Gold , US Oil , S&P 500 - Latest Retail Sentiment Analysis

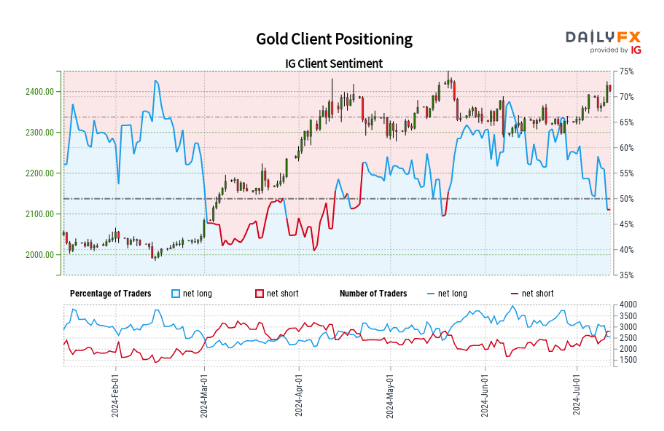

Gold Retail Sentiment

Recent retail trader data reveals a balanced market, with 49.85% of traders in long positions and a short-to-long ratio of 1.01 to 1. Notable shifts have occurred: long positions have decreased by 13.24% since yesterday and 13.73% over the past week. Conversely, short positions have increased by 8.36% daily and 6.44% weekly.

Our analytical approach often counters prevailing market sentiment. The current net-short positioning implies the potential for Gold price appreciation. The growing short bias observed both daily and weekly, strengthens our contrarian bullish view on Gold.

US Crude Oil Sentiment

Recent data indicates 58.26% of retail traders are net-long, with long positions outweighing short by 1.40 to 1. Net-long traders have decreased by 0.43% daily but increased by 7.19% weekly. Net-short traders have grown by 4.31% since yesterday but declined by 14.98% over the week.

Our strategy often opposes market sentiment. The current net-long majority implies potential US Crude price decreases. However, the conflicting short-term and medium-term changes in positioning yield an ambiguous trading outlook for Oil - US Crude.

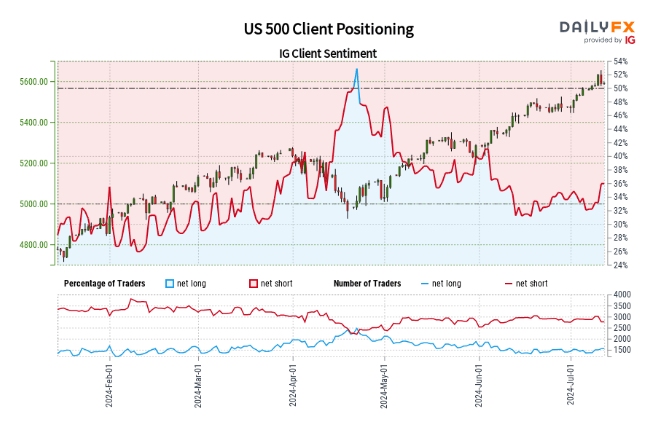

S&P 500 Sentiment

Retail trader data reveals a bearish tilt, with 36.30% net-long positions and a 1.75 to 1 short-to-long ratio. Net-long traders have grown by 13.58% since yesterday and 6.75% over the week. Net-short traders have declined by 8.07% daily and 2.91% weekly.

Our approach typically contradicts crowd positioning. The dominant net-short sentiment suggests continued US 500 price appreciation. However, the recent decline in net-short positions across both daily and weekly periods indicates a possible reversal in the current US 500 uptrend, despite the persisting net-short majority.

| Change in | Longs | Shorts | OI |

| Daily | -3% | -2% | -3% |

| Weekly | 7% | -17% | -4% |