Retail Trader Sentiment Analysis – Gold, Silver, and US Oil

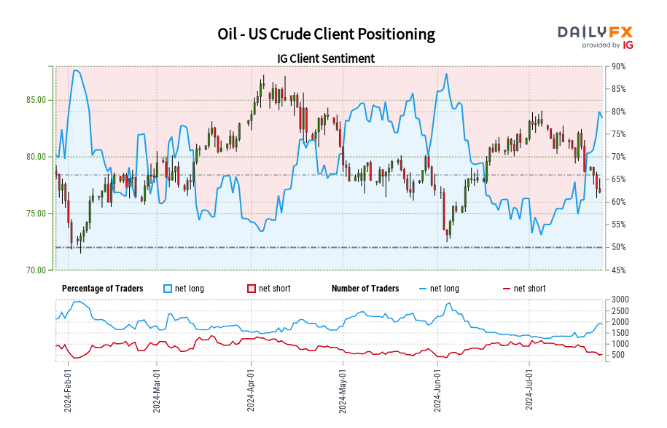

Gold Retail Trader Data: Mixed Bias

Analysis of the latest gold positioning shows:

Current positioning:

- 54.14% of traders are net-long

- Ratio of long to short traders is 1.18 to 1

Recent changes:

- Net-long traders: 16.62% decrease since yesterday, 1.79% decrease from last week

- Net-short traders: 4.69% decrease since yesterday, 18.73% decrease from last week

Sentiment interpretation:

- Contrarian view suggests gold prices may fall due to net-long positioning

- However, recent changes show a mixed picture

Overall, the data indicates a mixed Gold trading bias

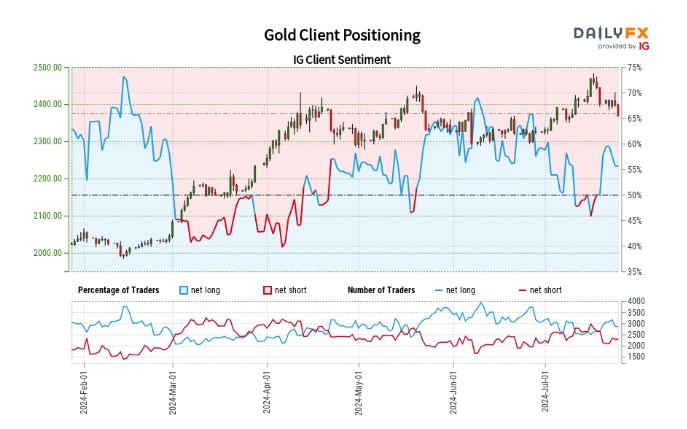

Silver Retail Trader Data: Long Skew but Mixed Sentiment

Analysis of the latest silver positioning shows:

Current positioning:

- 85.13% of traders are net-long

- Ratio of long to short traders is 5.72 to 1

Recent changes:

- Net-long traders: 10.33% decrease since yesterday, 0.12% decrease from last week

- Net-short traders: 1.44% increase since yesterday, 13.76% decrease from last week

Sentiment interpretation:

- Contrarian view suggests Silver prices may fall due to strong net-long positioning

- Recent changes show a slight reduction in net-long positions

Overall, the data indicates a mixed Silver trading bias

Silver

Mixed

of clients are

net long.

of clients are

net short.

| Change in | Longs | Shorts | OI |

| Daily | -9% | -5% | -8% |

| Weekly | 3% | -33% | -3% |

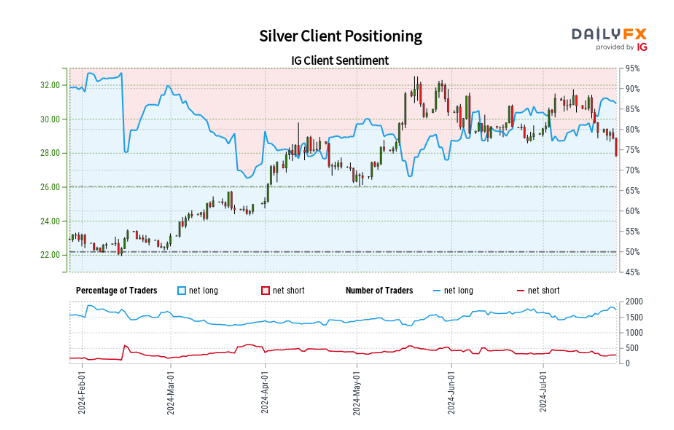

US Oil Retail Trader Data: Mixed Outlook

Analysis of the latest US crude oil positioning shows:

Current positioning:

- 77.94% of traders are net-long

- Ratio of long to short traders is 3.53 to 1

Recent changes:

- Net-long traders: 2.70% decrease since yesterday, 47.71% increase from last week

- Net-short traders: 4.95% increase since yesterday, 43.19% decrease from last week

Sentiment interpretation:

- Contrarian view suggests US crude oil prices may fall due to strong net-long positioning

- Significant weekly changes show a substantial increase in net-long positions

Overall, the data indicates a mixed US crude oil trading bias