USD/JPY and GBP/JPY – Latest Sentiment Analysis and Charts

- USD / JPY : Mixed Trading Bias

- GBP /JPY: Lower Prices Ahead?

USD/JPY: Mixed Trading Bias

Recent retail trader data indicates 20.37% of traders hold net-long positionsShort-to-long ratio of 3.91 to 1. Net-long traders decreased by 1.11% daily but increased by 15.77% weekly. Conversely, net-short traders increased by 0.29% daily but decreased by 9.29% weekly.

Our contrarian approach to market sentiment suggests potential USD/JPY price increases, given the predominantly short positions. However, the mixed short-term changes in positioning yield an unclear USD/JPY trading outlook.

USD/JPY Daily Price Chart

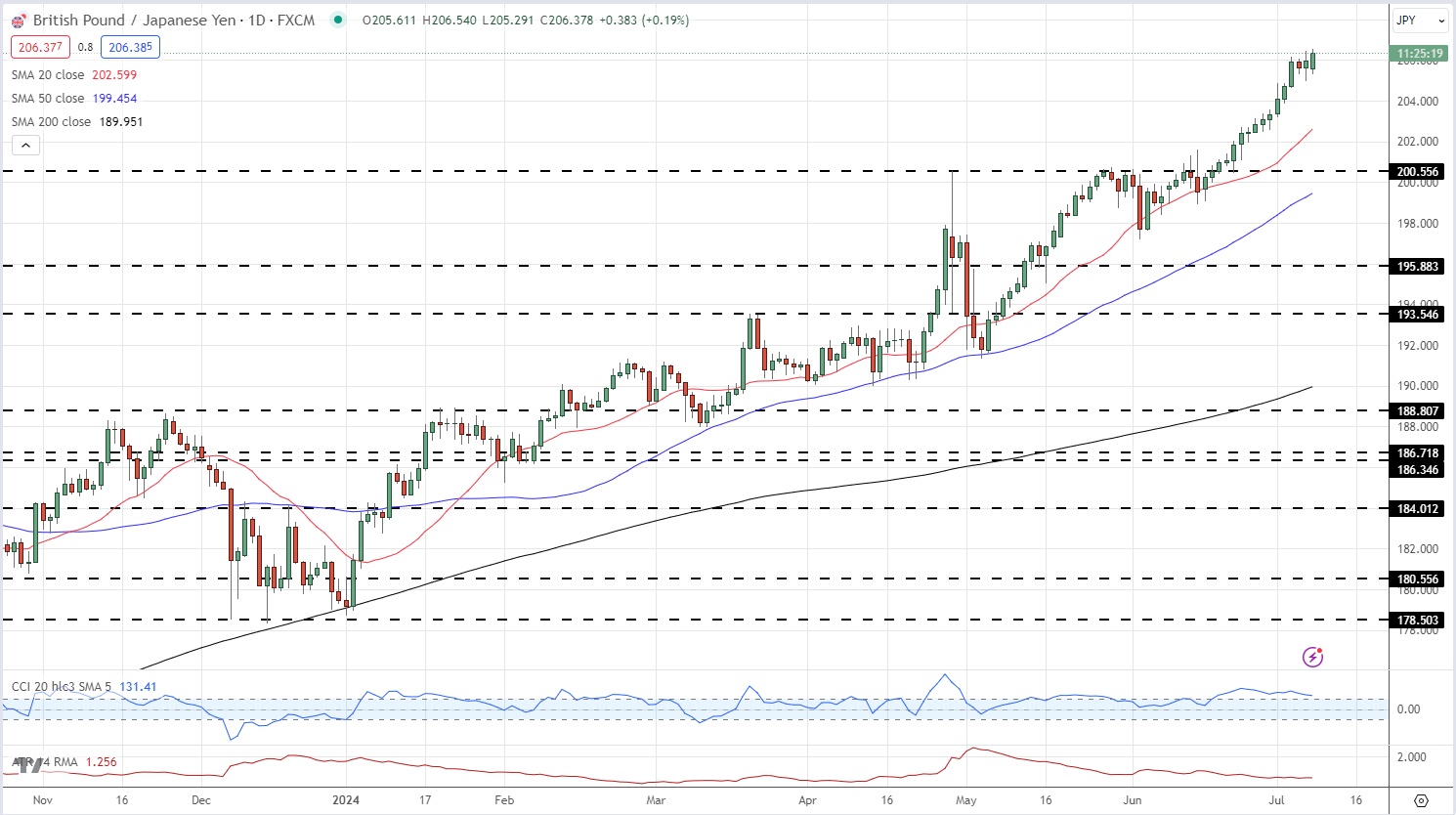

