After much anticipation, the tariff band-aid was finally ripped off yesterday. Unfortunately for those expecting the news to be relatively painless, they were left disappointed with discomfort as the White House rolled out 10% universal tariffs on all imports coming into the country, with additional duties levied on countries operating with large trade deficits with the U.S.

Speaking from the Rose Garden yesterday, President Trump declared it was “Liberation Day” as the new trade policies represent our country’s “declaration of economic impendence.”

The size, scope, and structure of the tariffs caught the market off guard. The ‘sell now, ask questions later’ reaction function has led to a sharp sell-off in global equity markets today as investors assess the potential impact of the new trade policies on the economy and their portfolios.

While there is a lot to unpack in the wake of yesterday’s news, here are five key tariff takeaways from “Liberation Day.”

1. Average Tariff Rate Well Above Expectations

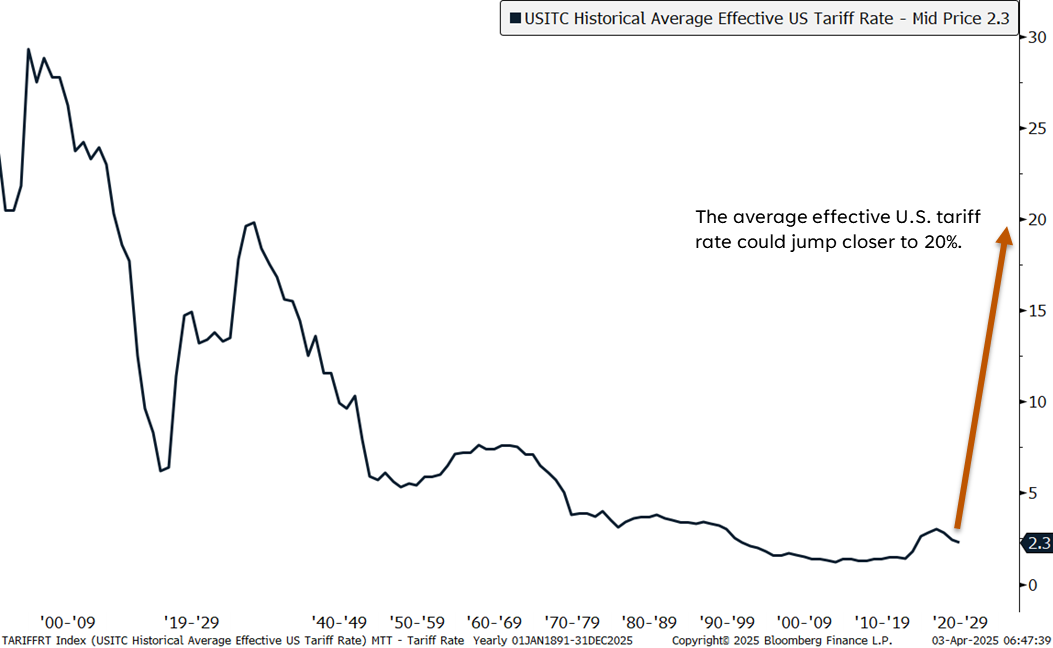

As the trade policies currently stand, and assuming no negotiations on reciprocal tariffs, the weighted average U.S. tariff rate could jump from 2.3% in 2024 to 20% (or even more), depending on the source of forecasts and pending sectoral tariffs that have not been announced. (For historical context, the Smoot-Hawley Act of 1930, one of the causes of the Great Depression, took the U.S. average tariff rate to 20%.)

Market expectations going into the event were for the effective tariff rate to climb closer to 10–15%. Of course, there is room for negotiation on the reciprocal tariffs, as well as the prospect of retaliation. Treasury Secretary Scott Bessent told our trading partners yesterday to "Sit back, take it in, let’s see how it goes. Because if you retaliate, there will be escalation. If you don’t retaliate, this is the high watermark."

The Effective Tariff Could Climb to a Century High

Disclosures: Past performance is no guarantee of future results. Indexes are unmanaged and cannot be invested in directly.

