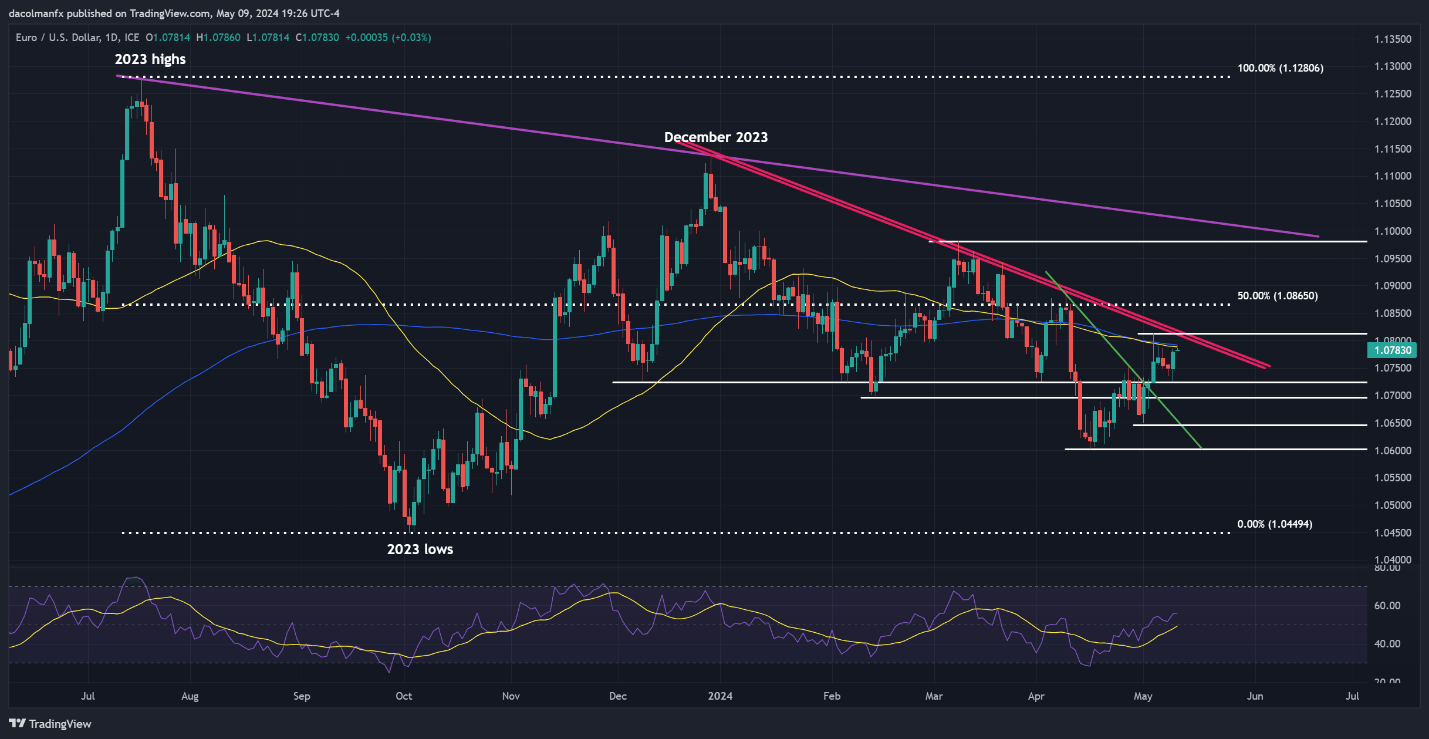

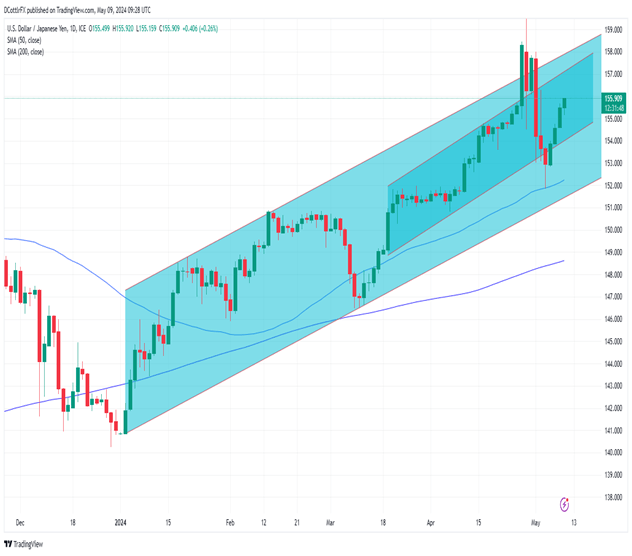

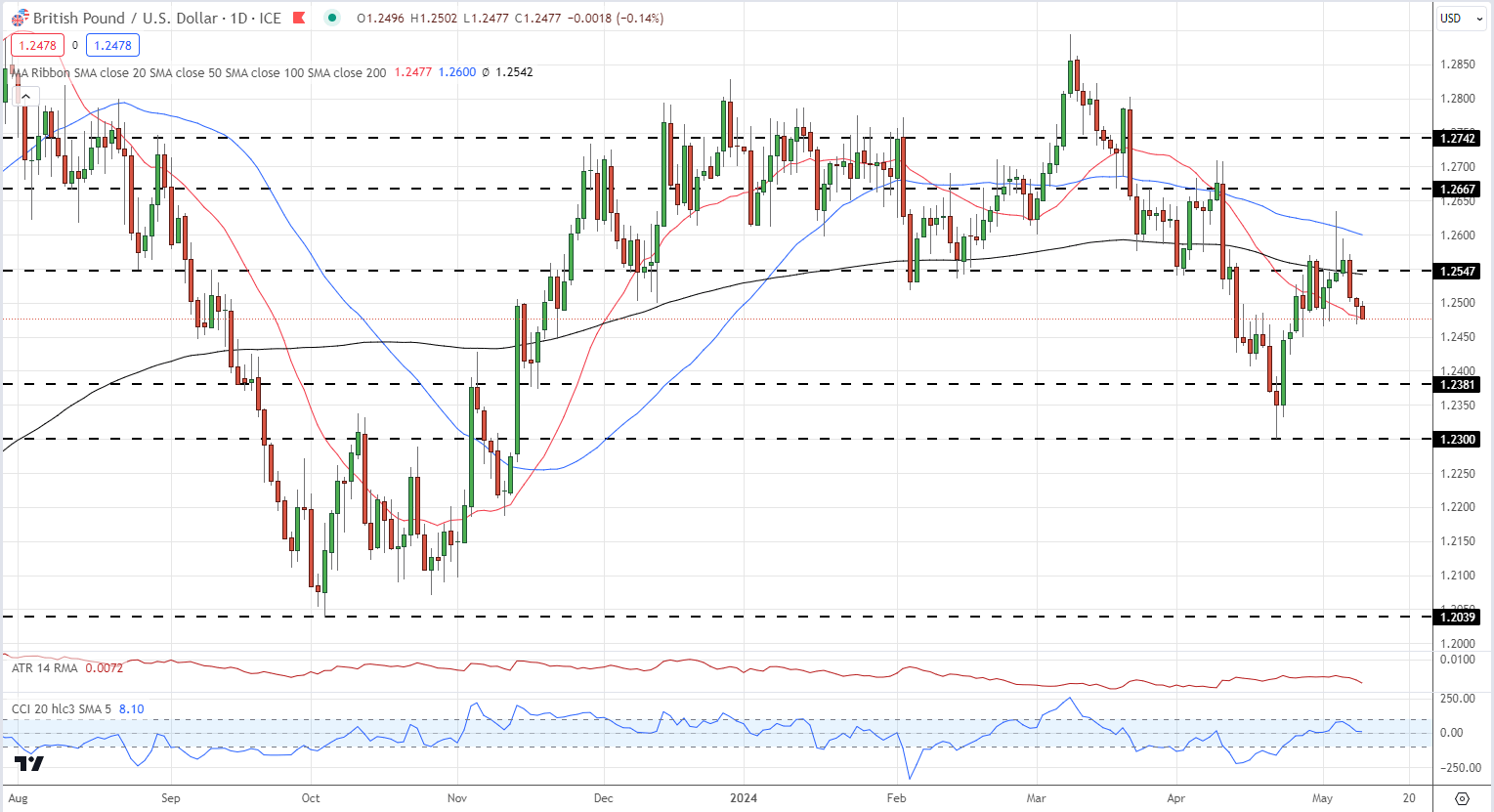

US Dollar’s Path Tied to Inflation Outlook; Setups on EUR/USD, USD/JPY, GBP/USD

