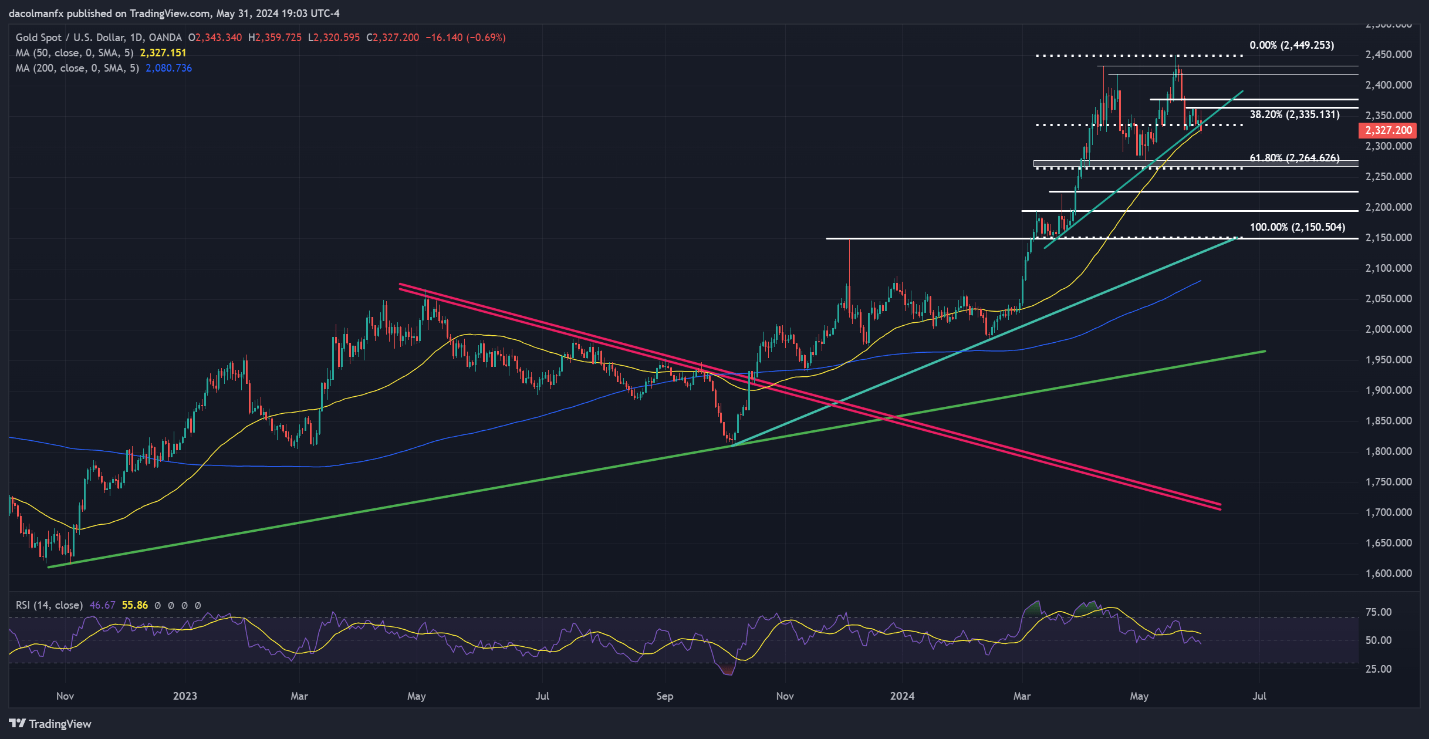

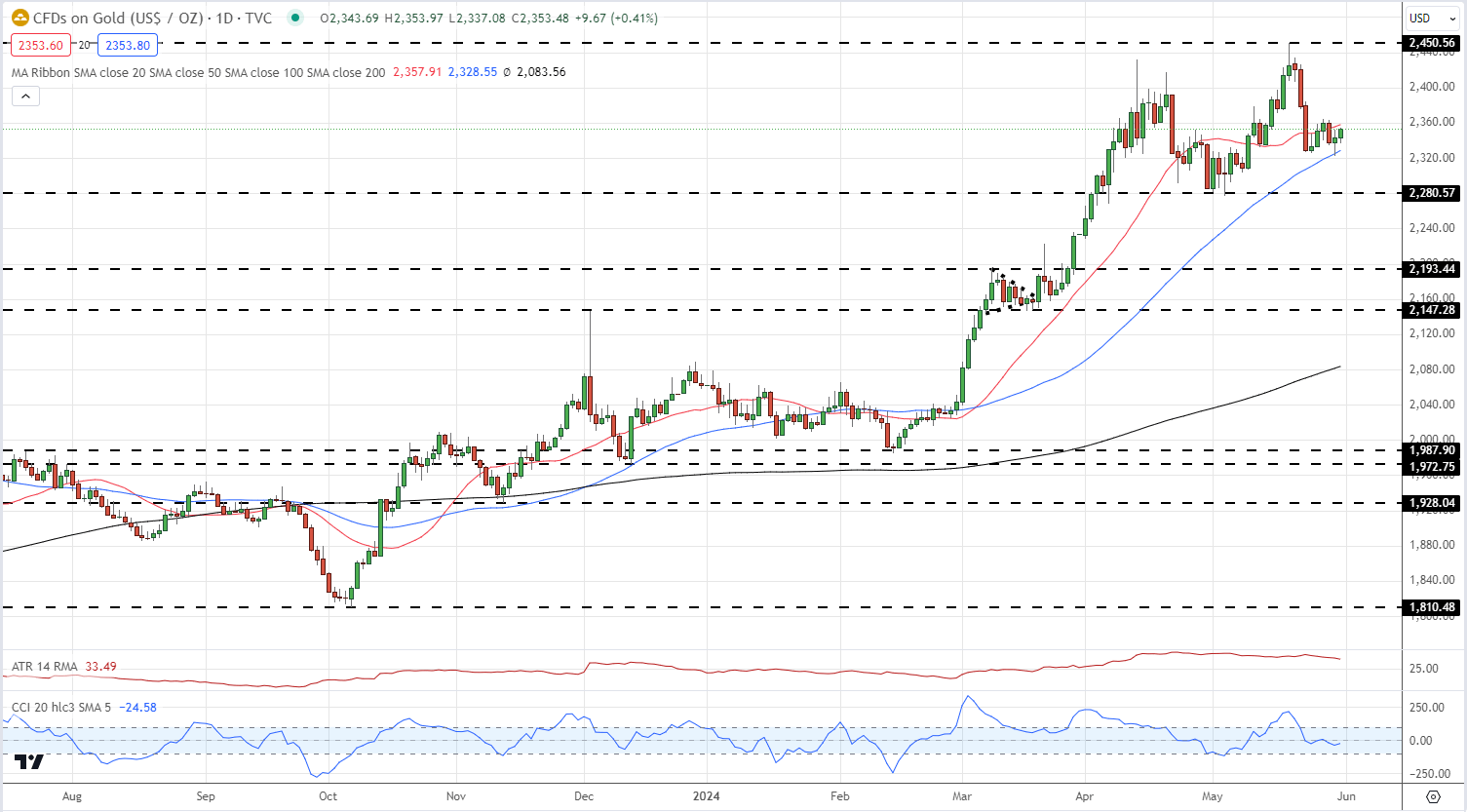

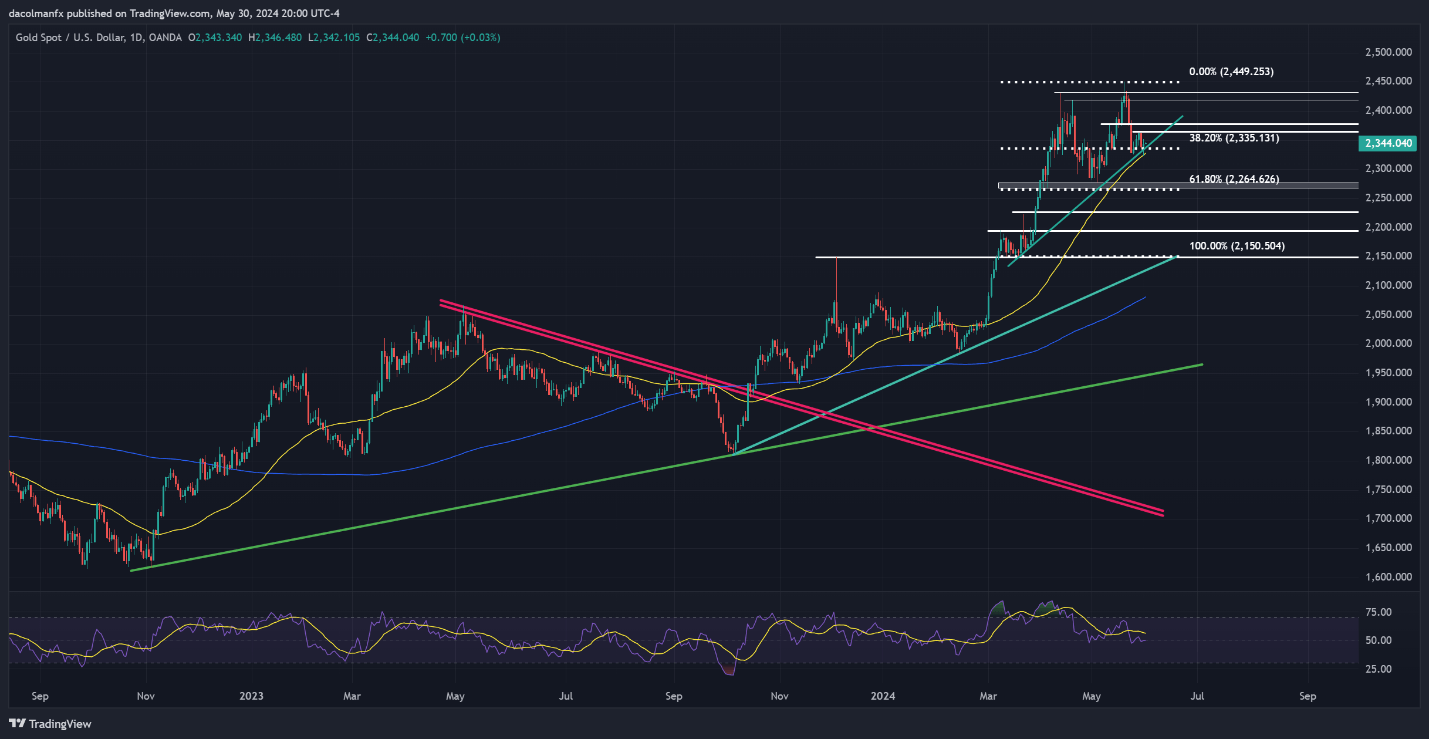

