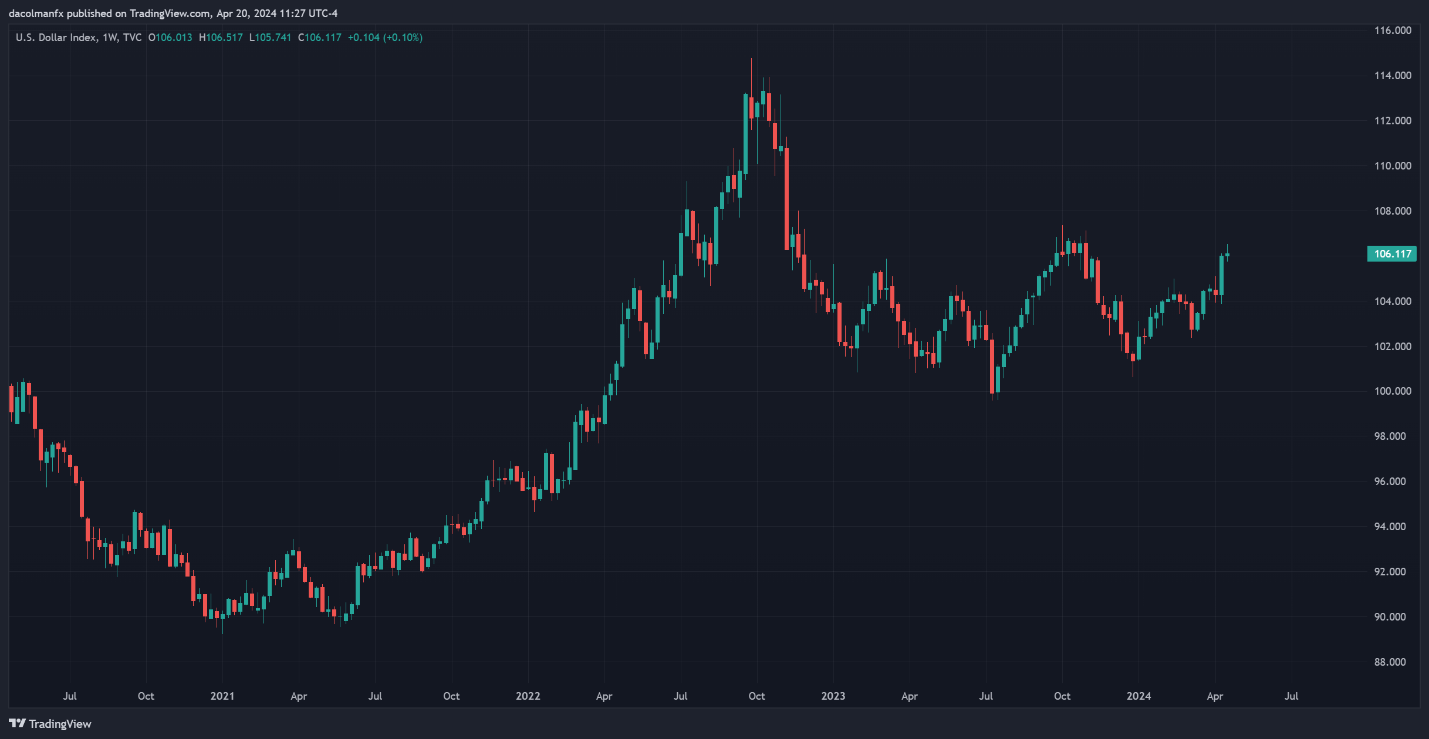

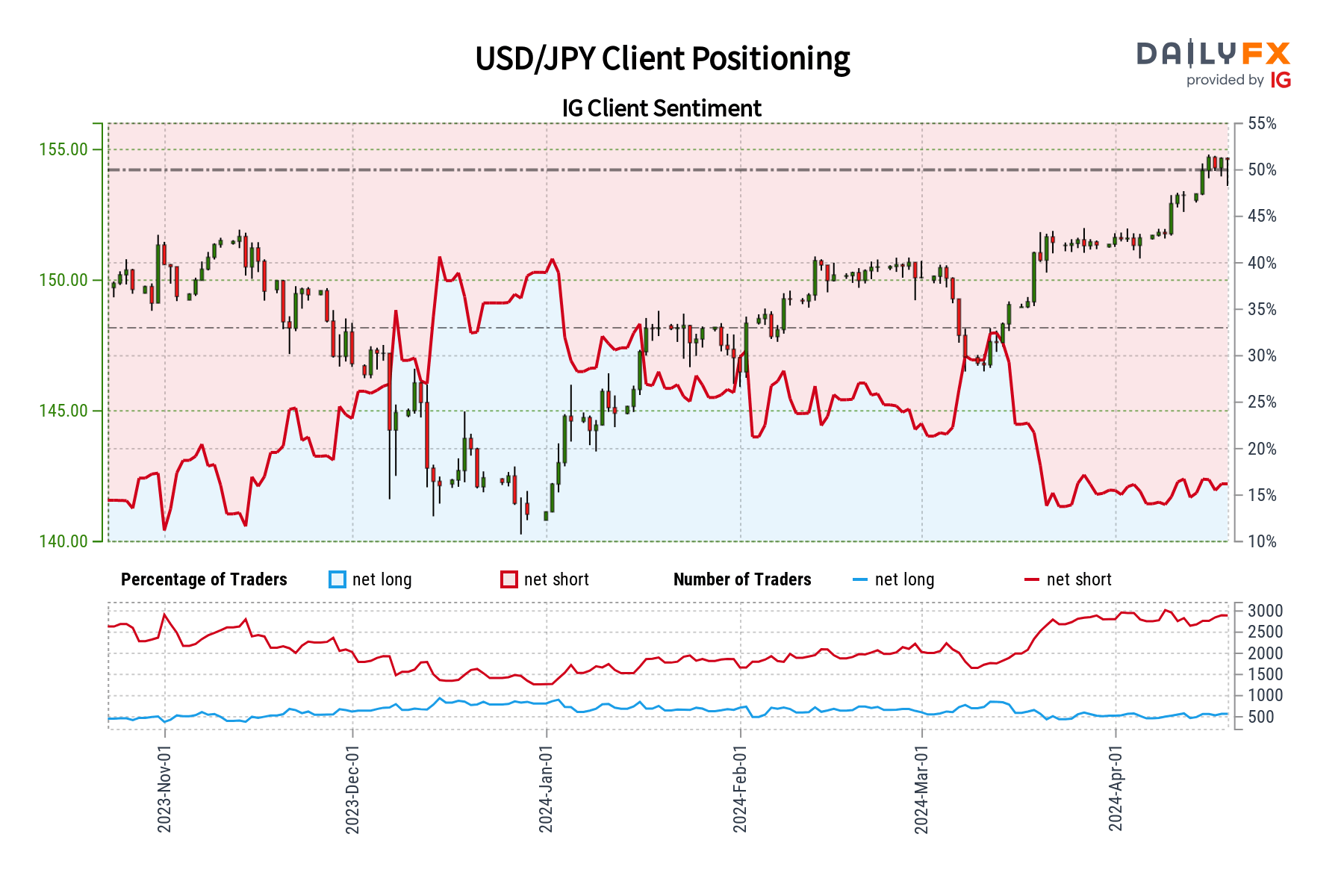

Markets Week Ahead: Gold, EUR/USD, USD/JPY - BoJ, US GDP, Core PCE, Big Tech Earnings

