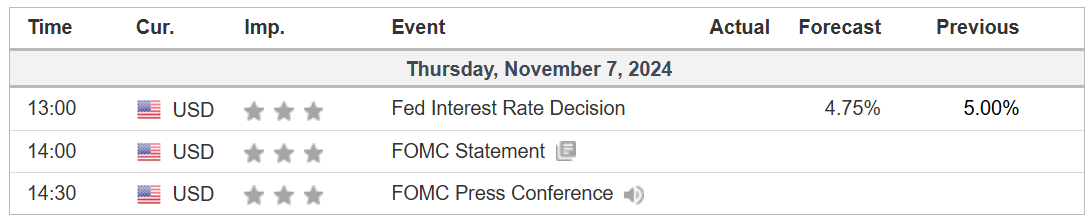

Fed Set to Take Next Step in Rate-Cut Cycle Amid Trump’s Return: What to Expect

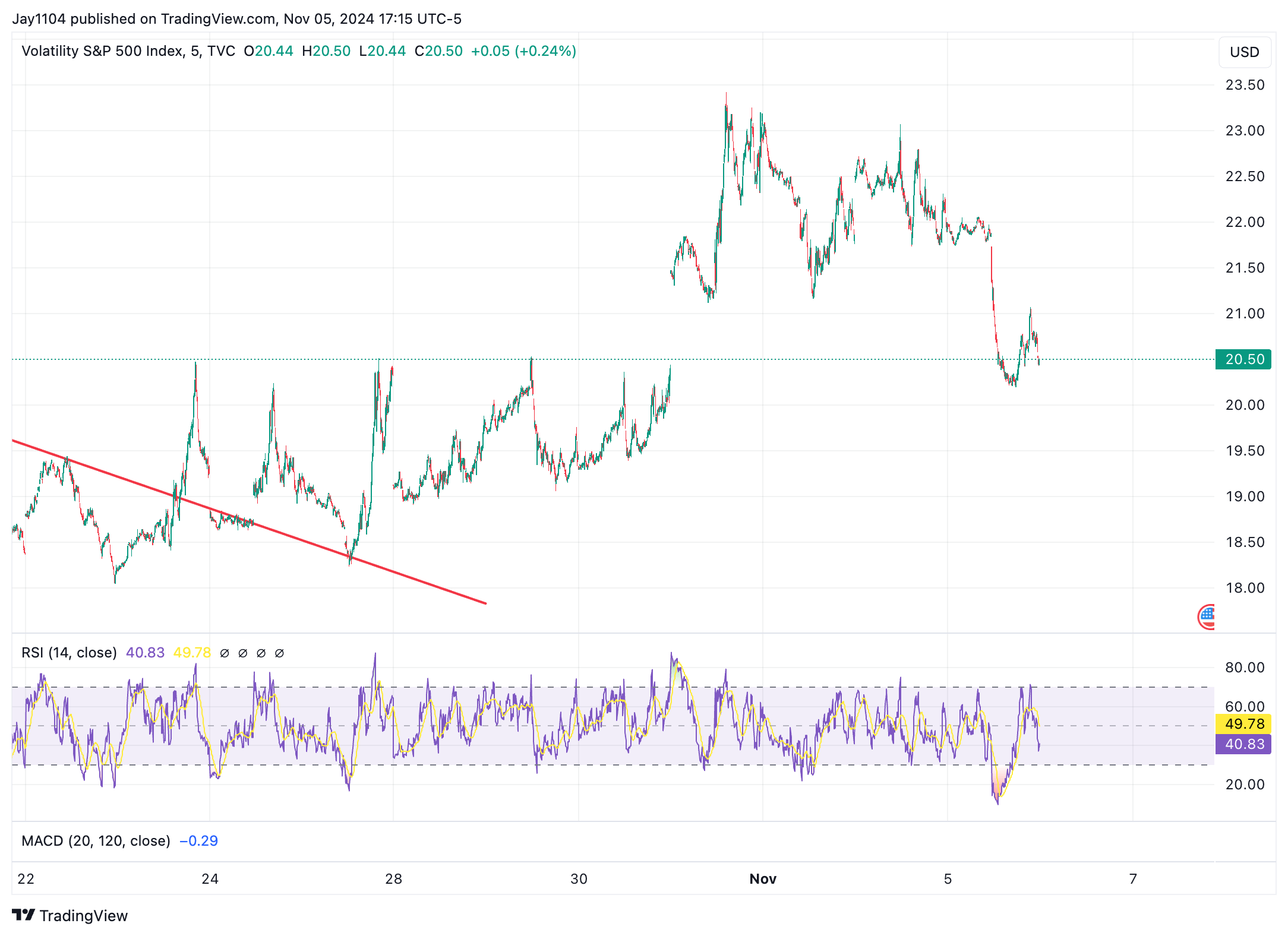

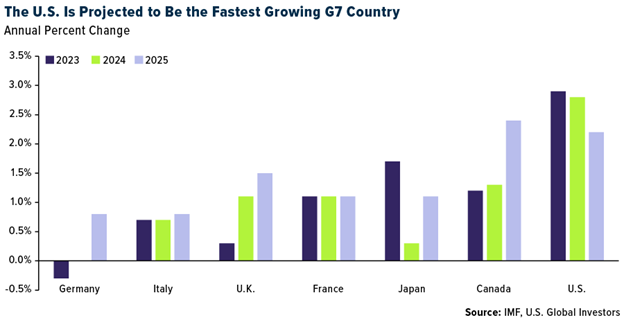

The Federal Reserve's November policy meeting is set to be a pivotal moment for markets. While investors are almost certain of a 25bps rate cut, the Fed’s guidance will be closely watched,...