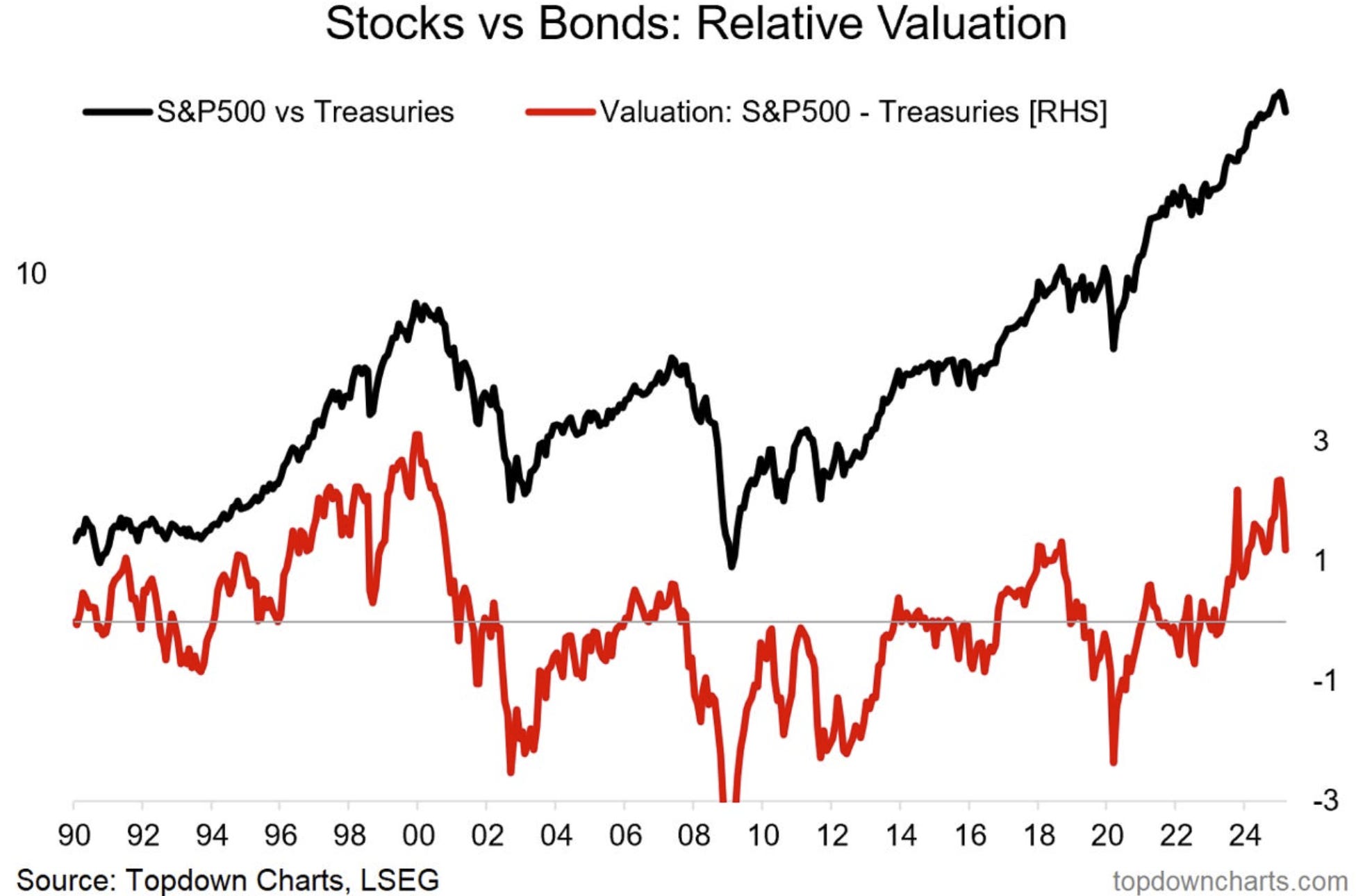

Stocks Bounce Back, but Bonds Suggest More Turbulence May Lie Ahead

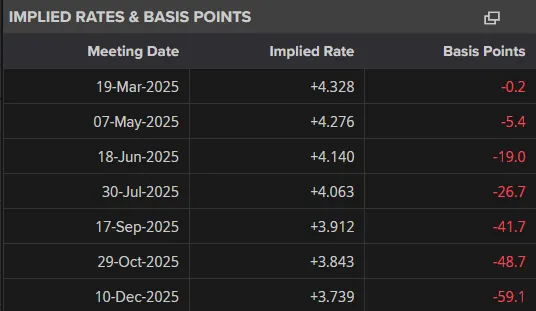

S&P 500 managed to gain back almost exactly on Wednesday what they lost on Tuesday, finishing the day up about 1.1% to close essentially unchanged at Monday’s close at 5,675. The equity market...