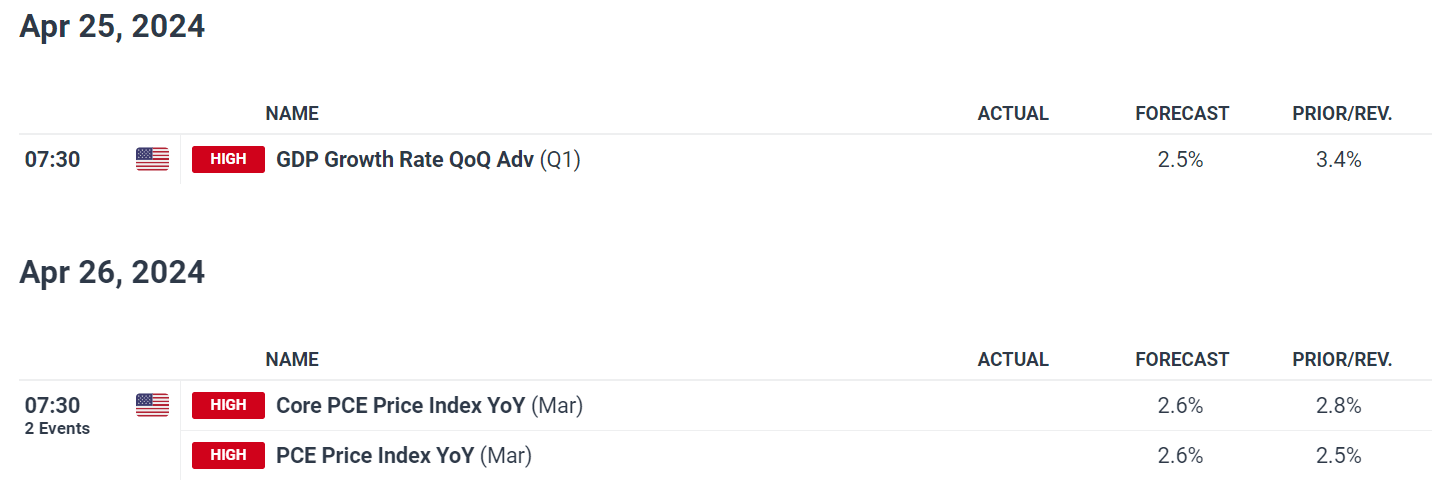

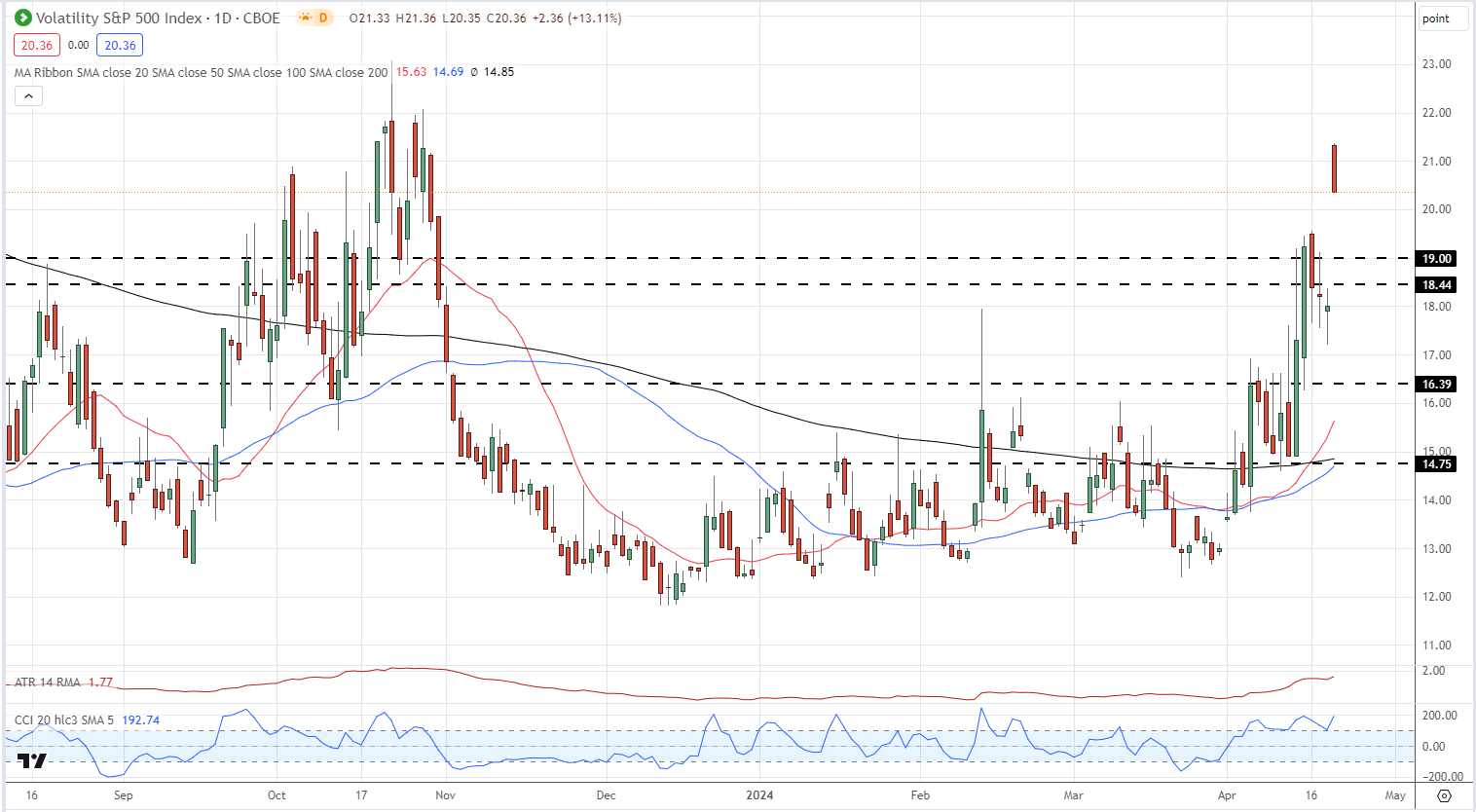

The upcoming week brings the Bank of Japan’s monetary policy decision and a flurry of high-impact economic data and earnings, setting the stage for potential volatility in financial markets.