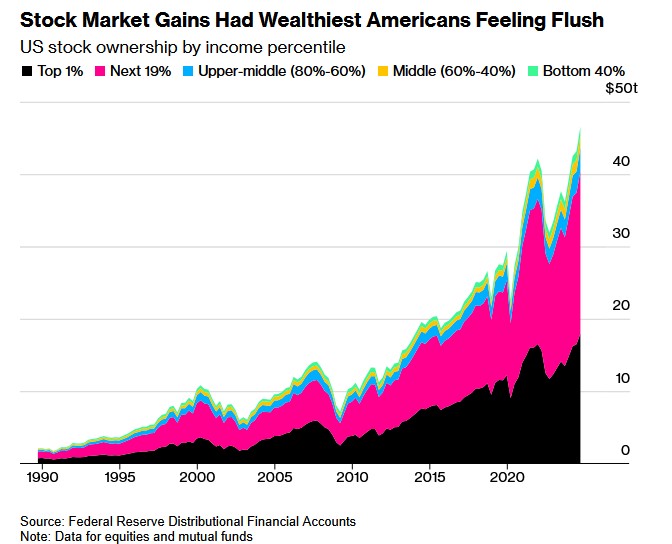

Ben Bernanke popularized the wealth effect theory during the financial crisis in 2008. In his words, “ higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending .” Moreover, he argued this would create a “ virtuous circle ” of increased spending, higher incomes, and further economic growth. Since then, the Fed has been more focused on wealth and, in particular, the role of the stock market in generating wealth.

The graph below, courtesy of Bloomberg, shows that the rising stock market is making the wealthy, wealthier. Moreover, 50% of personal spending comes from the top 10% of income earners. Thus, given the concentration of wealth among the consumers that spend the most, we wonder if the recent market decline is creating a wealth dissipation effect. Furthermore, given the surge in stock market wealth, might a further decline have a more significant impact on the economy than in years past?

We end with a startling fact from the New York Post: “ The top 1% of Americans have enough money to buy 99% of US homes .”

