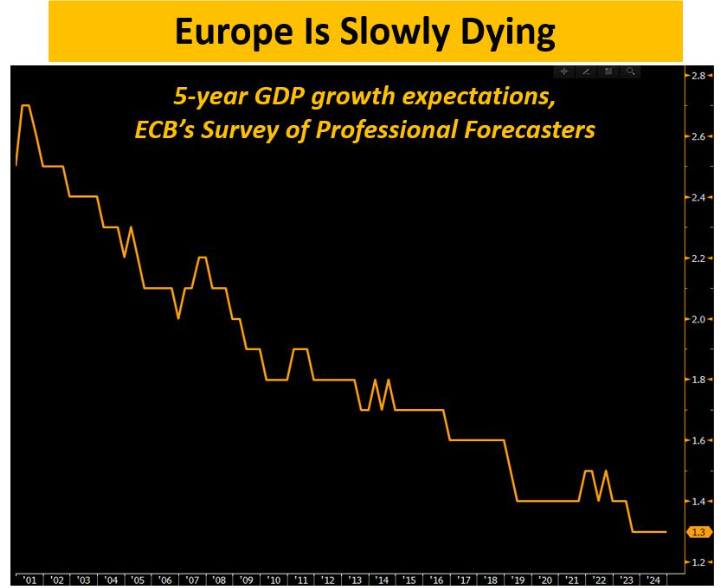

Europe Is Slowly Dying, Yet Markets Are Still in La-La Land

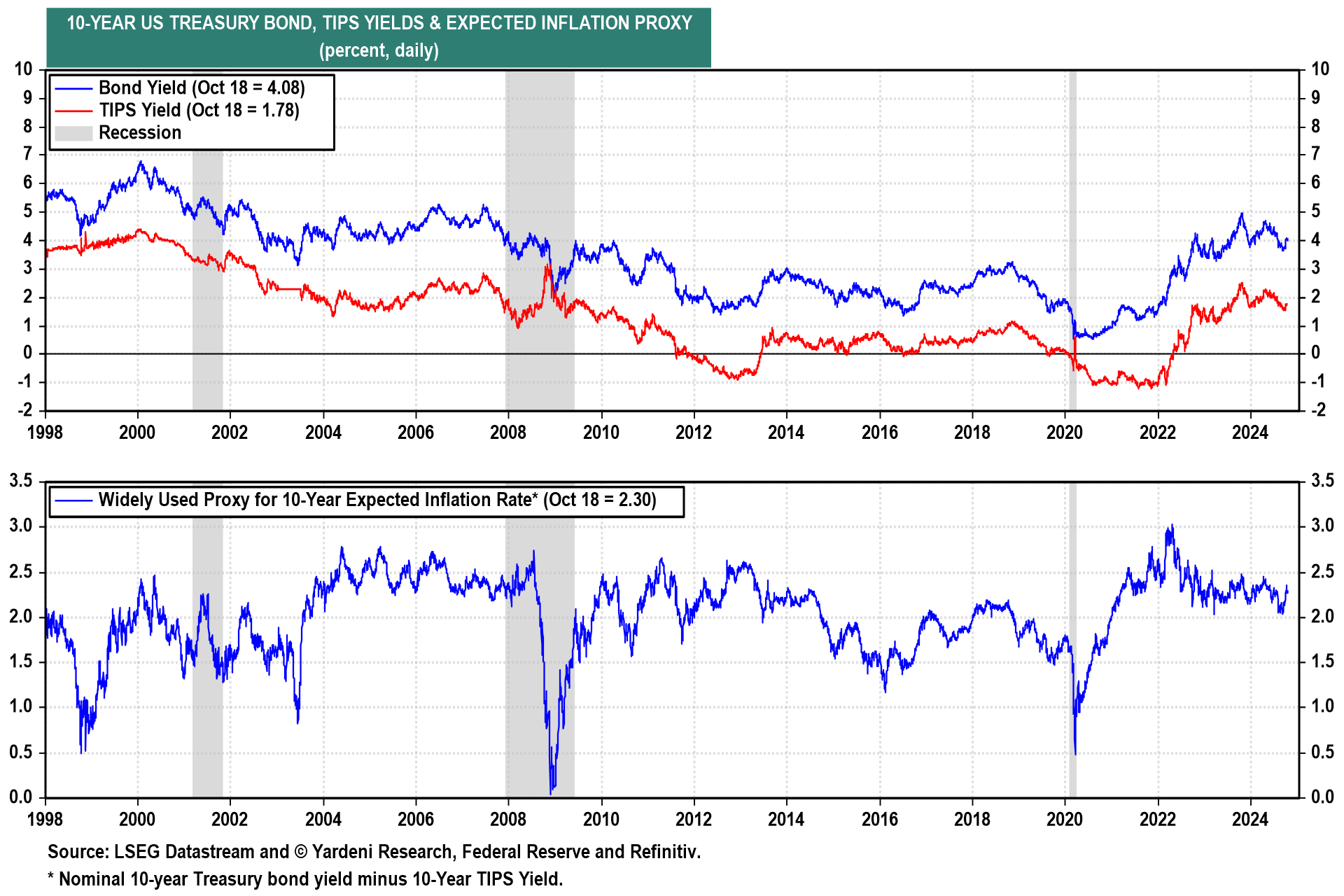

