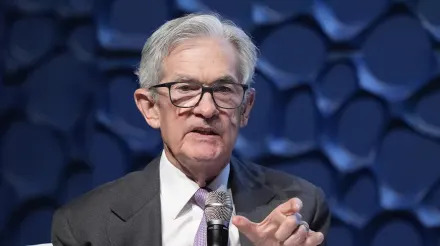

Fed's Powell declines to say if he would remain after chair term expires

Powell, asked at an event in Dallas whether he would consider being the first Fed chair in more than seven decades to remain on the Fed board after no longer serving as its leader, said only that he is committed to serving out his term as chair. "I'll certainly serve to the end ... of my chair term," Powell said. Powell's term as a Board of Governors member expires in January 2028.