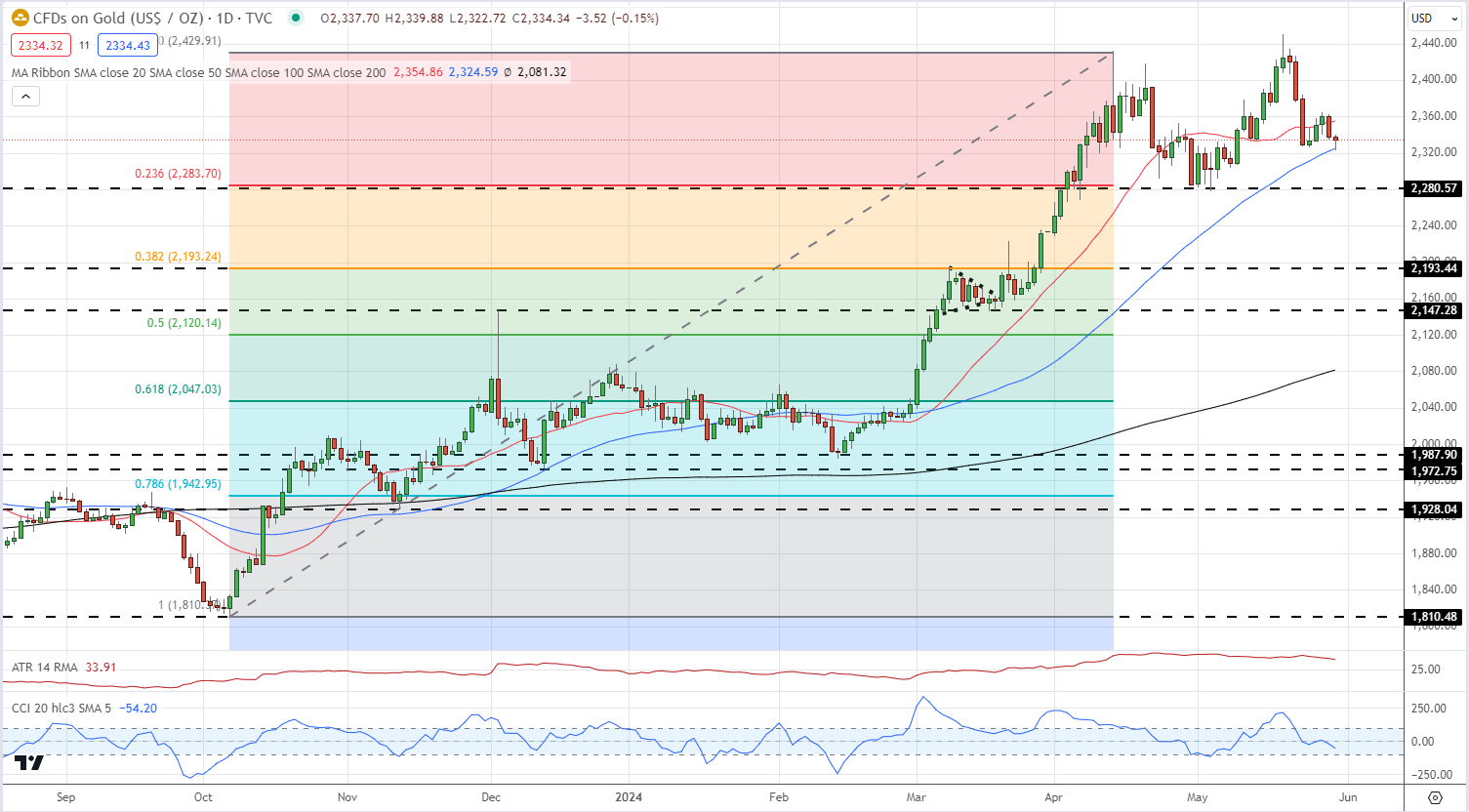

Gold Price Forecast: Bears Take Out Key Support, Next Leg Lower May Be Underway

