Market Latest – Nvidia (NVDA) Surge Helps the Nasdaq 100 Post a Fresh Record High

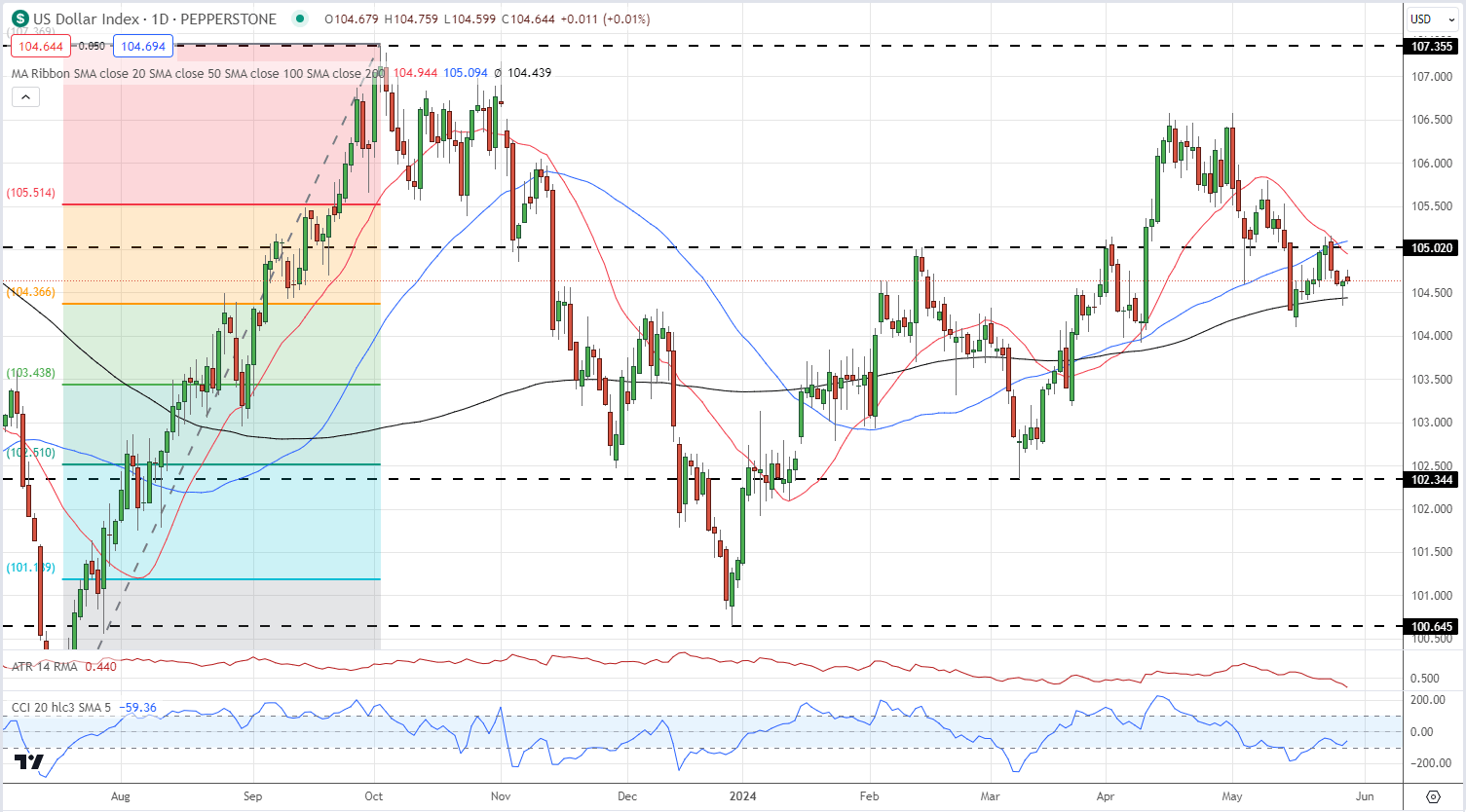

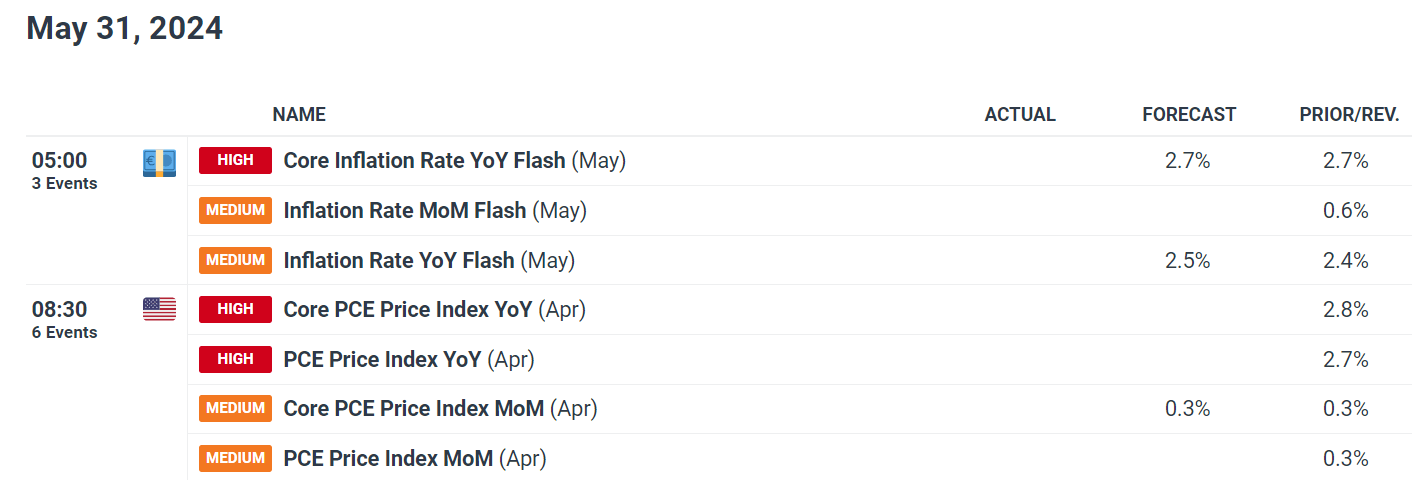

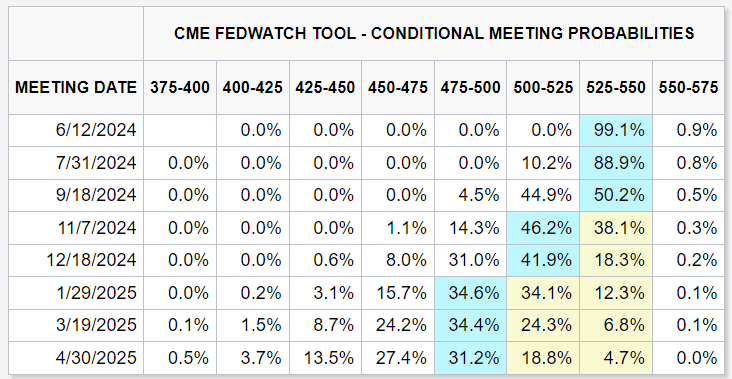

AI mega-stock Nvidia leapt by 7% in US trade, helping push the Nasdaq 100 to a fresh record closing high. The US dollar remains subdued ahead of Friday’s US inflation release.