Inflation, as measured by the Consumer Price Index (CPI) came in better than expected for the month of March.

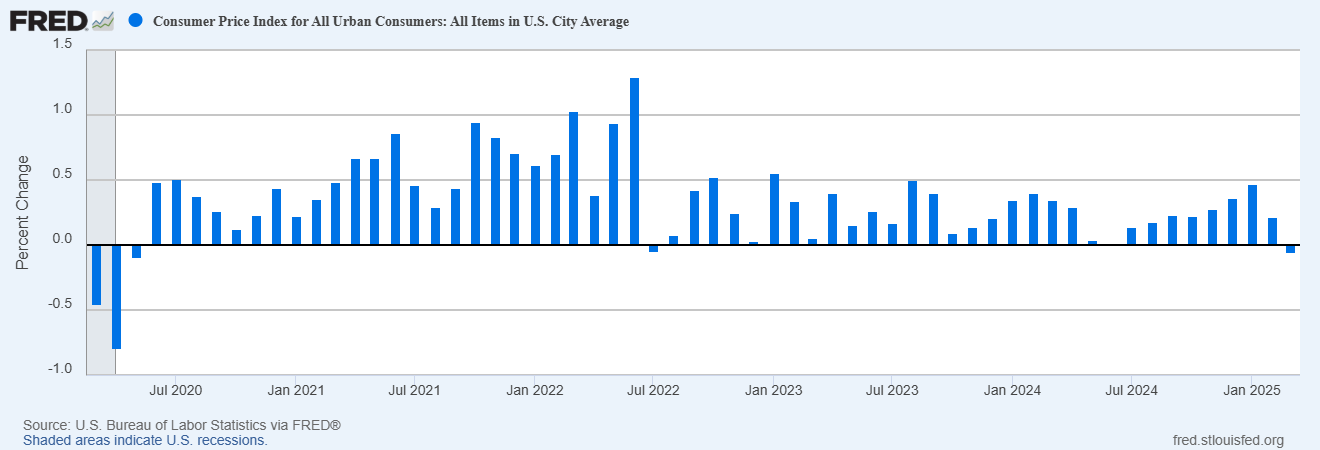

Headline CPI

fell -0.1% (market expected a rise of +0.1%), as a result of energy costs falling 2.4%. This is the best CPI report since May 2020.

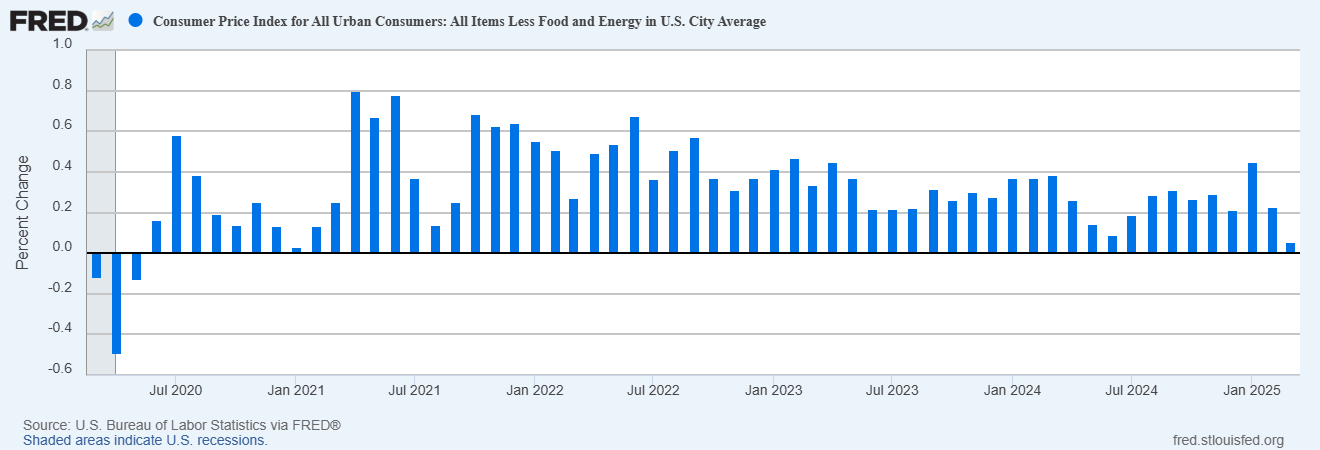

Even when excluding food & energy (

core CPI

), the results were much better than expectations. Core prices increased +0.1% (street was expecting a rise of +0.3%) in March, the slowest pace of price increases since January 2021.