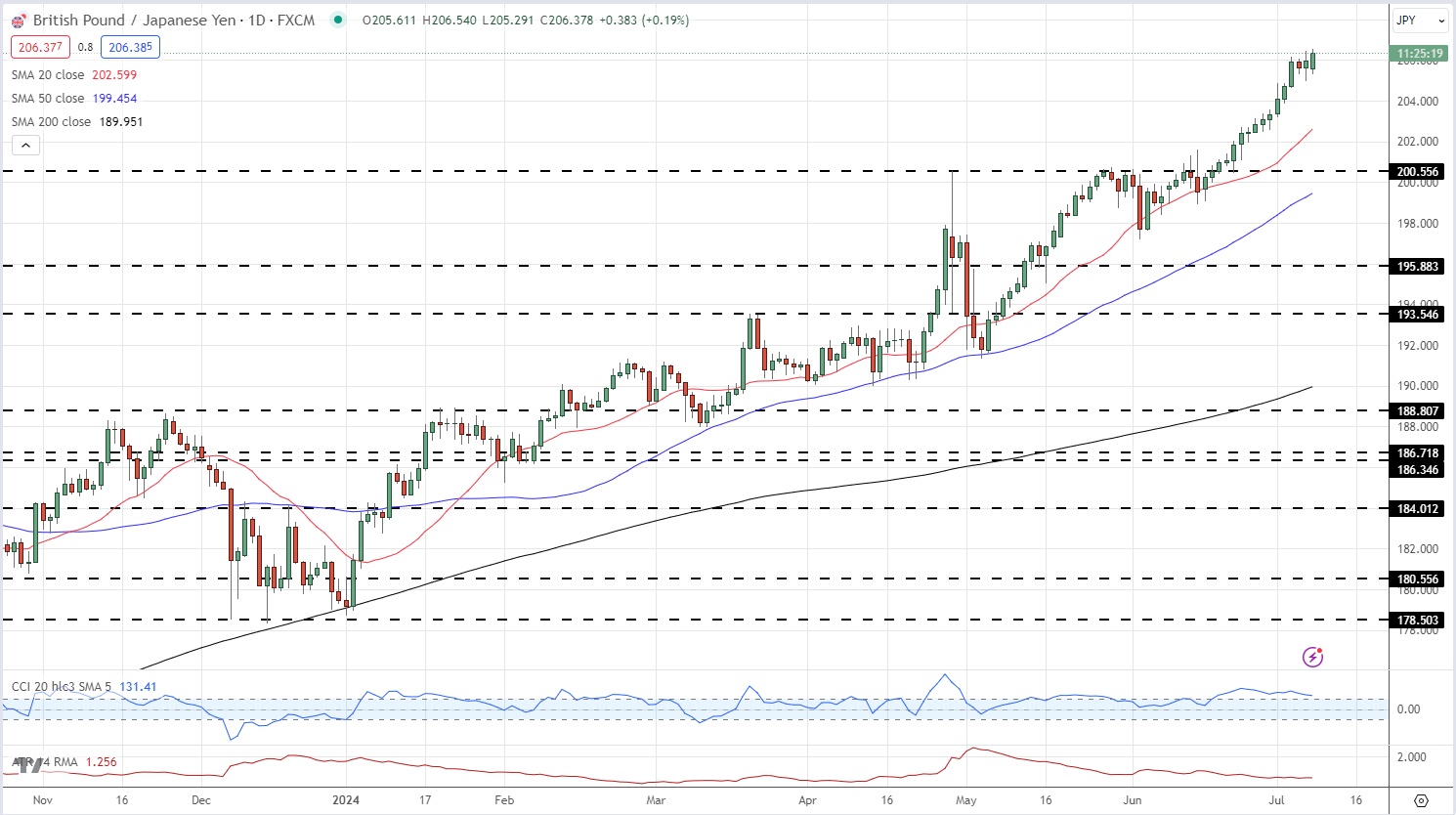

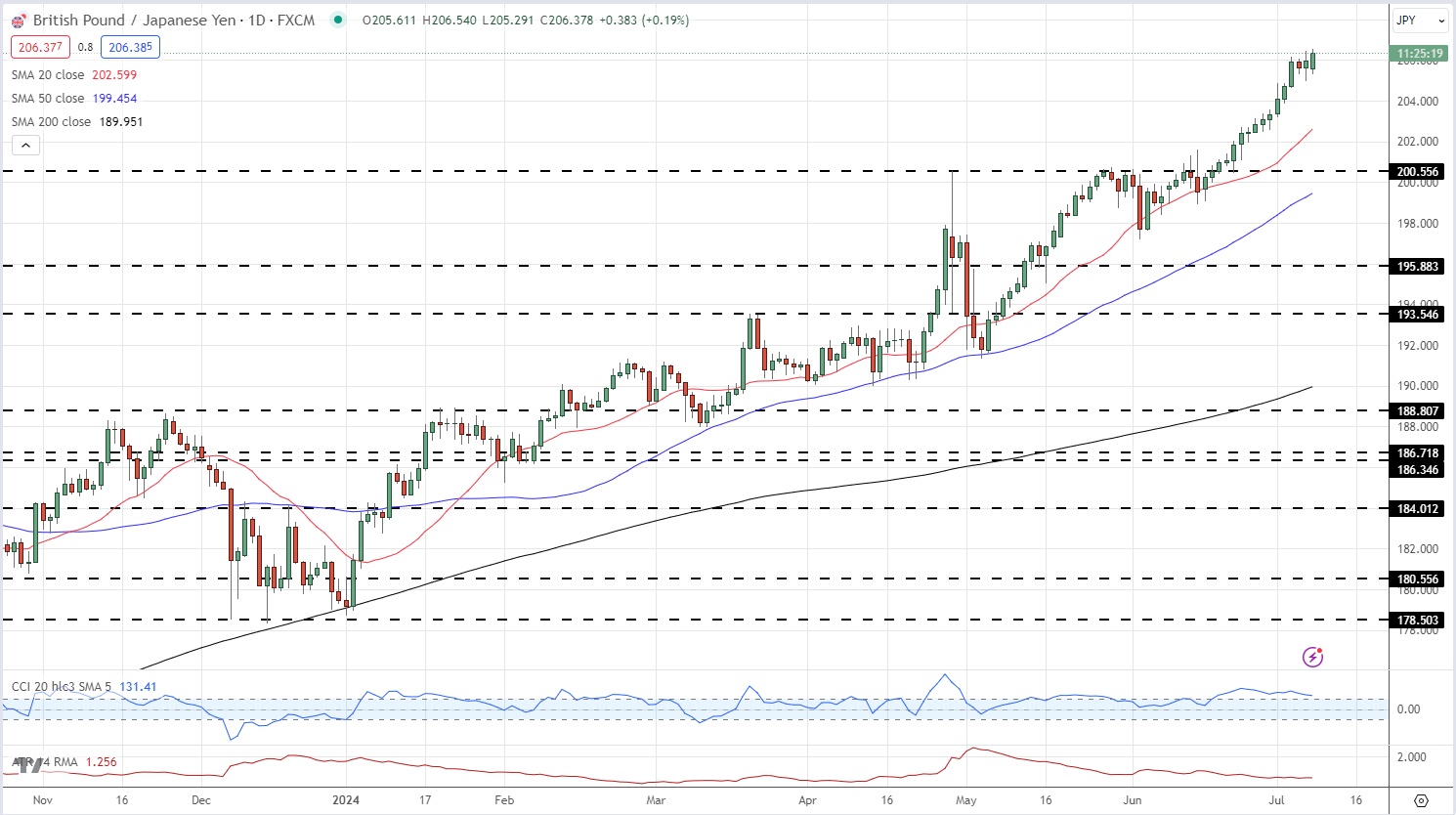

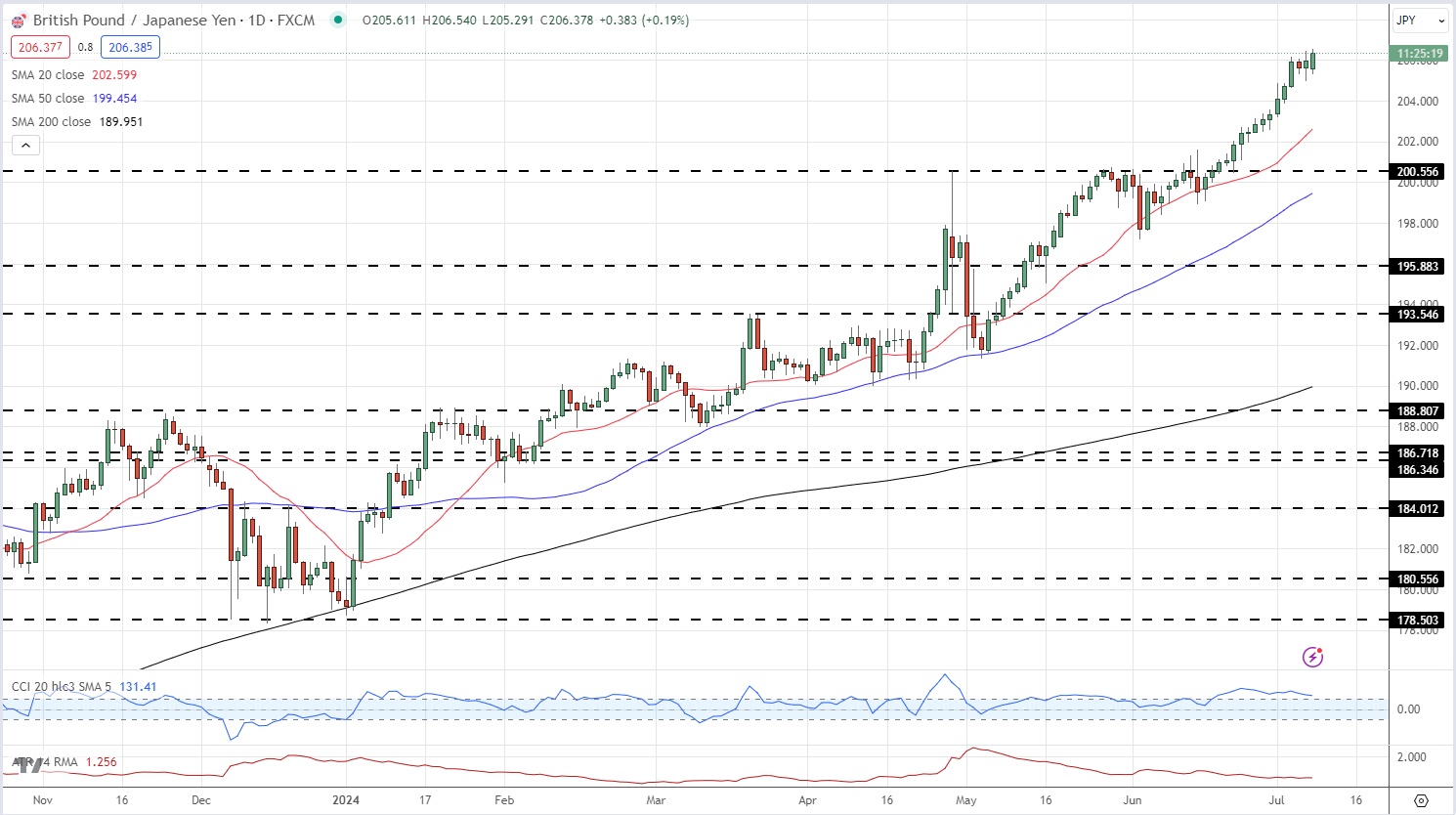

GBP/JPY: Lower Prices Ahead?

Current retail trader data indicates 22.95% net-long positionsShort-to-long ratio of 3.36 to 1. Net-long traders increased by 15.86% daily and 28.24% weekly. Net-short traders rose 0.53% daily but decreased 4.57% weekly.

Our contrarian approach to market sentiment suggests potential GBP/JPY price increases, given the predominantly short positions. However, the reduction in net-short positions over both daily and weekly timeframes signals a possible downward price reversal.

| Change in | Longs | Shorts | OI |

| Daily | -8% | -15% | -13% |

| Weekly | 8% | -18% | -13% |

GBP/JPY Daily Price Chart