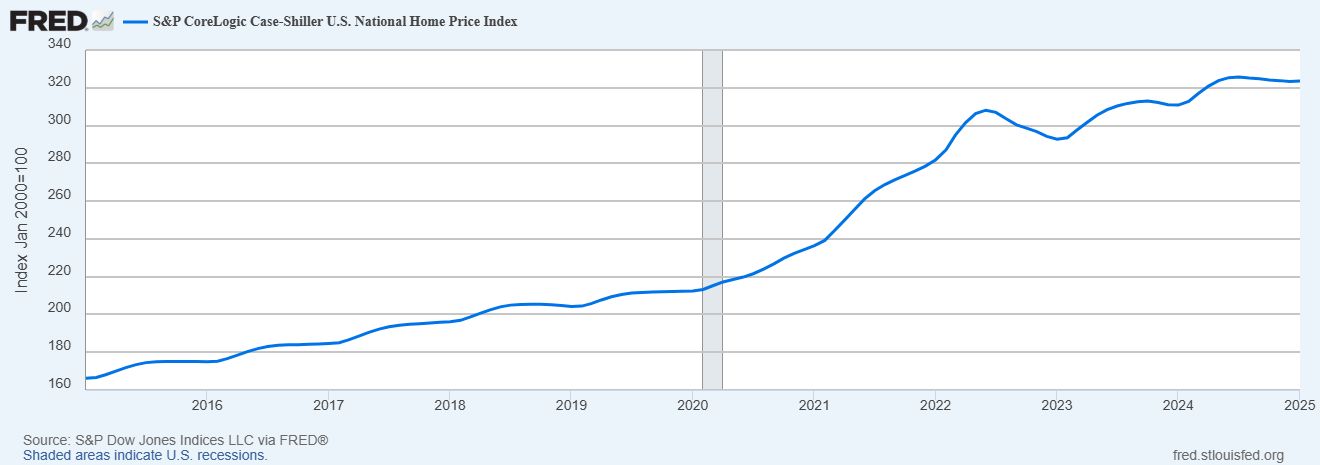

The latest housing data confirmed the moderation that began in the 2nd half of 2024. The combination of high mortgage rates and prices, along with inventory constraints and falling consumer sentiment, continue to make homeownership unattainable for many.

January Case Schiller national home price index increased (+0.1%) for the 1st time in 5 months & 4.1% above January 2024 levels.

But the index peaked in July 2024 and is currently down 0.7% from those levels.

For January, only 9 of 20 major cities saw home price gains

- Tampa (-0.6%) and Dallas (-0.5%) were the laggards

- LA (+0.5%) and Chicago (+0.5%) outperformed

Over the 12 months ending in January, 19 of 20 major cities saw price increases

- NY (+7.8%) & Chicago (+7.5%) outperformed

- Tampa (-1.5%) was the lone declined

February new home sales came in at an annualized rate of 676K (682K expected), essentially flat for the last 2 years & down from the peak of 1,031K in October 2020.

The South (+27K) and Mid-West (+13K) gained

Northeast (-6K) & West (-22K) declined

Median sales price for new houses sold came in at $414,500 (down from the October 2022 peak of $460,300).

The monthly supply of new homes for sales ticked down from 9 in January to 8.9 in February