Paul Tudor Jones, Stanley Druckenmiller Are Short on Bonds - Could They Be Wrong?

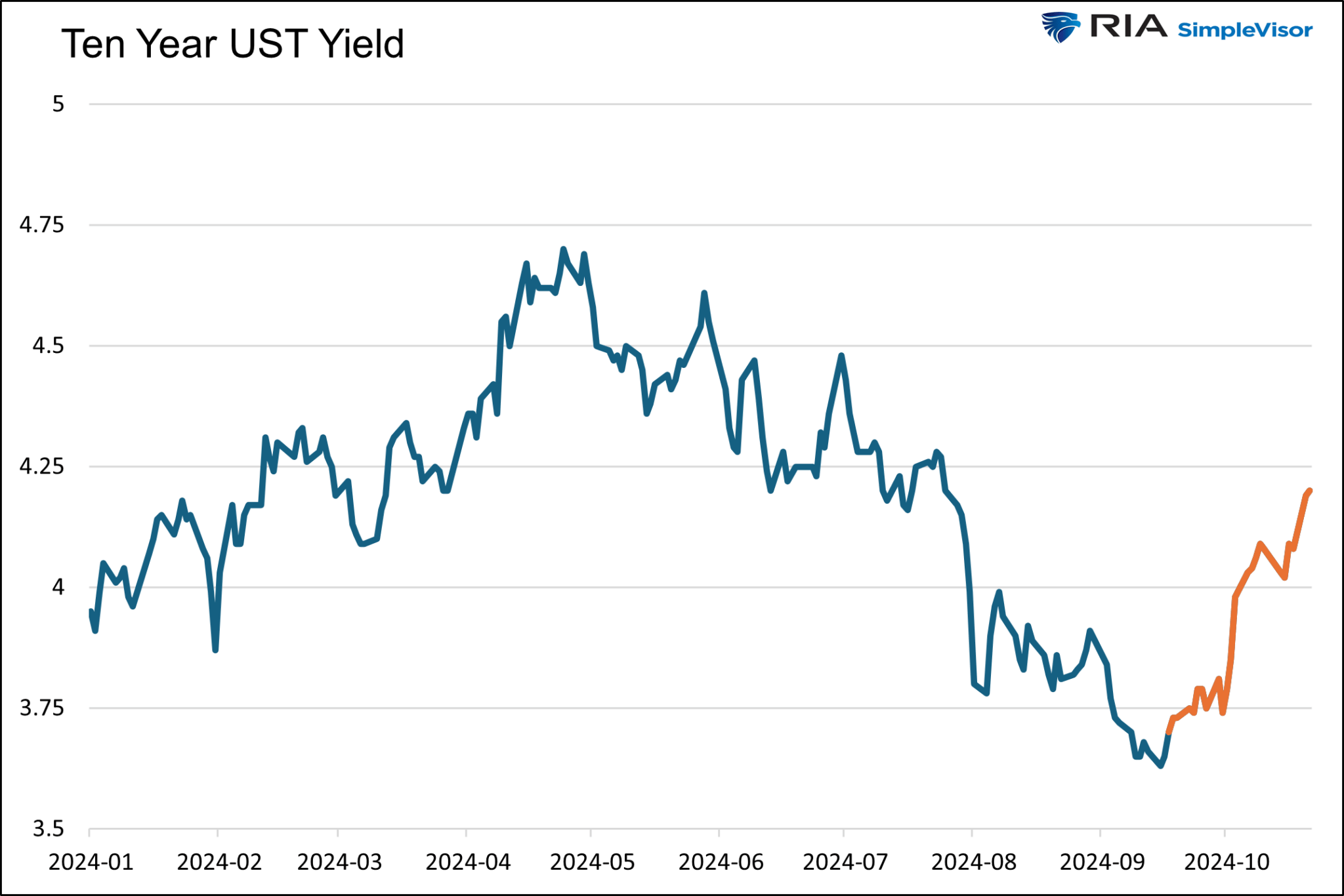

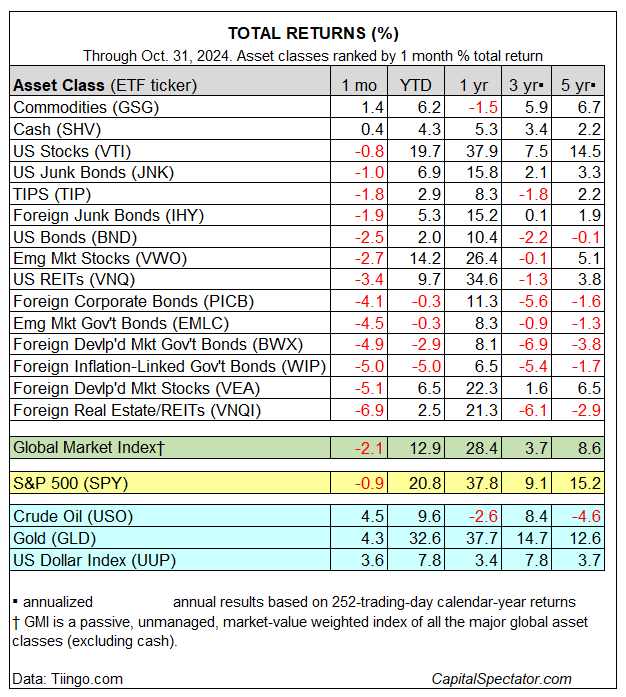

