Biotech company Amgen (NASDAQ:AMGN) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 10.9% year on year to $9.09 billion. The company’s full-year revenue guidance of $35 billion at the midpoint came in 1.4% above analysts’ estimates. Its non-GAAP profit of $5.31 per share was 4.6% above analysts’ consensus estimates.

Is now the time to buy Amgen? Find out in our full research report .

Amgen (AMGN) Q4 CY2024 Highlights:

"Robust growth in sales and earnings throughout 2024 reflects the momentum of our business. With strong performance globally, we are investing heavily in our rapidly advancing pipeline to deliver innovative therapies across our four therapeutic areas," said Robert A. Bradway, Chairman and Chief Executive Officer.

Company Overview

Founded in 1980 to pioneer genetic engineering techniques, Amgen (NASDAQ:AMGN) is a biotechnology company that develops medicines, focusing on treatments in oncology (cancers), cardiology (heart-related), and immunology (e.g. arthritis and psoriasis).

Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Sales Growth

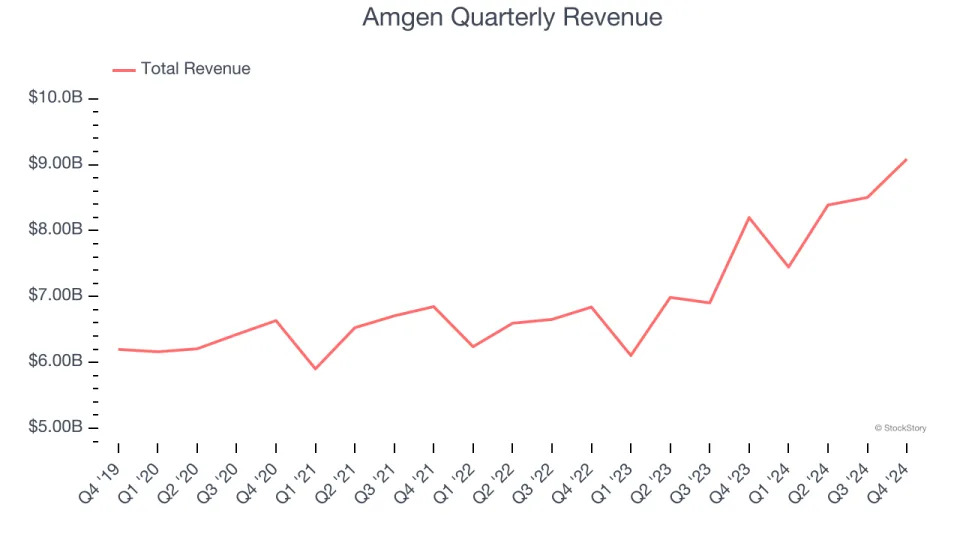

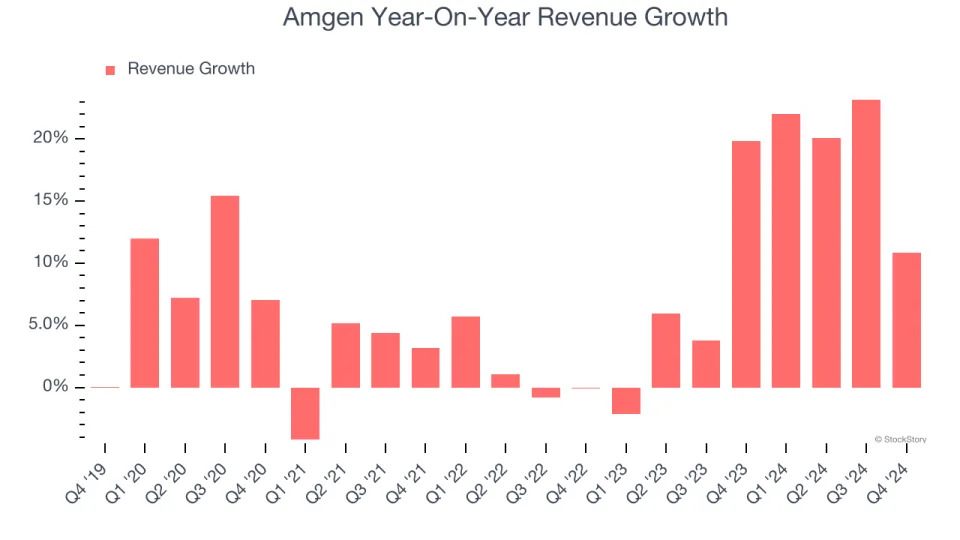

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Amgen grew its sales at a decent 7.7% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Amgen’s annualized revenue growth of 12.7% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Product & Pipeline. Over the last two years, Amgen’s Product & Pipeline revenue () averaged 13.8% year-on-year growth.

