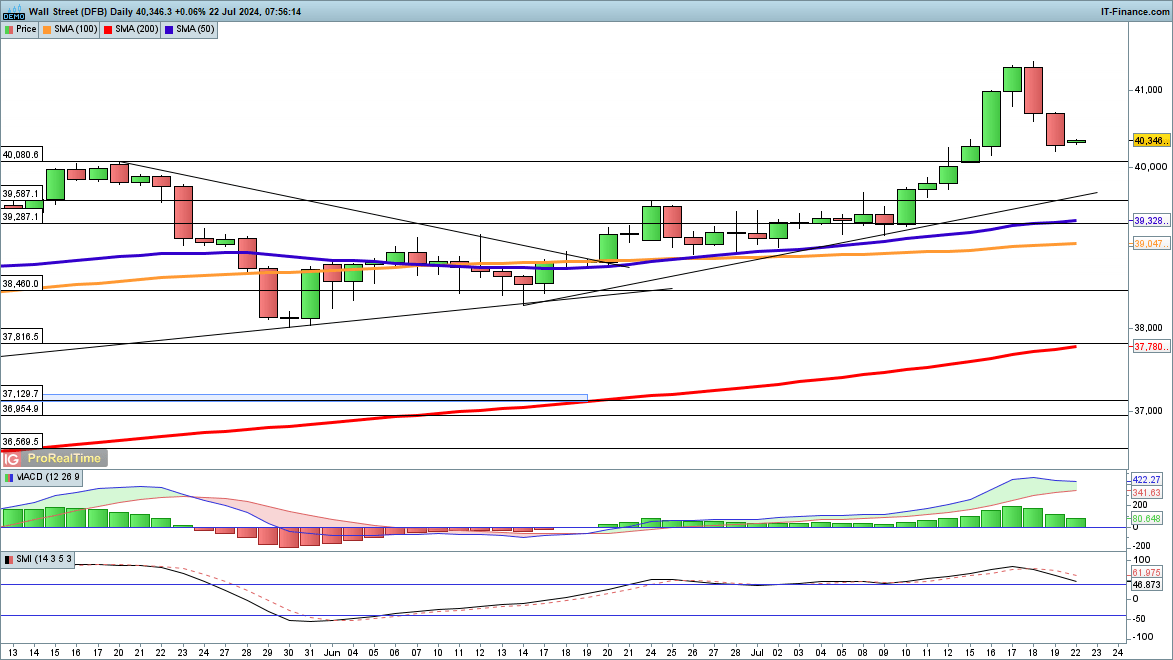

Dow is holding on above 40,000

After two days of heavy losses, the index still remains above its previous highs, as investors brace themselves for a busy week of earnings.

Further declines will target 40,080, and then down to rising trendline support from mid-June. Bulls will look for a revival back above 40,500 to suggest that a low has been formed for the time being.

