In a growing sign that spot Bitcoin exchange-traded funds (ETF) may be approved, stock brokerage service Fidelity Investments listed several of the proposed ETFs on its web app on Jan. 10, including the ARK 21Shares Bitcoin ETF (ARKB), Vaneck Bitcoin Trust ETF (HODL), Invesco Galaxy Bitcoin ETF (BTCO), Franklin Bitcoin ETF (EZBC) and WisdomTree Bitcoin ETF (BTCW).

At the time of publication, other proposed spot Bitcoin

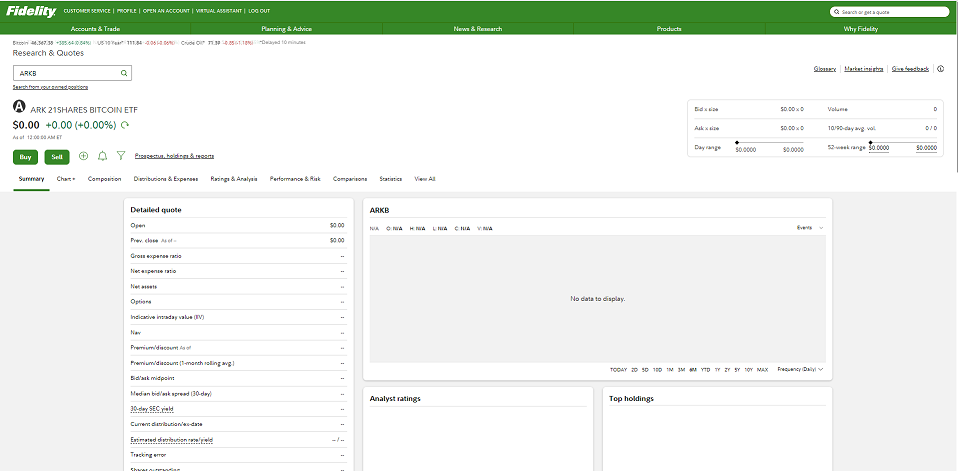

The Fidelity app pages for these funds appear to have been populated from templates. They contain stock risk disclaimers and a blank chart. Presently, the shares for these funds cannot be purchased on these pages.

The listings on Fidelity provide further evidence that these funds may be on the verge of being approved by the United States Securities and Exchange Commission. On the same day that Fidelity listed these funds, the Cboe BZX stock exchange also listed ARKB, HODL, BTCO, BTCW and EZBC , as well as FBTC, in its interface. These funds aren’t available for purchase on Cboe, and they have still not officially been approved by the SEC.

Related: Bitcoin ETF speculation written into the Bitcoin blockchain

On Jan. 9, the SEC’s X (formerly Twitter) account posted a false message stating that the spot Bitcoin ETFs were approved. This announcement was later contradicted by SEC Chair Gary Gensler, who clarified that the regulator’s X account had been hacked . Bloomberg ETF analyst Eric Balchunas has stated that he expects the ETFs to be approved between 4:00 pm and 6:00 pm Eastern Time (9:00 pm and 11:00 pm UTC) on Jan. 10.