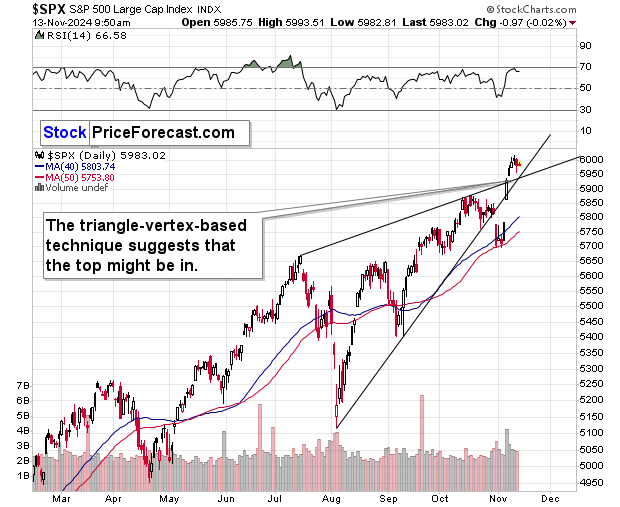

Could This Really Indicate a Top for Stocks, Copper, and Gold?

We saw a small move up in the precious metals sector (and then back down), which is completely in tune with what I wrote yesterday, and as such, it doesn’t change the outlook. Indicators of a...