The allure of following the crowd is strong when it comes to trading financial assets – buying when the market is gripped by euphoria and selling when panic takes hold. Yet, experienced traders recognize the potential hidden within contrarian approaches. Tools like IG client sentiment offer a valuable peek into the market's collective mood, possibly revealing moments where excessive bullishness or bearishness could foreshadow a reversal.

Of course, contrarian signals aren't foolproof. They become most powerful when integrated into a well-rounded trading strategy. By thoughtfully blending contrarian observations with technical and fundamental analyses, traders gain a richer understanding of the forces at play – dynamics that the majority might overlook. Let's explore this concept by examining IG client sentiment and its potential influence on silver , NZD/USD and EUR/CHF .

For an extensive analysis of gold

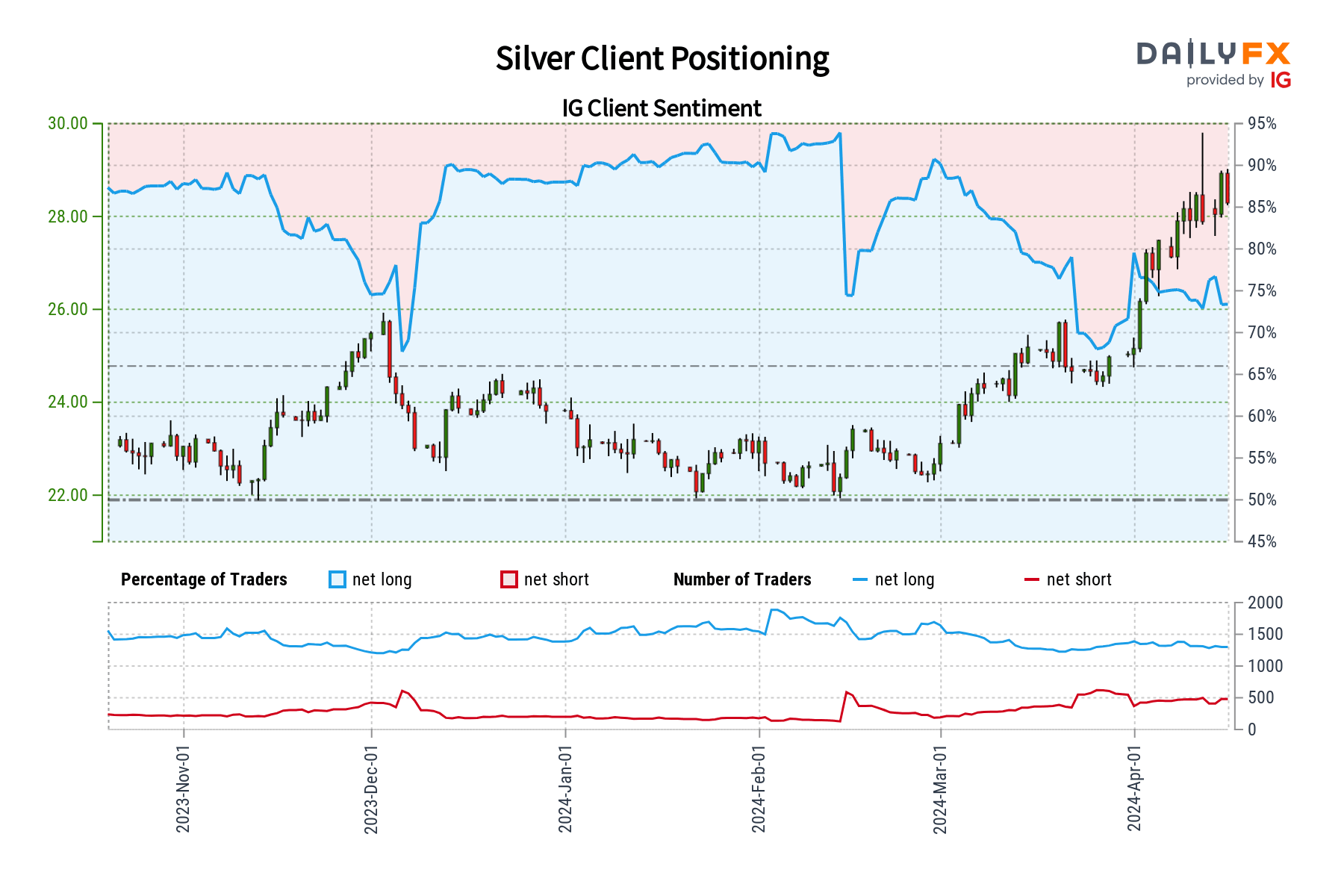

Silver Forecast – Market Sentiment

IG data reveals a bullish tilt in sentiment towards silver, with 72.58% of traders currently net-long, resulting in a long-to-short ratio of 2.65 to 1. However, this bullishness has decreased compared to yesterday (down 3.75%) and last week (down 9.32%).