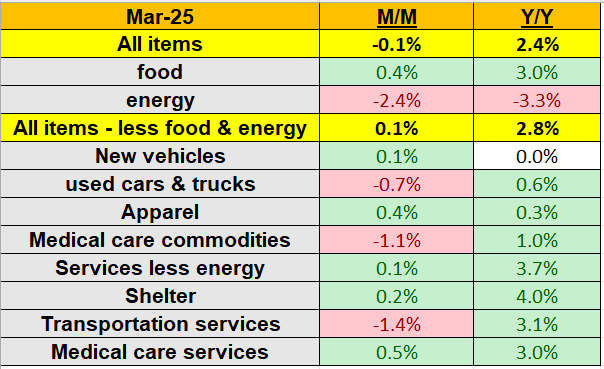

Breaking it down by category, 6 consumer categories saw prices increase while 4 declined.

The biggest price increases came within the medical care services (+0.5%), food (+0.4%) & apparel (+0.4%). While the decliners were led by energy (-2.4%), and transportation services (-1.4%). Only one category (energy) is down year over year.

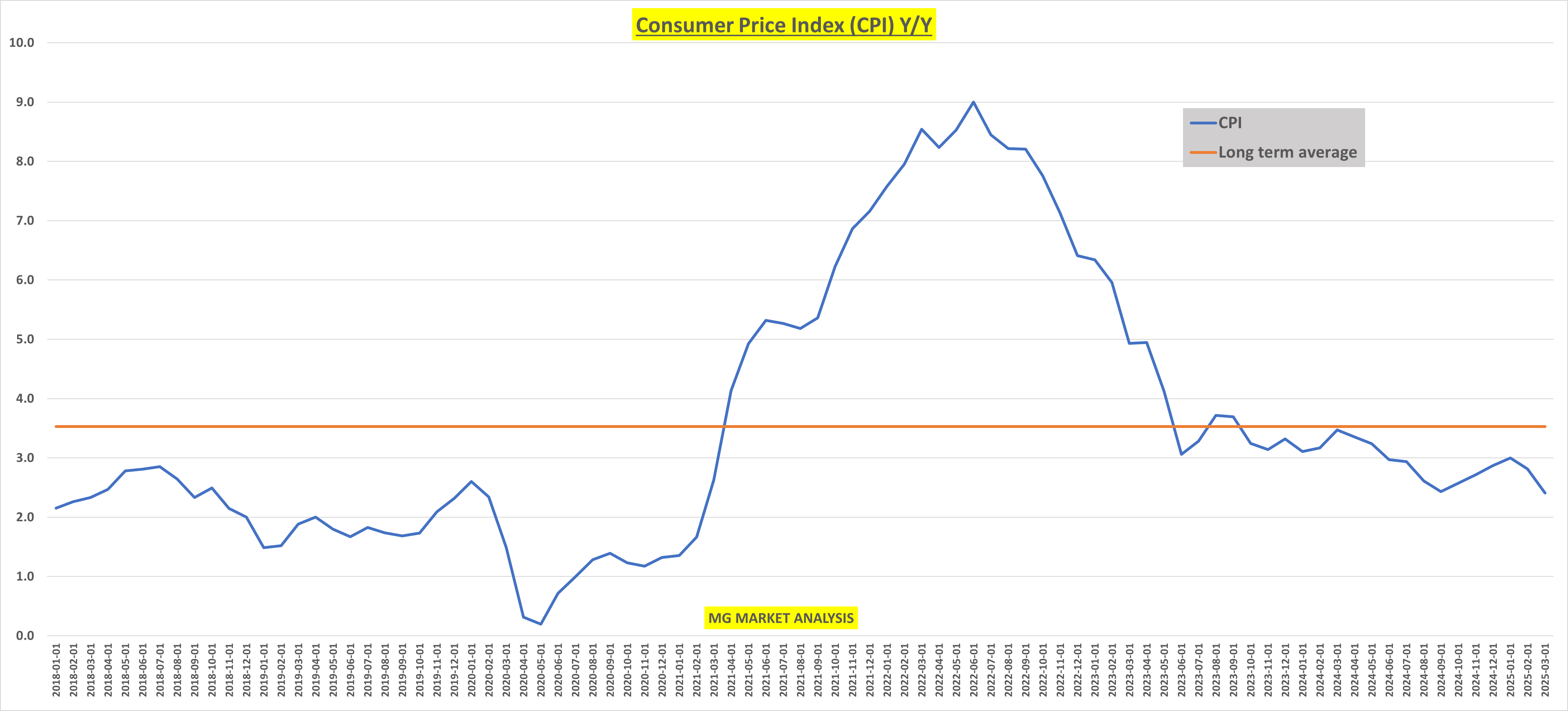

Annual CPI

fell from from 2.8% to 2.4%. Remaining below the long-term average (orange line) of 3.5%.

