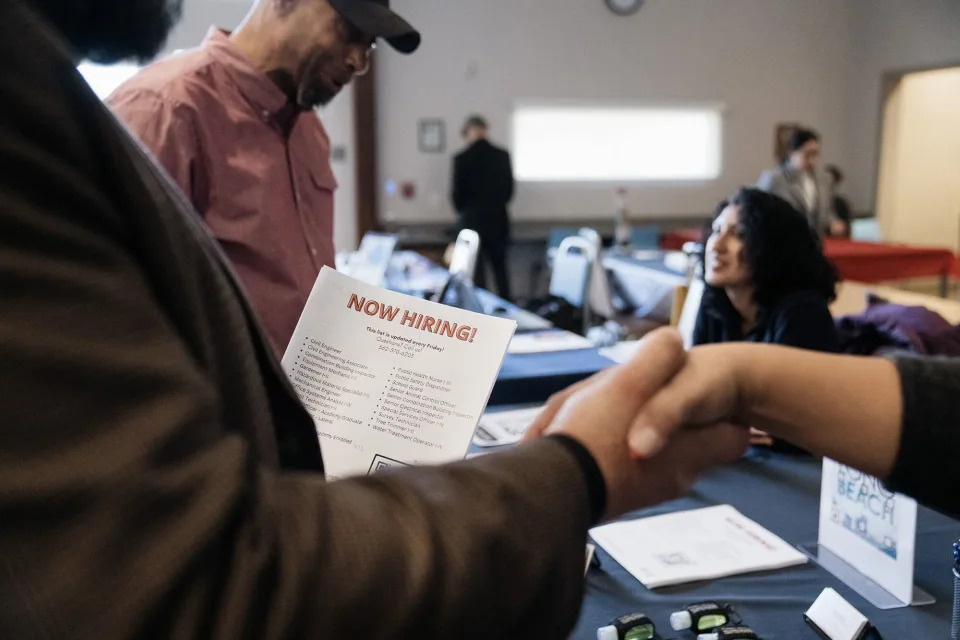

US Hiring Comes Up Short in Possible Warning Sign for Fed

(Bloomberg) -- Sign up for the Economics Daily newsletter to discover what's driving the global economy.Most Read from BloombergWorld's Second Tallest Tower Spurs Debate About Who Needs ItThe Plan for the World’s Most Ambitious Skyscraper RenovationMadrid to Ban E-Scooter Rentals, Following Lead Set in ParisThe Outsized Cost of Expanding US RoadsRome May Start Charging Entry to the Trevi FountainUS hiring fell short of forecasts in August after downward revisions to the prior two months, a devel