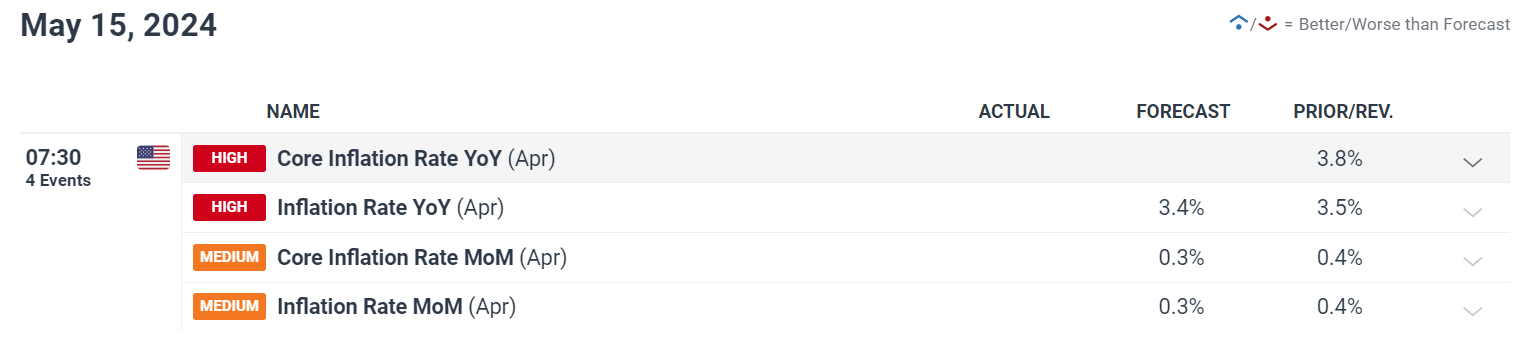

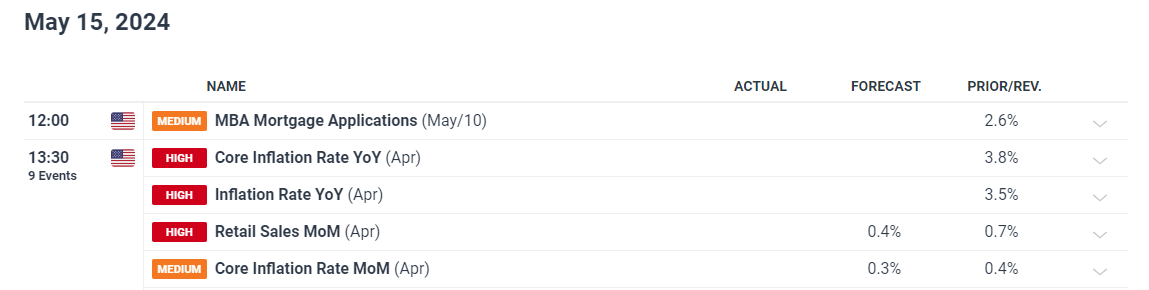

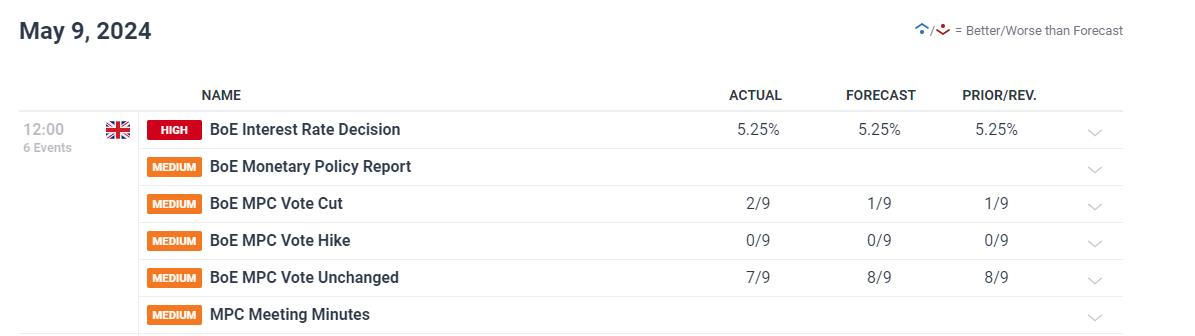

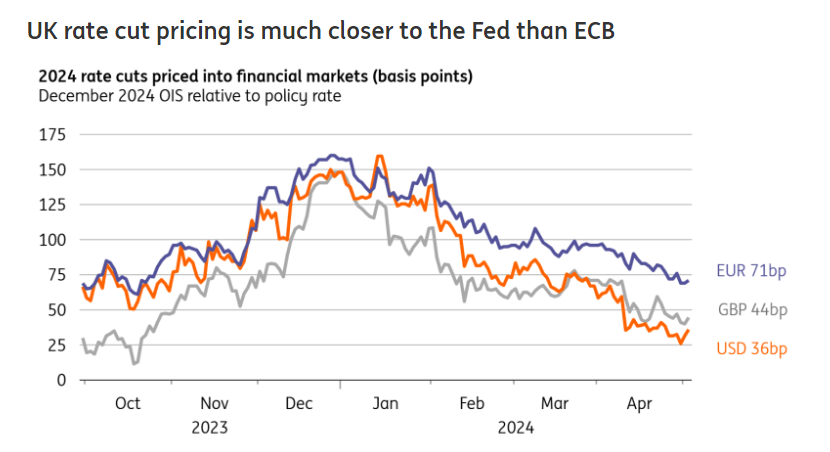

After poor performance earlier in the month, the U.S. dollar rebounded this week, supported by a moderate rise in bond yields. We could see a continuation of the greenback's upward movement if the upcoming US inflation report tops consensus estimates.