Our approach often incorporates a contrarian perspective. While the prevalent bullishness could signal potential weakness in silver prices , the recent decrease in net-long positions introduces a degree of uncertainty. This shift suggests a possible reversal to the upside may be in the cards, despite the overall net-long positioning.

Important Note: These mixed signals highlight the necessity of combining contrarian insights with technical and fundamental analysis for a more comprehensive understanding of market dynamics.

Frustrated by trading setbacks? Take charge and elevate your strategy with our guide, "Traits of Successful Traders." Unlock essential strategies to steer clear of frequent pitfalls and costly missteps.

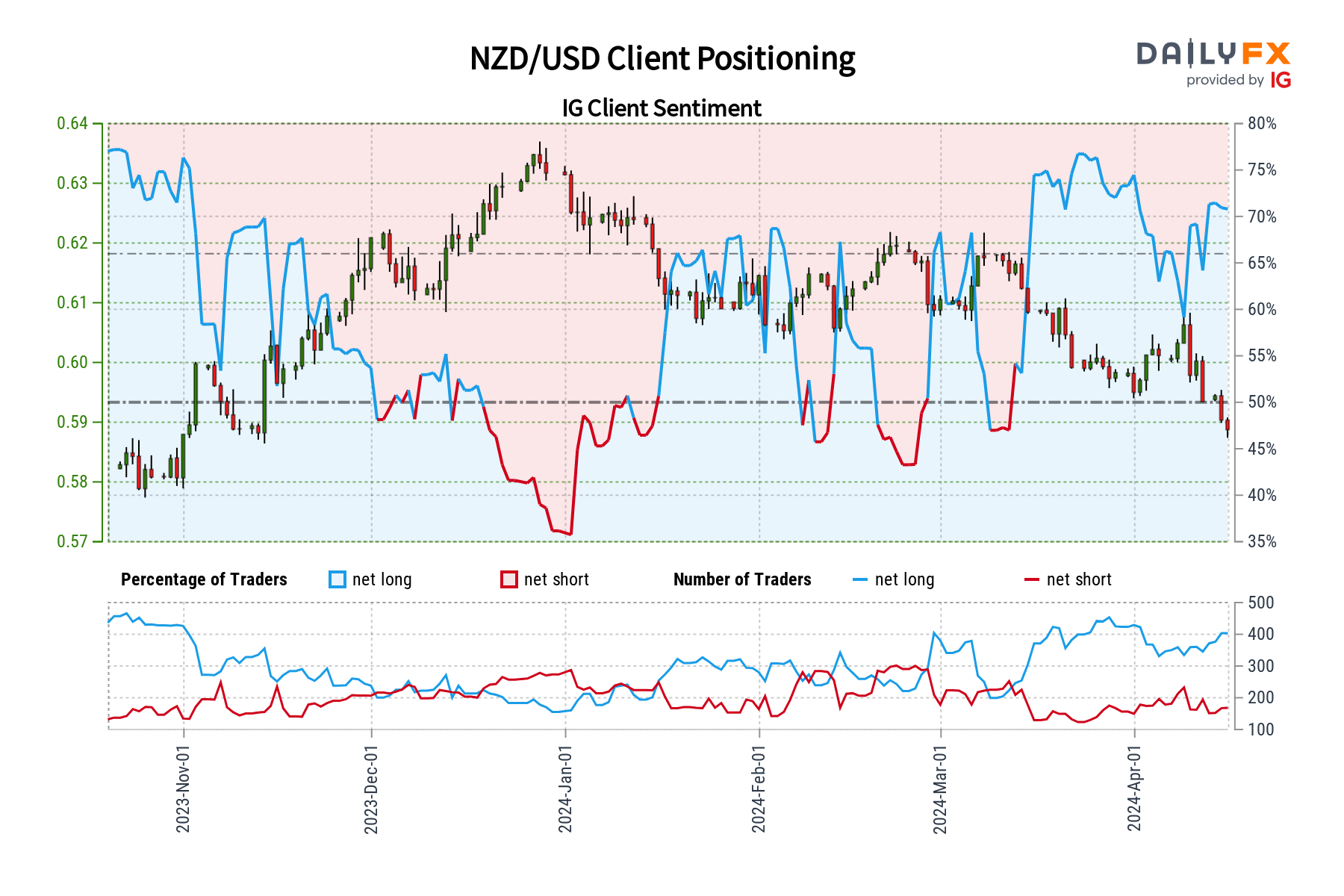

NZD/USD Forecast – Market Sentiment

IG data indicates a strong bullish bias towards NZD / USD among retail traders, with 72.35% of clients currently holding net-long positions. This translates to a long-to-short ratio of 2.62 to 1. The number of net buyers has risen significantly since yesterday (up 7.22%) and compared to last week (up 11.23%).

Our trading strategy often leans towards taking a contrarian perspective. The widespread bullishness on NZD/USD suggests the pair may have room to weaken further over the coming days. The ongoing increase in net-long positions strengthens this bearish contrarian outlook.

Important note: While contrarian signals provide valuable insights, they are most effective when combined with technical and fundamental analysis. Always conduct a thorough market assessment before making any trading decisions.