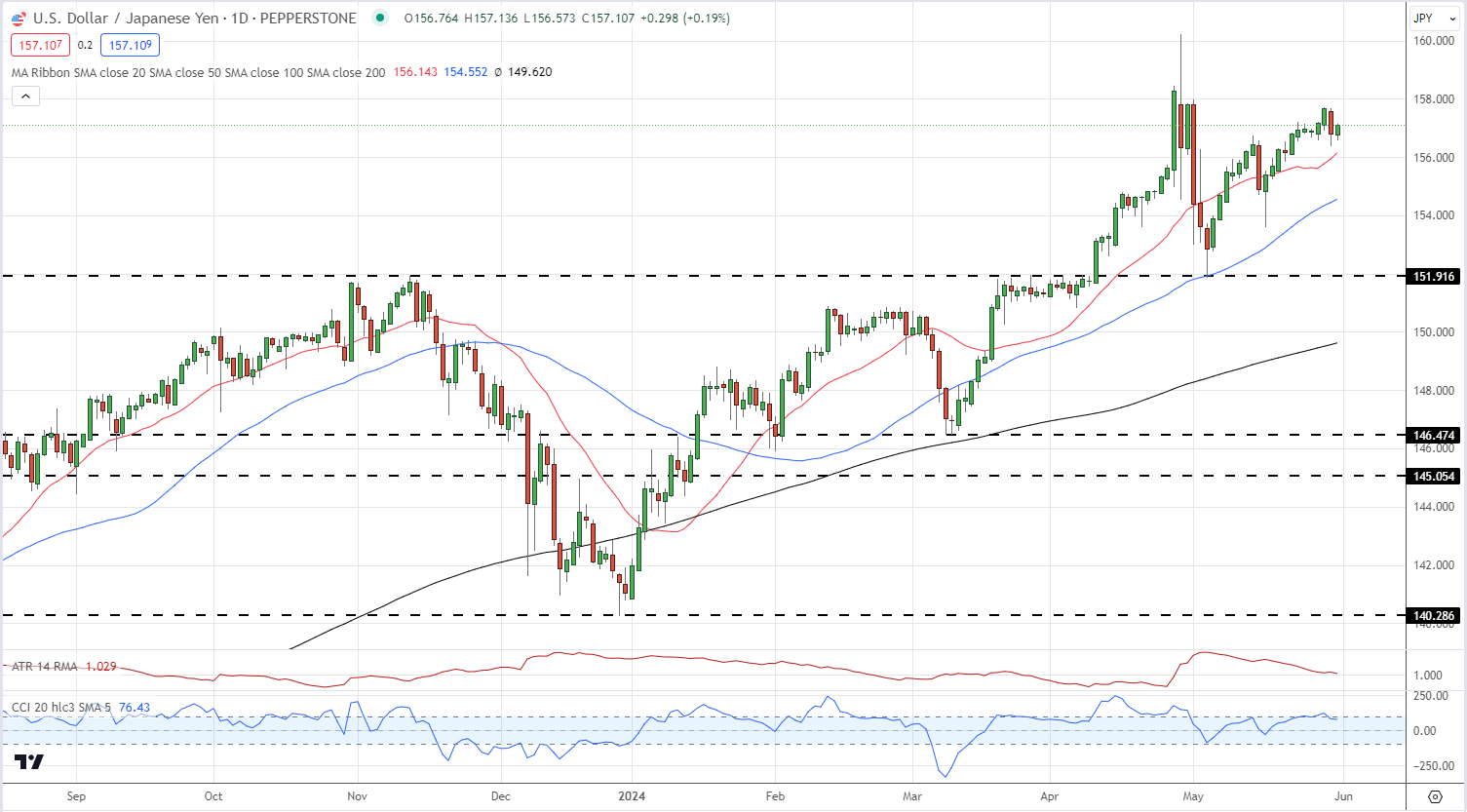

This article solely discusses gold’s near-term technical outlook, analyzing market sentiment and price action dynamics. Potential scenarios that could play out over the coming days are also scrutinized.