As investors brace for a potentially turbulent 2025, dividend-focused exchange-traded funds like the Schwab U.S. Dividend Equity ETF (SCHD) have outperformed riskier, growth-focused funds such as the Roundhill Magnificent Seven ETF (MAGS) .

Concerns over inflationary tariffs, coupled with the increasing potential for a recession, have rattled the market, leading investors to shift toward defensive, income-generating assets while reducing exposure to high-volatility growth stocks.

This trend reflects a classic flight to safety as investors seek to balance capital preservation with steady returns.

Dividend ETF in Focus

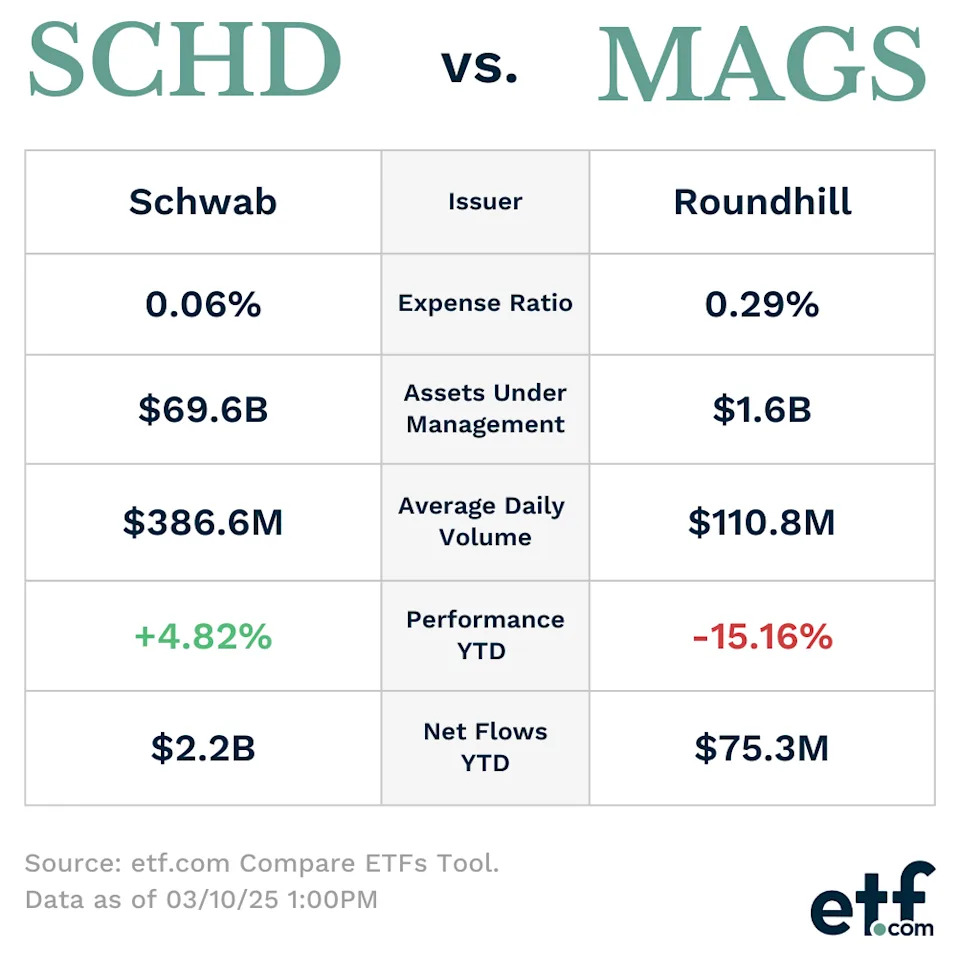

MAGS was trading nearly 5% lower in midday trading Monday, for a total price decline of nearly 15% year to date, while SCHD was trading up about 0.5% on the day and has gained 5% for the year. That’s a whopping 20% differential.

The divergence in performance between SCHD and MAGS highlights how different equity strategies react to shifting macroeconomic conditions. While SCHD’s dividend-focused portfolio has benefited from stable earnings and resilient cash flows, MAGS’ concentration in high-growth tech stocks has suffered as economic uncertainty weighs on investor sentiment.

SCHD vs. MAGS: A Tale of Two Objectives

SCHD is designed to invest in high-quality, dividend-paying U.S. stocks, with a focus on companies that have strong free cash flow, stable earnings and a history of consistent dividend payments. This dividend ETF provides investors with an attractive dividend yield, lower volatility and a value-tilted portfolio that tends to outperform during periods of economic uncertainty.

MAGS is a concentrated ETF holding only the seven largest U.S. technology stocks : Apple Inc. (AAPL) , Microsoft Corp. (MSFT) , Nvidia Corp. (NVDA) , Amazon.com Inc. (AMZN) , Meta Platforms Inc. (META) , Tesla Inc. (TSLA) and Alphabet Inc. (GOOGL) . While these companies have driven much of the stock market’s growth over the past two years, they are now facing multiple headwinds, including rising input costs from inflationary tariffs, tightening monetary conditions and slowing consumer demand.

As a result, MAGS has struggled in recent months, with investors rotating out of high-multiple tech stocks and into more stable, income-generating assets.

In terms of recent performance, SCHD has held up well as dividends provide a buffer against market volatility, while MAGS has faced steep declines as rising interest rates and economic slowdown concerns pressure high-growth names.

The key difference lies in how these ETFs react to changing economic conditions: SCHD benefits from stability and reliable income, whereas MAGS thrives in a risk-on, growth-driven environment.

Related reading: The 5 Best Dividend ETFs for 2025

2025 Outlook for SCHD and MAGS

Looking ahead, SCHD is likely to continue performing well if economic uncertainty persists and investors remain cautious. Dividend-paying stocks tend to be more resilient during market downturns, as their steady income streams provide support even when capital appreciation slows. Additionally, if the Federal Reserve begins cutting interest rates in response to economic weakness, dividend ETFs could become even more attractive relative to riskier growth investments.

For MAGS, the outlook is more uncertain. While big tech stocks could rebound if rate cuts materialize or if inflation subsides, the risks remain high. If tariffs on imported goods from China, Mexico and Canada lead to prolonged inflationary pressures, it could weigh on profit margins for large-cap tech companies. Additionally, if a recession unfolds, consumer and enterprise spending on technology may decline, further pressuring MAGS’ holdings.

The Bottom Line

Ultimately, investors must weigh risk tolerance and time horizon when choosing between these ETFs. SCHD remains a solid choice for those seeking stability and passive income, while MAGS could see more volatility but also offers significant upside if macroeconomic conditions improve.

For now, as fears of inflation and recession dominate the market narrative, SCHD appears better positioned to weather the storm, while MAGS may remain under pressure until economic clarity emerges.

Permalink | © Copyright 2025 etf.com. All rights reserved