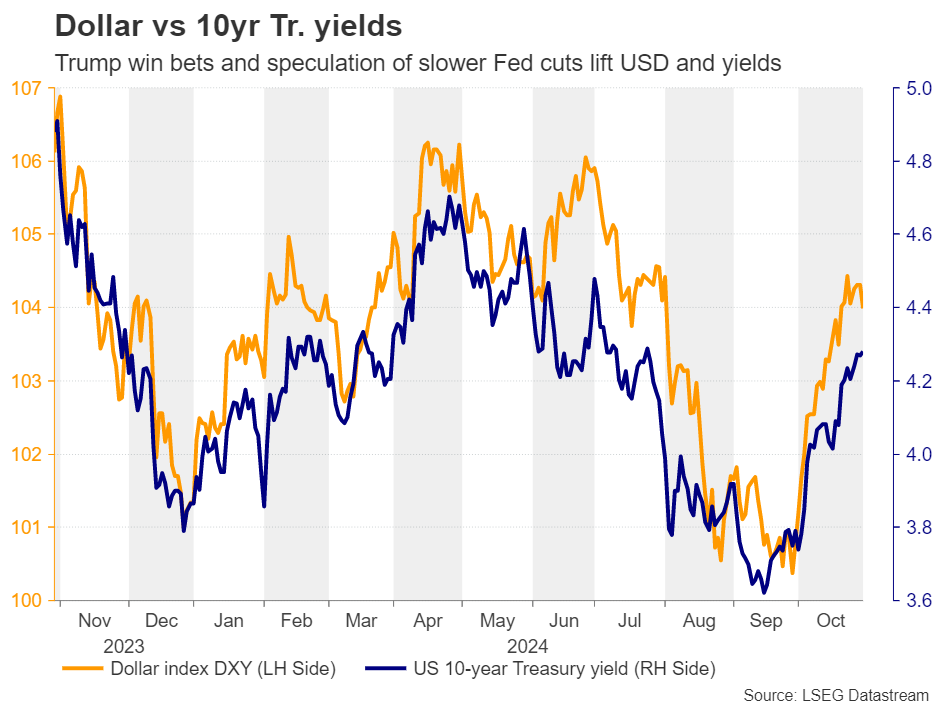

Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on higher yields, be wrong? Instead of mindlessly assuming such legendary...