What To Watch Today

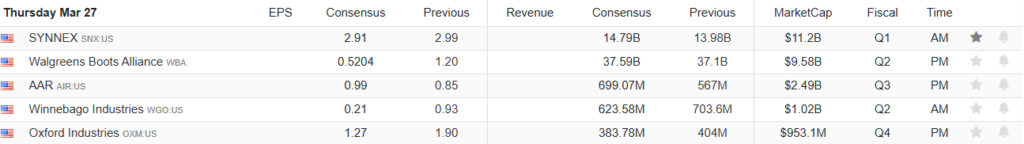

Earnings

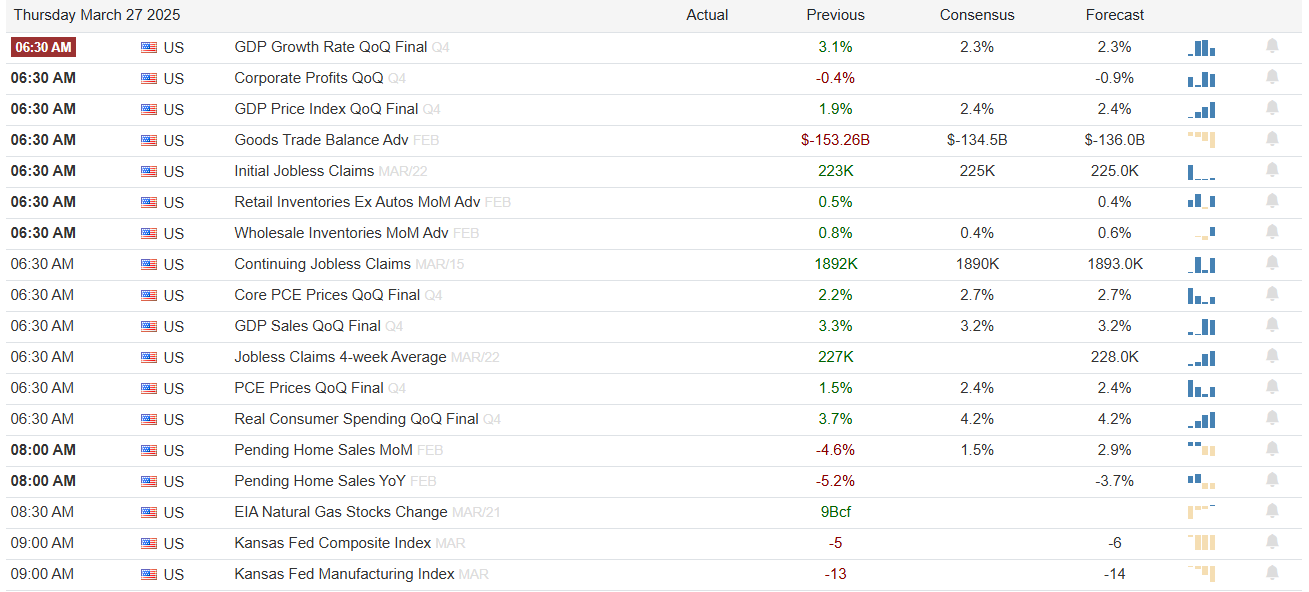

Economy

Market Trading Update

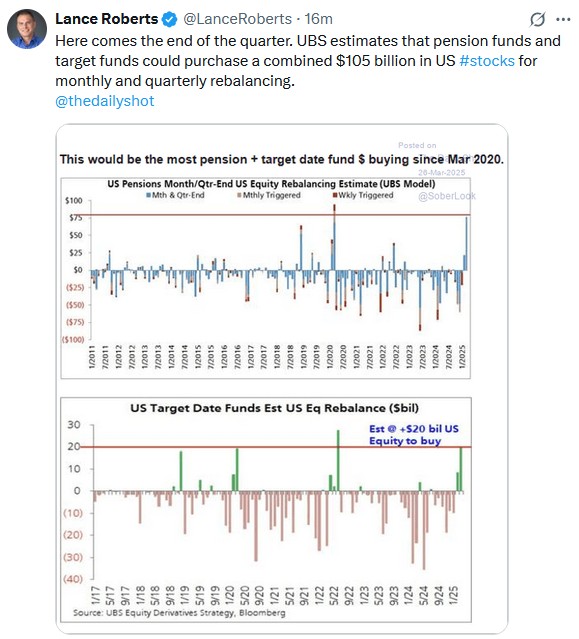

Yesterday , we noted that we are entering the end of the quarter, and pension and target-date funds need to rebalance portfolios. Given the recent correction, this suggests that these entities will likely be net buyers of equities. However, yesterday, another shift in tariff policies interrupted the market rally from the recent lows.

“Following President Trump’s comments earlier in the week that he would detail the scale of auto levies in the coming days, Bloomberg reports that – citing the usual people familiar with the matter – the Trump administration is readying an announcement on auto tariffs as soon as today. Bloomberg added that the people shared the timing of the expected announcement on condition of anonymity, to discuss plans not yet made public. However, one of the people, though, cautioned that the president’s plans could still shift. “

As discussed previously, the

“on again, off again”

tariff policies make it difficult for markets to predict future earnings and corporate profitability. With the

“E”

in forward valuation measures in flux, markets struggle to price in expected outcomes. However, from a technical basis, yesterday’s sell-off didn’t change the recent improvement in either the technical signals or money flows. However, the outlook will undoubtedly change if the selloff continues over the next few days.

For now, we are not making any major adjustments based on a one-day reversal after a rally. However, we will reassess our exposures if we begin to technically break down from here.

