A mad rush for U.S. small-cap stocks over the past week has left investors pondering whether a rotation from this year’s Big Tech winners could gain more steam.

Strategists at BofA Global Research said a sustained stock-market rotation hinges on a 10-year Treasury yield BX:TMUBMUSD10Y below 4% and an ISM manufacturing PMI index above 50%.

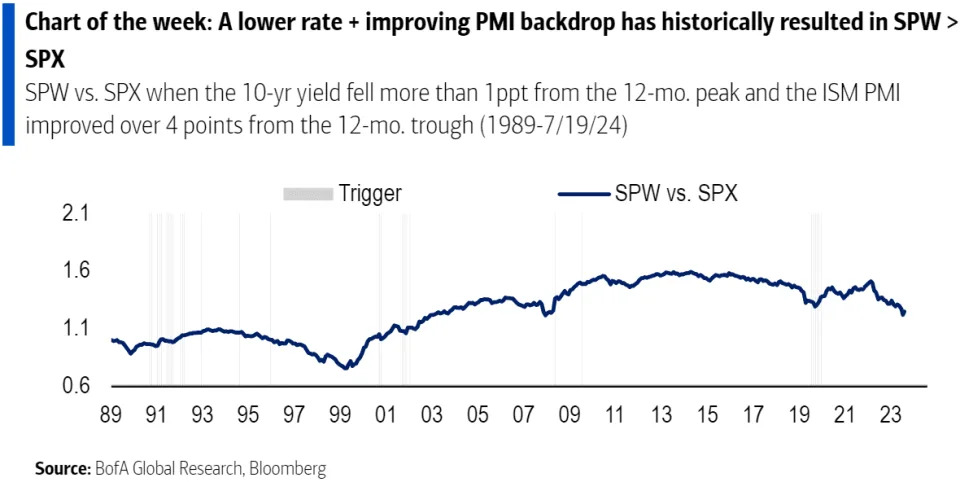

Historically, the S&P 500 equal-weighted index XX:SP500EW has outperformed the market-cap-weighted S&P 500 SPX 90% of the time when the 10-year Treasury yield fell by more than 1 percentage point from its 12-month peak, while the ISM manufacturing PMI improved more than 4 percentage points from its 12-month trough, a team of BofA strategists led by Ohsung Kwon, equity and quant strategist, said in a Monday note (see chart below).

That suggests investors need to see a current 10-year yield trading at around 3.99%, below its 52-week closing high of 4.99% hit on Oct. 19, as well as an ISM manufacturing PMI index at above 50%, which indicates an expansion in the manufacturing sector of the economy, for the stock-market rotation to continue.

“The manufacturing economy is in the second longest downturn in history with 21 months without two straight months of PMI that are above 50%,” Kwon and his team wrote. “We believe a large part of that has been caused by the destocking cycle, which we expect will be moderating in the second half of 2024.”

The Institute for Supply Management’s manufacturing index slipped to 48.5% in June from 48.7% in the prior month. Previously, the key barometer of U.S. factories fell to 46.5% in July 2023, the lowest level in the past 12 months.

Numbers below 50% signal that the sector is shrinking.

See: Here’s how a President Kamala Harris could act on key economic issues

The yield on the 10-year Treasury advanced 2.1 basis points to 4.259% on Monday as traders focused on the likelihood that Vice President Kamala Harris would be selected as the Democratic Party’s nominee for the White House. For the year, the 10-year rate has advanced nearly 40 basis points as lingering Inflation concerns have kept the Federal Reserve in wait-and-see mode on interest-rate cuts, according to FactSet data.

Yet traders in the federal-funds futures market on Monday see a 93.6% probability that the Fed will start cutting its benchmark rate in September, according to the CME FedWatch Tool , but the policymakers still face a wave of inflation data before deciding on the end-of-summer rate cut.

U.S. stocks finished higher on Monday as the Magnificent Seven and chip stocks NVDA led the way after taking a beating last week.

The Nasdaq Composite COMP rose 1.6%, while the S&P 500 was up 1.1% and the Dow Jones Industrial Average DJIA edged up 0.3%, according to FactSet data.