Interactive Brokers Group

IBKR has been performing remarkably well this year. The stock touched a new all-time high of $179.68 during Monday’s trading session.

IBKR is in the spotlight because of the recently held U.S. presidential elections and the Federal Reserve’s interest rate cuts. These events resulted in major market volatility and increased trading volume, driving significant benefits for this global electronic brokerage firm.

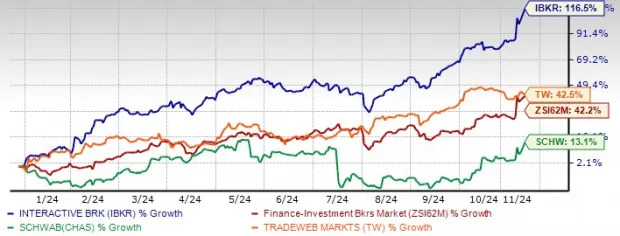

Hence, Interactive Brokers stock has surged 116.5% this year. This impressive rise has significantly outpaced the 39% rally of the industry it belongs to. When compared with its close peers, IBKR’s performance is noticeably stronger.

Charles Schwab

SCHW has gained just 13.1%, while

Tradeweb Markets Inc.

TW stock has jumped 45.5% in the same timeframe.

Year-to-Date Price Performance

Fed Rate Cuts & U.S. Presidential Election Aid IBKR

After two years of aggressive interest rate hikes, the Fed has begun cutting rates. In September, the central bank lowered the rates by jumbo 50 basis points and followed this up with a 25-basis point cut last week. Driven by clarity on several macroeconomic factors, equity markets soared. Also, the S&P 500 Index has posted positive returns 86% of the time in the 12 months following the first rate cut of the cycle.

Additionally, the U.S. presidential elections and results have led to higher volatility and volume across the stock markets. Since the results were out, all major stock indexes have been rallying. The S&P 500 Index and the Dow closed above 6,000 and 44,000 levels, respectively, for the first time on Monday.

As investors contemplate how incoming President Donald Trump’s policies will impact the U.S. economy and industries, market volatility and heightened client activity are expected to persist. Hence, IBKR is likely to keep benefiting from the rise in global robust options, futures and stock volumes and increased volatility.

This will drive Interactive Brokers’ commission fees higher. For the nine months ended Sept. 30, 2024, commission fees jumped 21% year over year to $1.22 billion. Net interest income grew 13% during the same time frame to $2.34 billion despite interest rate cuts in several countries. “A continued risk-on environment” resulted in a significant jump in margin borrowing, and solid account growth led to increases in the company’s segregated cash portfolio.

Also, the introduction of the election political contract on its newly launched ForecastEx platform resulted in a rise in new account openings in October. Net new accounts were 65,000 last month, witnessing an increase of 12% from the prior month. Further, total client Daily Average Revenue Trades (DARTs) grew 7% to 2,823,000 in October.

Other Factors Driving IBKR Stock

IBKR processes trades in stocks, futures, options, cryptocurrencies and forex on more than 150 exchanges across several countries and currencies. Unlike many of its peers, the company has a low compensation expense relative to net revenues (11.5% in the first nine months of 2024) driven by its technological excellence.

Since its inception, Interactive Brokers has been focused on developing proprietary software to automate broker-dealer functions. This has resulted in steady revenue growth as commission per trade improves. Net revenues are expected to rise further, given the solid DART numbers.

Interactive Brokers has taken several measures to enhance its global presence and expand its product suite. These efforts have bolstered the company's market share. IBKR intends to strengthen its position in the online brokerage space by launching new products and services.

ForecastEx was unveiled on Aug. 1. The company’s clients from eligible countries can trade Forecast Contracts on upcoming economic data releases and climate indicators.

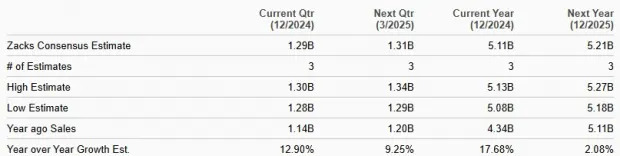

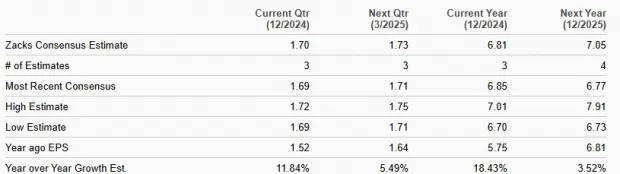

Driven by favorable developments, IBKR is expected to deliver solid results in 2024 and 2025.

Sales Estimates

Earnings Estimates

Lofty Valuations for Interactive Brokers Stock

Given the impressive rally, IBKR stock appears expensive relative to the industry. The company’s forward 12-month price/earnings (P/E) multiple of 25.53X is well above the industry’s 14.12X.

Price-to-Earnings F12M

Hence, from a valuation perspective, Interactive Brokers shares doesn’t offer an attractive buying opportunity. Also, the stock is trading at a premium compared with SCHW, which has a P/E F12M ratio of 20.85. On the other hand, TW is trading above IBKR’s P/E F12M ratio at 39.65.

Final Thoughts on IBKR Stock

Considering the pros and cons of IBKR, investors should refrain from rushing to buy the stock right now. Instead, they should keep an eye on the upcoming administrative changes and other macroeconomic developments before making any decision. Its premium valuation also warrants caution.

The stock currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Tradeweb Markets Inc. (TW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research