The mood on Main Street continues to deteriorate. March

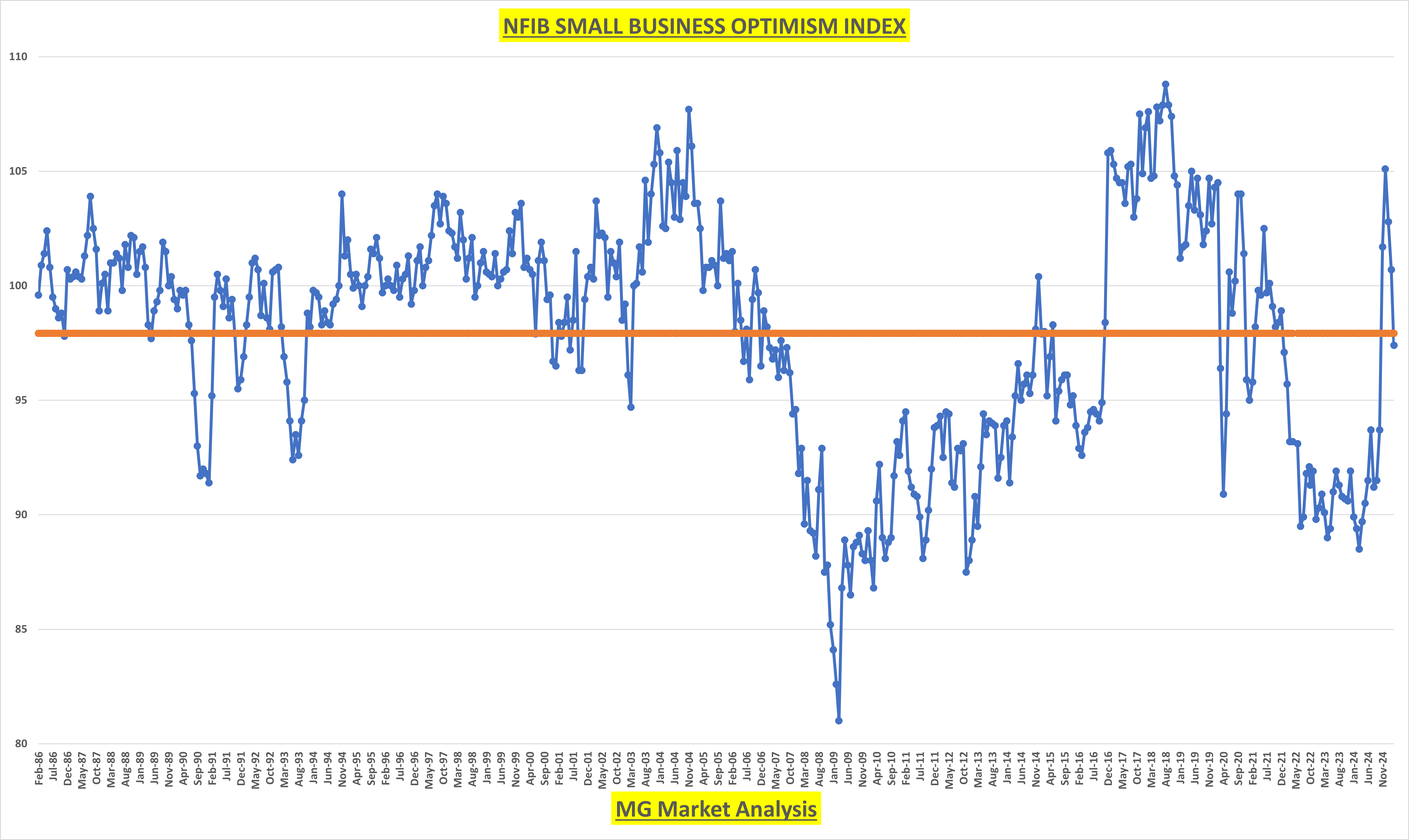

small business optimism

came in below estimates yesterday morning and fell below the long-term average (orange line on above chart) for the 1st time in 5 months.

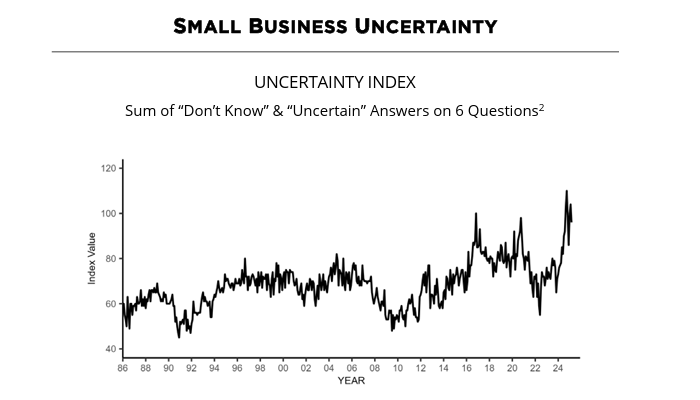

After the initial post-election pop, the index has fallen for the 3rd consecutive month as uncertainty continues to trend well above average. And even above the levels seen during the 2008 financial crisis.

To put this in perspective:

“Since 1986, NFIB’s Uncertainty Index (based on the percent of respondents reporting “uncertain” or “don’t know” to six questions) has averaged 68. But, since 2016 it has averaged 80 and reached its highest level of 110 in October 2024.”

That means the uncertainty index subcomponent is currently 41% above the long-term average.

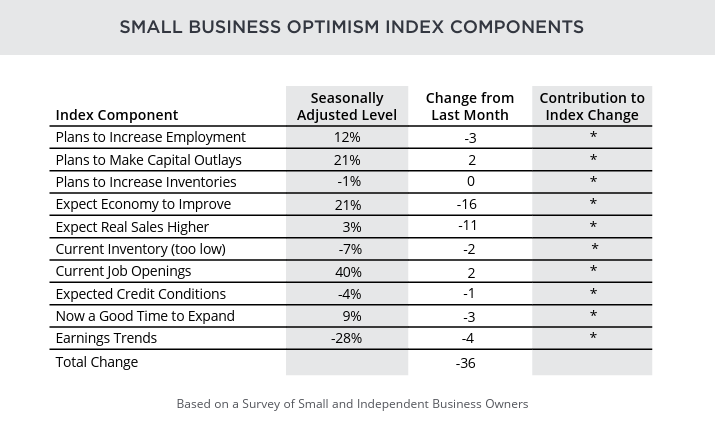

The percentage of small business owners expecting the economy to improve and real sales to be higher took the biggest hit for the month.

“The net percent of owners expecting better business conditions fell 16 points from February to a net 21% (seasonally adjusted). This is the third consecutive monthly decline and the largest monthly decline since December 2020.”

“The net percent of owners expecting higher real sales volumes fell 11 points from February to a net 3% (seasonally adjusted). This is the third consecutive month real sales expectations declined after surging from recession levels after the election.”

Quality of labor, taxes, and inflation were cited as the most important problems. And there doesn’t appear to be any relief on price increases:

“Seasonally adjusted, a net 30% plan price hikes in March, up one point from February and the highest reading since March 2024.”

“The net percent of owners raising selling prices was 26 percent in March, much lower than the 66 percent level reached in March 2022, but still historically high. From 1986 to 2020, the average was 8 percent!”

Between consumer sentiment plunging and small business owners being disappointed, it’s not the recipe for the boom we all hoped for. I remind you again that small business optimism and consumer sentiment were well below their long-term averages for most of the last 4 years, and markets and the economy still did fine. In my opinion, it’s the record levels of uncertainty that are making this different.