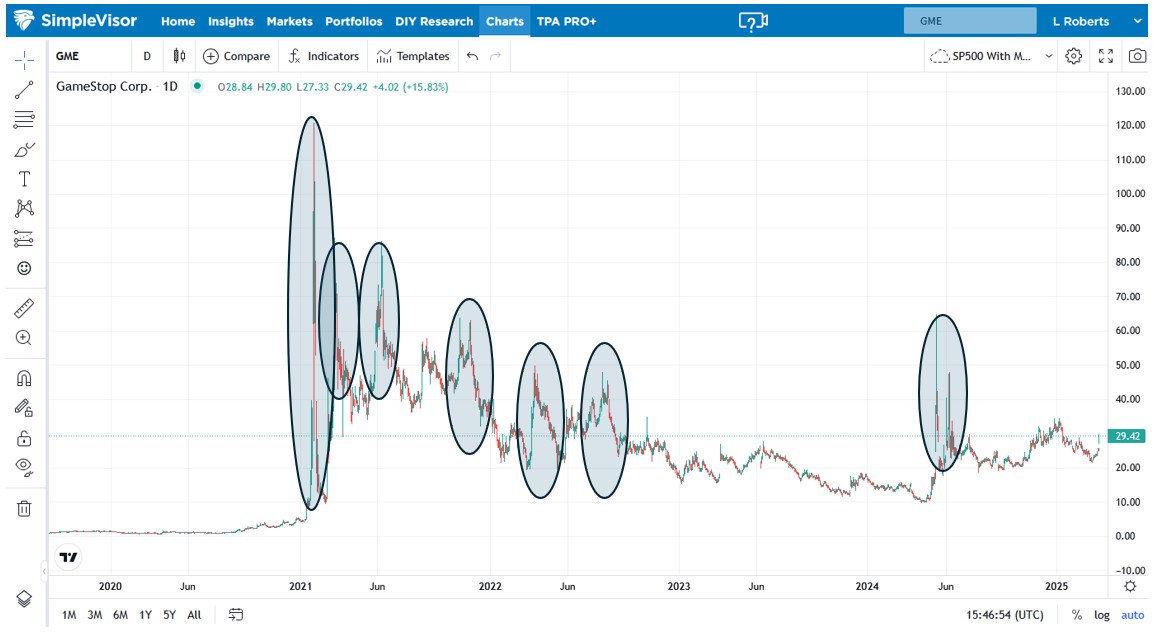

GameStop Is Back In Vogue

GameStop (NYSE:

GME

), the famed meme stock, is back in the news. After bouts of significant volatility, as circled below, the stock finally seemed to have found a relatively limited trading range. Those days may be over. However, it may not be because “Roaring Kitty” is buying. GameStop shares rose about 15% on Wednesday as its board “

has unanimously approved an update to its investment policy to add

Bitcoin

as a treasury reserve asset.

” The company has approximately $4.5 billion in cash, so it could make a sizeable splash in the Bitcoin market. However, as we see with MicroStrategy (NASDAQ:

MSTR

), with Bitcoin comes volatility.

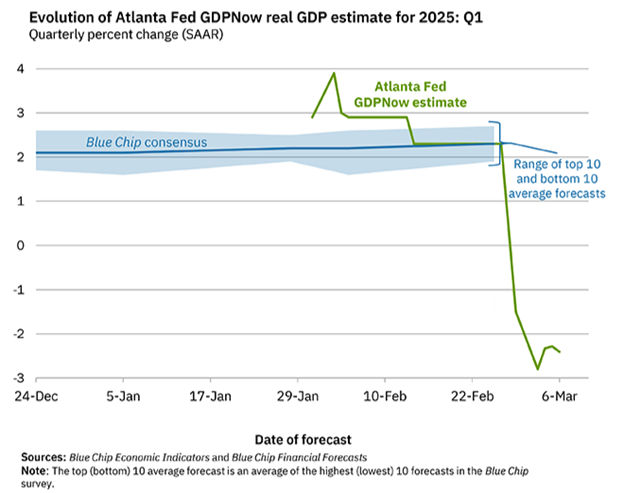

GDPNow Or Nowcast?

The Atlanta Fed’s GDPNow economic forecasting tool predicts an imminent recession, which is fueling investor angst. However, the New York and St. Louis Feds’ Nowcast economic forecasts predict continued economic growth in the first quarter.

Confused?

This article explores the GDPNow and Nowcast models to understand the recent forecast divergences. A better understanding of the two models helps us appreciate the current state of the economy and, therefore, better estimate the first quarter GDP . Importantly, it shows that investor angst over an imminent recession may be unwarranted.

READ MORE…

Tweet of the Day