Dow Jones Daily Chart

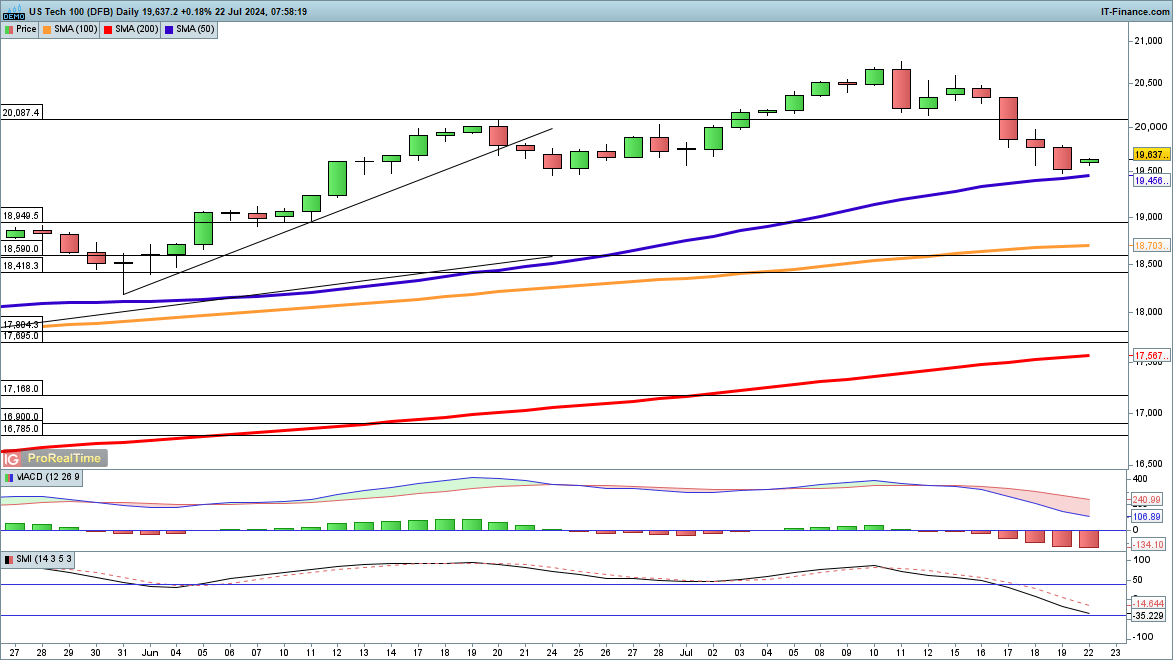

Nasdaq 100 stabilises after losses

The past two weeks have witnessed the index's first real pullback since May.

The price neared the 50-day simple moving average (SMA) last week and has moved higher this morning. It will need a move back above 19,800 to suggest that a low has formed. This might then see the index target the previous highs of around 20,750.

Nasdaq 100 Daily Chart

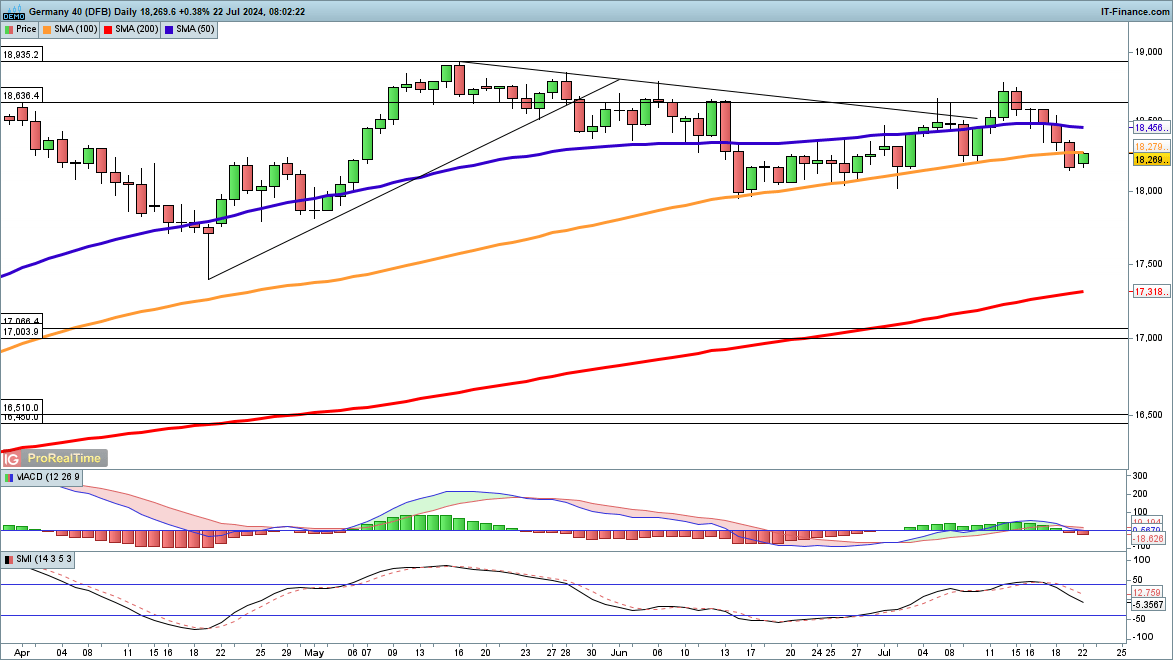

Dax closes below key indicator

Friday saw the index close below the 100-day SMA for the first time since 13 November.

June and July saw the price hold above this indicator, so Friday's weak close may signal that more losses are ahead. A close below 18,000 bolsters this view. Bulls will want to see a move back above the 100-day SMA in order to stave off the expectation of further declines.

DAX 40 Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | -19% | 34% | 13% |

| Weekly | 2% | 2% | 2% |