The sharp declines in U.S. equity indexes over the past week were unsettling, but far from unprecedented. Historically, similar sell-offs have occurred at least 14 other times in the past century under strict definitions of what constitutes a "waterfall decline" — and many more times under a broader criterion.

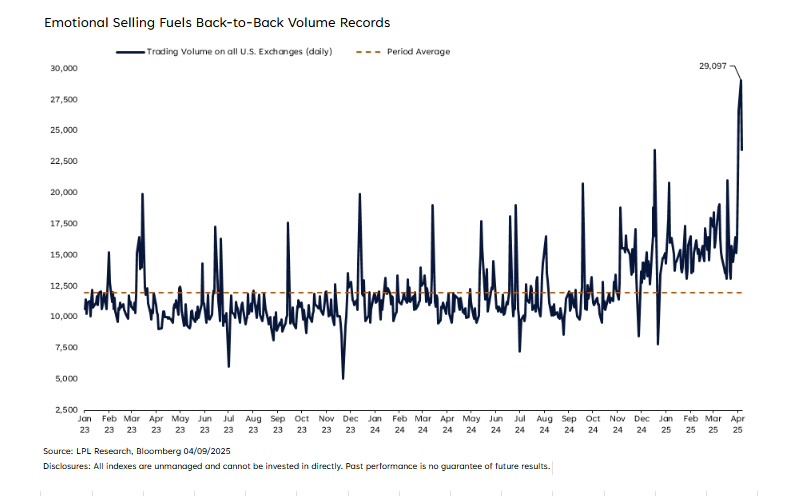

Market shocks tend to trigger aggressive risk repricing, and last week’s tariff announcement was a prime example. Few expected the sheer magnitude of the tariffs announced, making them a true shock to the system. Initially, markets responded quite rationally, trimming exposure to risk in an orderly fashion. However, by Friday, emotional selling had firmly taken over as evidenced by the highest volume session in the history of the U.S. stock market (and again on Monday), which saw many pockets of the market pushed to levels that didn’t really seem all that rational.

Emotional Selling Fuels Back-to-Back Volume Records

We’ve long understood that short-term market efficiency is often an illusion, precisely because of events like this. Market corrections driven by fear and uncertainty can lead to severe overreactions. That’s not to minimize the significance of what happened — it matters.

The uncertainty injected into the broader economy affects everyone, from households debating major purchases to CEOs crafting multi-year strategic plans. But while this turmoil will likely hinder economic growth, it’s hardly the abrupt standstill of the COVID-19 crisis. Yet, despite this logical reality, some public companies in the shipping industry, as just one example of many, saw valuations plunge to levels that would only make sense if the global economy was indeed grinding to a screeching halt along the lines of something like COVID-19 — again, something that simply isn’t happening.

So, despite the fear gripping markets, there is a silver lining. When valuations overshoot to irrational extremes, opportunities emerge for investors willing to think long-term. Dislocations like this can present chances to buy solid assets at prices that reflect panic rather than reality. While uncertainty remains high and will likely remain so in the near term, disciplined investors will recognize that moments of excessive fear often set the stage for future returns. Markets, by their nature, eventually stabilize, and those who are able to look past the short-term chaos should be well rewarded in the longer term.