Interested in learning how retail positioning can offer clues about EUR / CHF 's directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Get it now!

| Change in | Longs | Shorts | OI |

| Daily | -11% | -22% | -16% |

| Weekly | -4% | -27% | -15% |

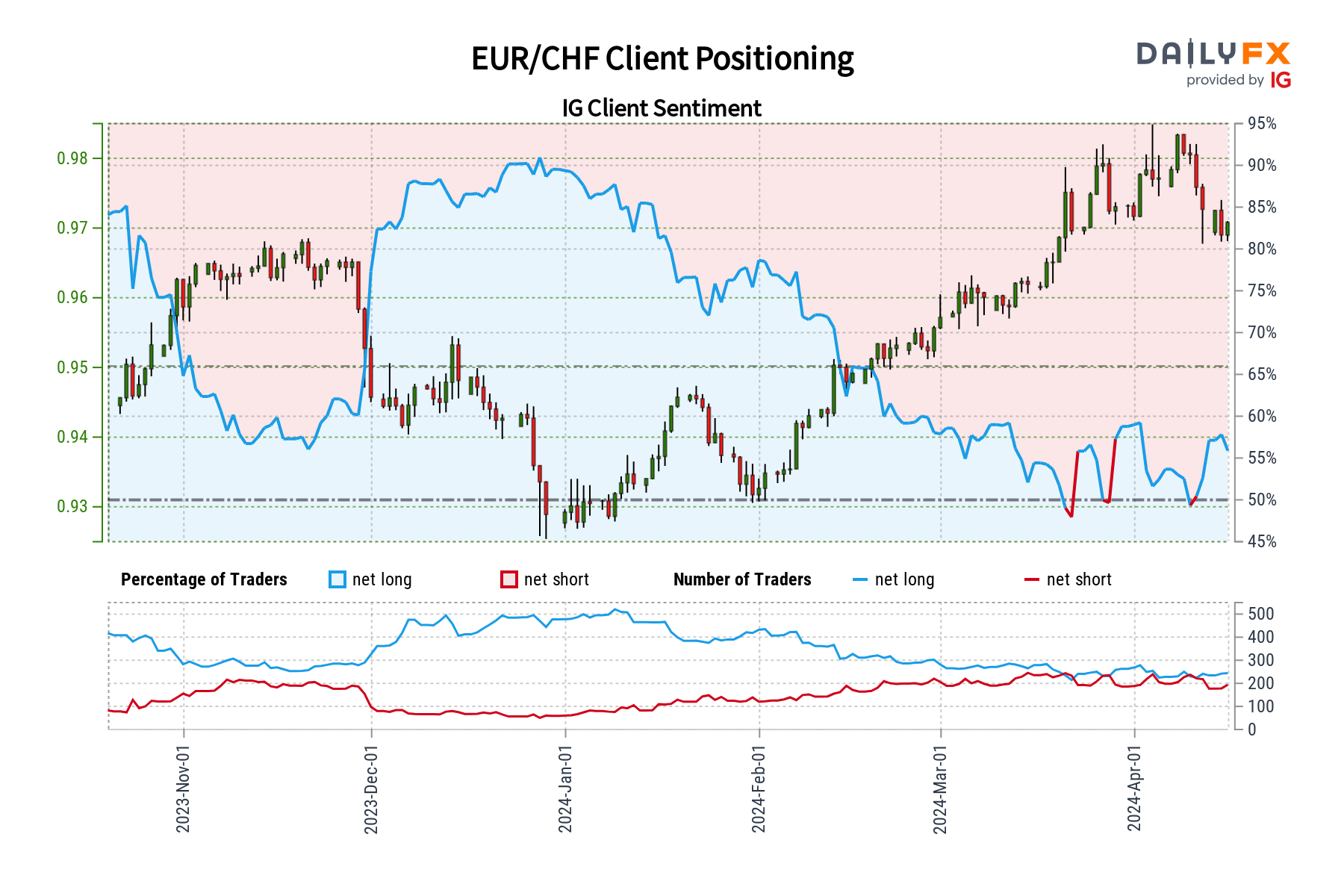

EUR/CHF Forecast – Market Sentiment

As per the latest data from IG, 55.76% of clients are bullish on EUR/CHF, indicating a long-to-short ratio of 1.26 to 1. Traders maintaining net-long positions have risen by 8.33% since yesterday and by 4.66% from last week, whereas clients with bearish wagers have dropped by 1.01% compared to the previous session and by 17.99% relative to seven days ago.

We often adopt a contrarian approach to market sentiment. The current predominance of net-long traders suggests a potential further decline for EUR/CHF in the short term. The increasing number of buyers compared to both yesterday and last week, alongside recent changes in positioning, strengthens our bearish contrarian trading outlook on EUR/CHF.

Important Note: Remember that contrarian signals offer just one piece of the trading puzzle. Integrate them with thorough technical and fundamental analysis for a more comprehensive decision-making process.