filed for proposed XRP ETFs. Canary Capital also filed to register a spot LTC ETF.

Crypto Index ETFs

On Oct. 29, securities exchange NYSE Arca asked the SEC for permission to list shares of Grayscale Digital Large Cap Fund (GLDC).

“[T]he proposed rule change, if adopted, would represent the first national securities exchange ruleset permitting the listing and trading of shares of multi-crypto asset [ETFs],” Grayscale said .

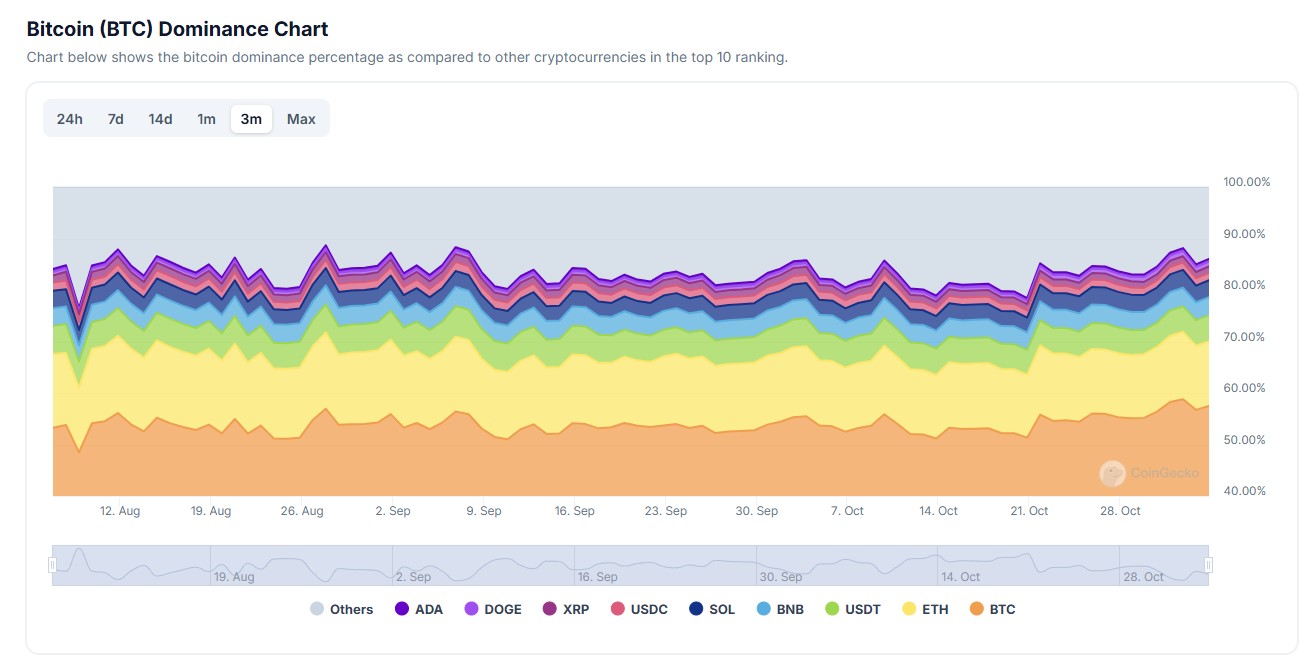

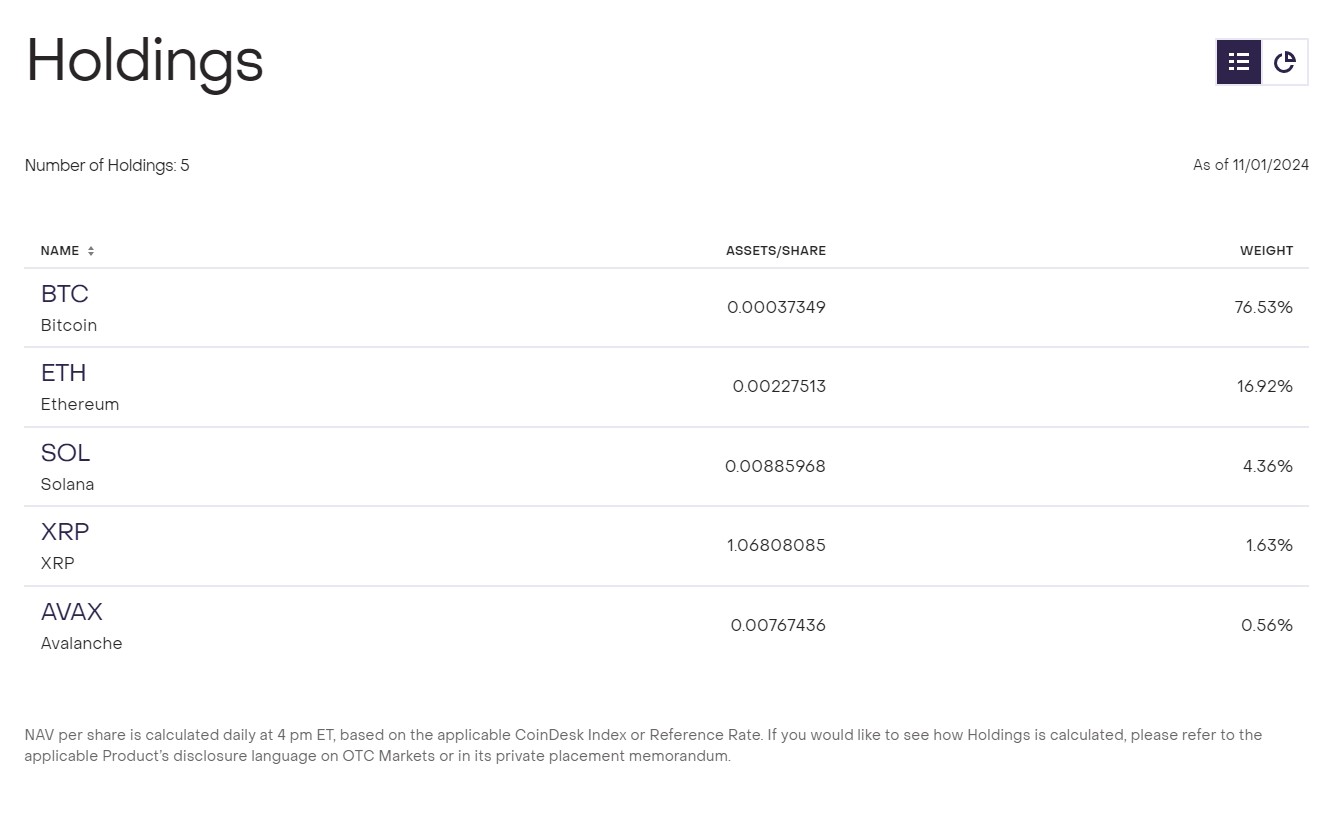

The fund holds a crypto index portfolio comprising BTC, ETH, SOL, XRP and Avalanche

Grayscale

faces competition

from other proposed index funds, including those from asset managers Hashdex and Franklin Templeton, but GDLC is unique in including altcoins such as SOL, AVAX and XRP.

Crypto index ETFs are currently limited to BTC and ETH because those are the only digital assets the SEC has authorized to be included in ETFs, Katalin Tischhauser, head of investment research at crypto bank Sygnum,

told Cointelegraph

in August.

“The next logical step is index ETFs because indices are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” Tischhauser said.

Magazine: AI agents trading crypto is a hot narrative, but beware of rookie mistakes