2. Higher Tariffs Will Complicate Growth, Inflation Backdrop

What does a higher tariff rate mean for the economy and market? The simple answer is to expect lower growth and earnings estimates, with added upside risk to inflation. This is a bad combination for equity markets, which are wasting no time in repricing these downside risk factors. Strategists are also starting to take their numbers down following yesterday’s news.

For example, Strategas raised their odds of a U.S. recession this morning from 35% to 45% and warned about risk of a resetting of expectations during the upcoming first-quarter earnings season, especially in tariff-related industries like autos, air freight and logistics, food products, household goods, and construction materials (to name a few).

While acknowledging it is a bit of guesswork due to uncertainty surrounding trade negotiations and retaliation, we estimate S&P 500 earnings could face a 5–7% reduction based on a 20% effective tariff rate assumption.

Regarding inflation, Goldman Sachs estimates that every one percentage point increase in the tariff rate is worth 0.1% on the core Personal Consumption Expenditures (PCE) Index — the Federal Reserve’s (Fed) preferred inflation gauge. Using a 20% base rate estimate on the average tariff rate, this could add around 1.8% to core inflation this year.

3. Canada and Mexico Relative Winners; China Drew the Short Straw

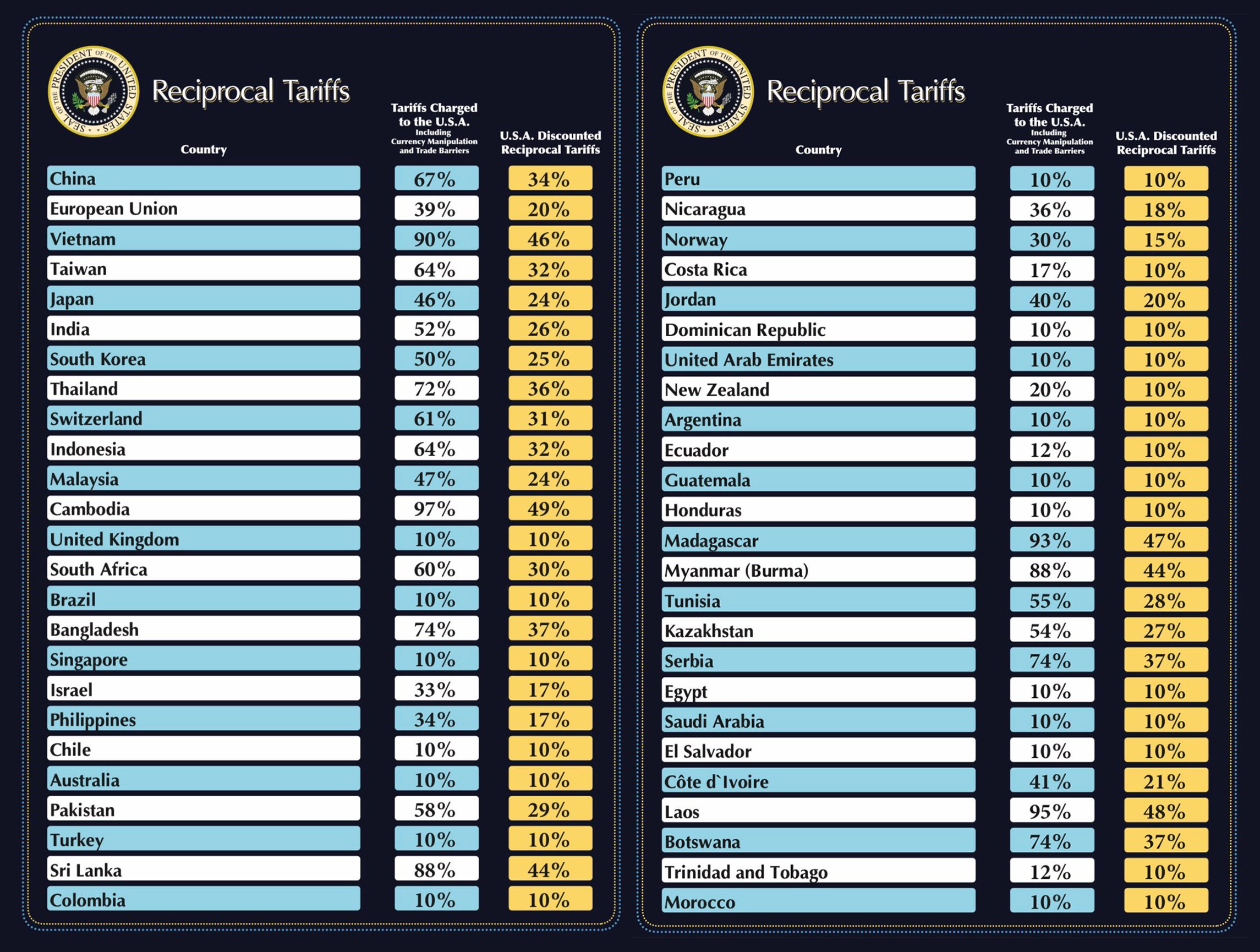

All countries exporting goods to the U.S. are now subject to a 10% tariff effective April 5. The White House imposed additional reciprocal tariffs on around 60 other countries based on how much they taxed U.S. imports. The reciprocal tariffs take effect on April 9, leaving limited time for negotiation. The European Union and Japan — major trading partners of the U.S. — are now subject to reciprocal tariff rates of 20% and 24%, respectively.

Canada and Mexico were notable exceptions from the universal 10% tariffs and are also not on the reciprocal tariff list. While both countries still face the previously announced 25% tariff on non-United States–Mexico–Canada Agreement (USMCA) goods, USMCA-compliant goods will continue to benefit from a 0% tariff. In contrast, China was hit with an additional 34% tariff rate, bringing its total tariff rate to 54% (the reciprocal tariff is stacked on to the existing 20% tariff rate).

Furthermore, President Trump rescinded the de minimis exception for China. This means imported goods from China valued at $800 or less will now be subject to all applicable duties. The European Union and Japan — our other major trading partners — are now subject to reciprocal tariff rates of 20% and 24%, respectively.

4. S ome Notable Tariff Exemptions