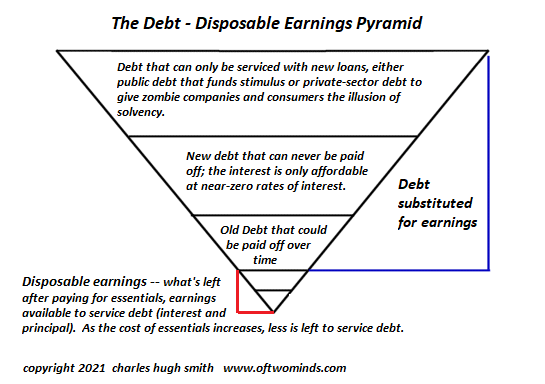

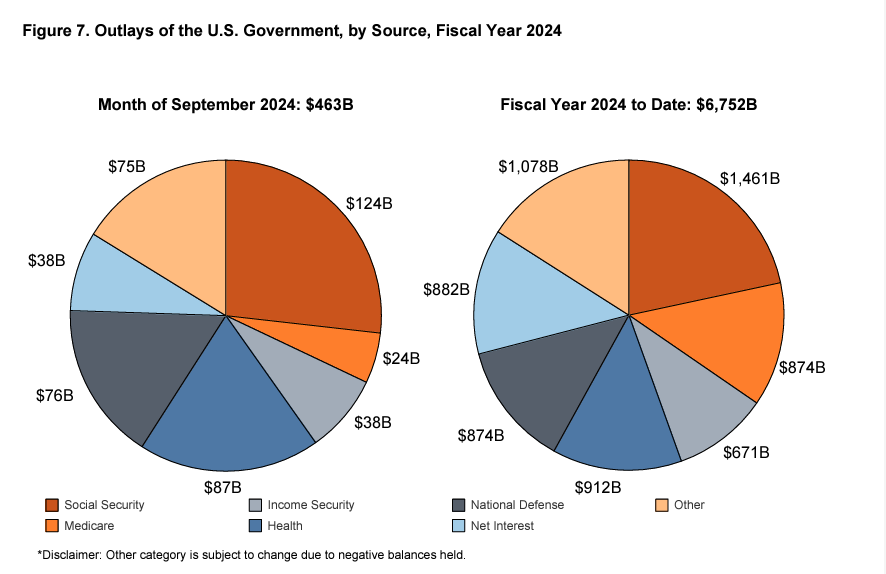

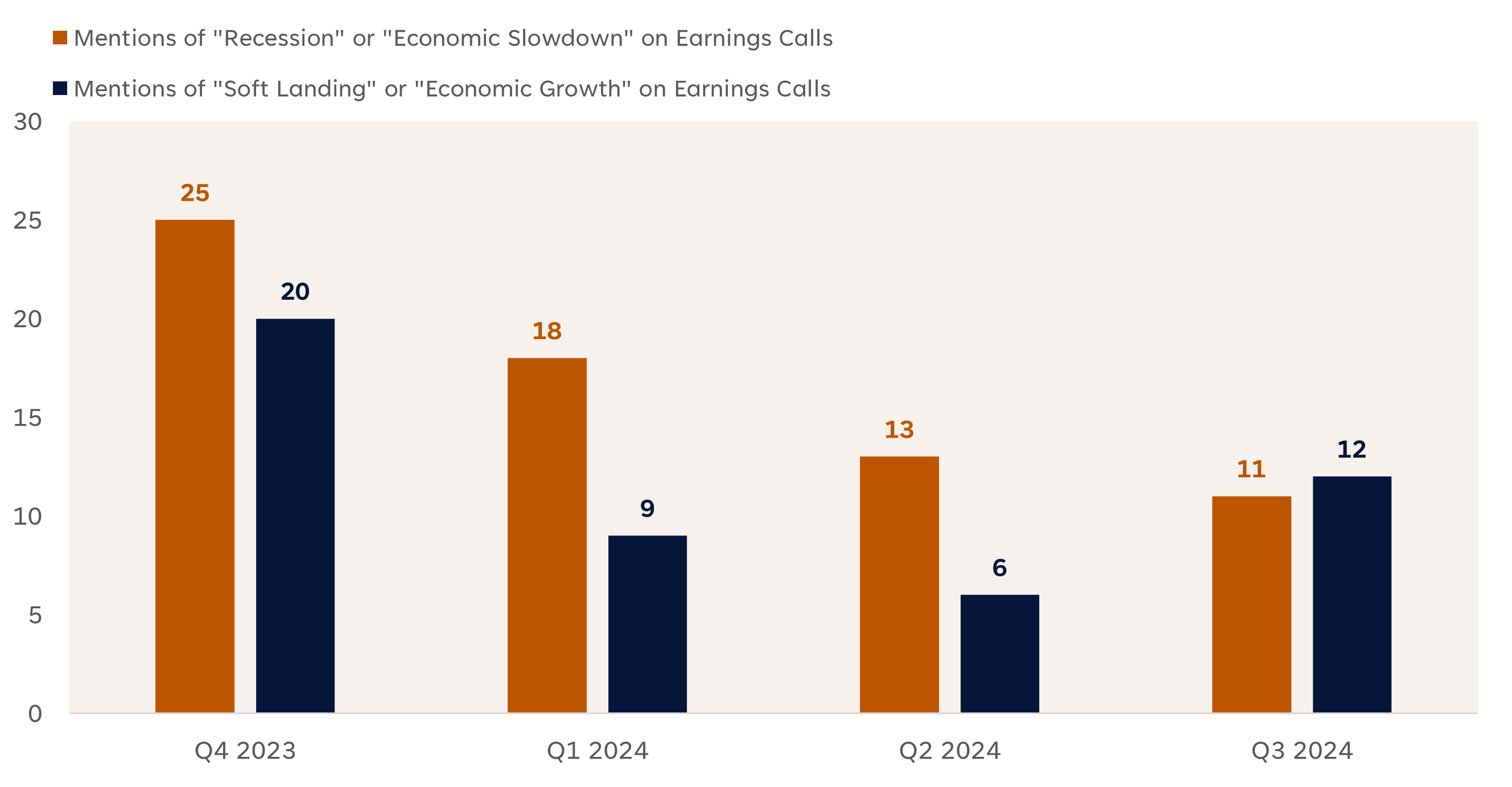

Macro clouds remain on the horizon. Wherever you look at, you see unsustainable economic models: we are either relying on debt-fueled growth (US), trying to squeeze exhausted growth models (China),...