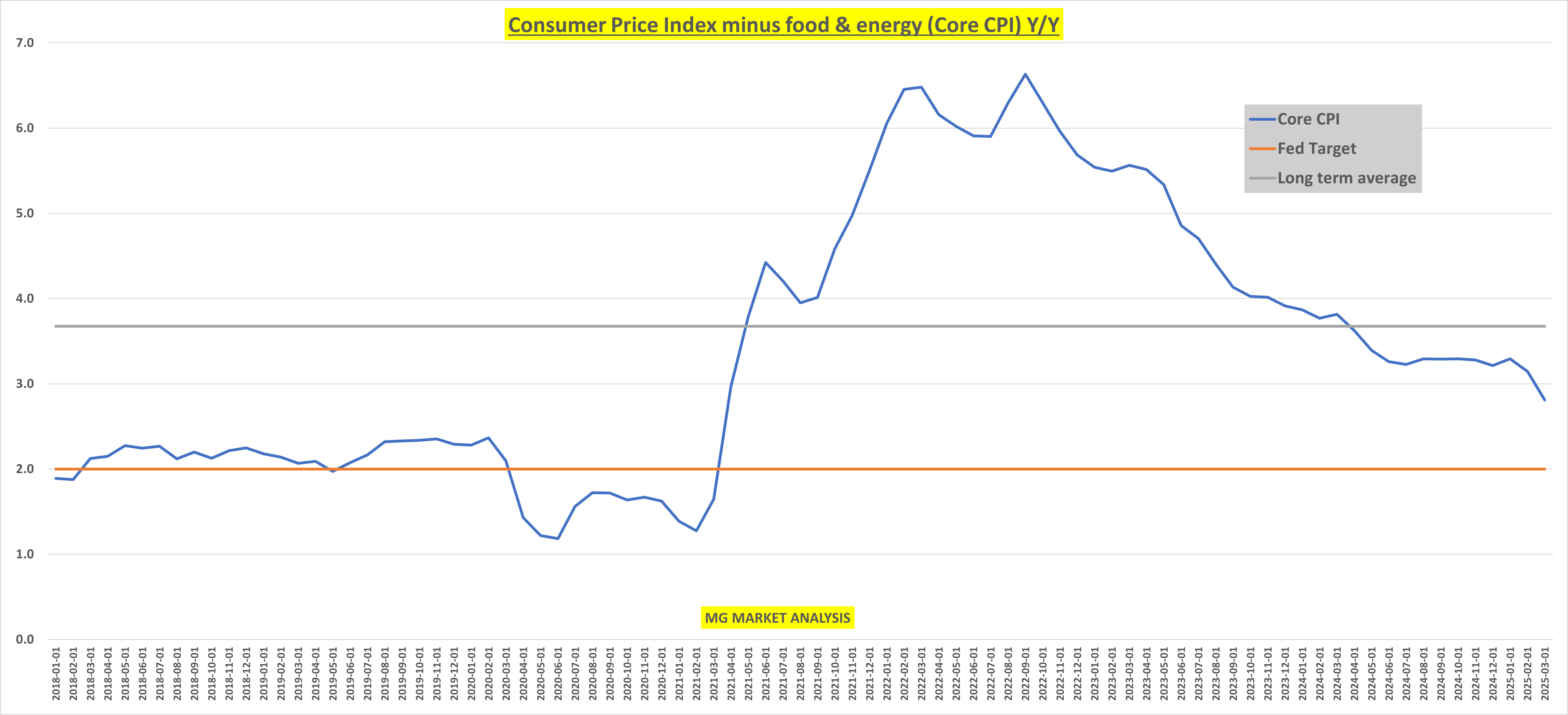

While

Core CPI

fell from 3.1% to 2.8%. Remaining below the long-term average (orange line) of 3.7%, but still above the Fed’s target (grey line) of around 2%.

Bottom line: good news here, but core inflation is still higher than the Fed would like it. And it’s possible the market is looking ahead to some near-term increases in inflation due to the tariff uncertainty.

While it’s nice to see stocks rising again, I wouldn’t get too excited just yet. We are paying about 20x current earnings estimates that will probably need to be revised lower.