The White House announced that steel and aluminium products and autos/auto parts already subject to the Section 232 tariffs would be excluded, along with copper , pharmaceuticals, semiconductors, and lumber, which are subject to future Section 532 tariffs.

Gold , energy, and other select minerals not available in the U.S. also received an exemption from the reciprocal tariffs. While the products under review for reciprocal tariffs could increase the effective tariff rate, we suspect the administration may face pressure to dial back the rate if economic recession risk becomes increasingly apparent.

5. Some Silver Linings

First, “Liberation Day” is now behind us, and the narrative should shift from tariff policy to tariff negotiation. The administration has already stated that the reciprocal tariff amounts mark the high watermark for rates, barring any retaliation. Second, the market now has details on what likely is the worst-case scenario for trade policy, assuming our trading partners follow the path of negotiation rather than escalation.

This means we could be close to peak policy uncertainty, which may be enough for buyers to step back into the market as they did when policy uncertainty peaked in August 2019. Third, lowered growth expectations and higher revenues from the added tariffs will place added pressure on Congress to pass a tax bill that could include lower corporate and income tax rates.

Fourth, the added revenue from tariffs will help narrow the ballooning budget deficit. According to Strategas, the proposed tariffs could generate around $500 billion of additional tariff revenue from the already $150 billion that has been collected from the first batch of tariffs. This also means there could be less pressure on Treasury supply, potentially bringing down yields.

Summary

Equity markets are reacting about as expected to the worse-than-feared tariff news. The drastic jump in the U.S. tariff rate will weigh on global economic activity, earnings growth, and profit margins and introduce upside risk to inflation. Investor and business sentiment will suffer another blow and will likely take some time to repair. As bad as the tariff news is, it does bring some clarity on trade, potentially marking a peak in policy uncertainty.

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, and we continue to monitor price action for a potential capitulation point accompanied by washed-out conditions.

Within fixed income, the STAAC holds a neutral weight in core bonds, with a slight preference for mortgage-backed securities (MBS) over investment-grade corporates. In our view, the risk-reward for core bond sectors (U.S. Treasury, agency mortgage-backed securities, investment-grade corporates) is more attractive than plus sectors. We believe adding duration isn’t attractive at current levels, and the STAAC remains neutral relative to our benchmarks.