This quarter, Amgen reported year-on-year revenue growth of 10.9%, and its $9.09 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Adjusted Operating Margin

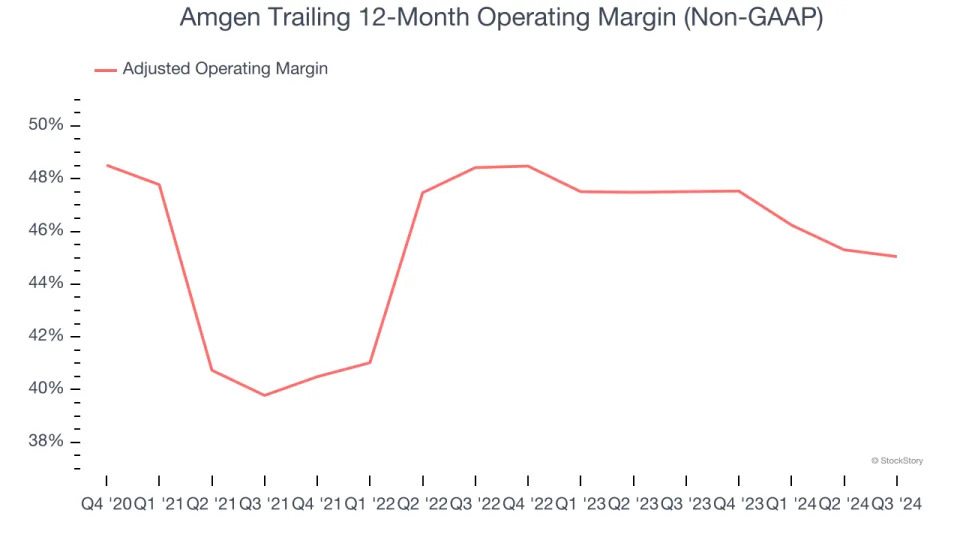

Amgen has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 46.1%.

Analyzing the trend in its profitability, Amgen’s adjusted operating margin decreased by 5.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 4.9 percentage points. This performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

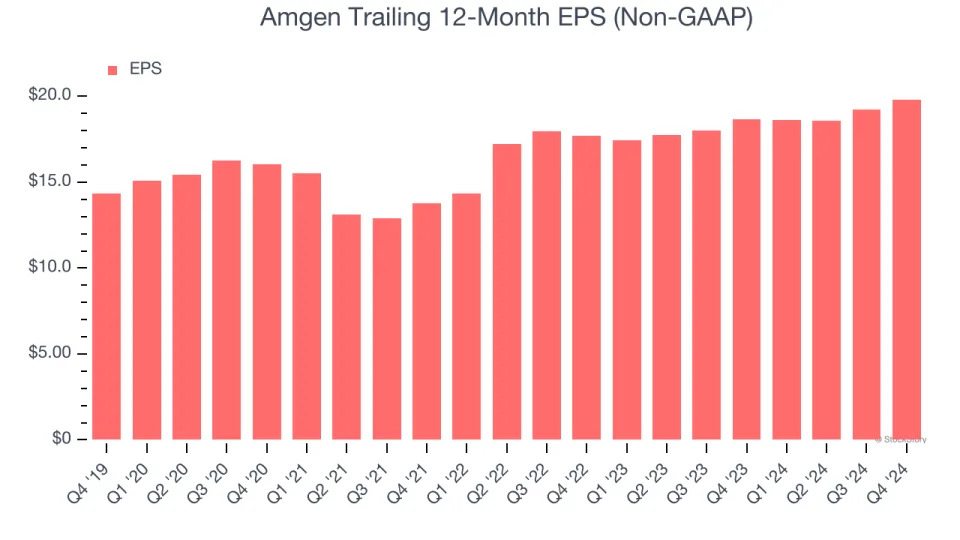

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Amgen’s EPS grew at a decent 6.7% compounded annual growth rate over the last five years. However, this performance was lower than its 7.7% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Amgen’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Amgen’s adjusted operating margin declined by 5.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Amgen reported EPS at $5.31, up from $4.71 in the same quarter last year. This print beat analysts’ estimates by 4.6%. Over the next 12 months, Wall Street expects Amgen’s full-year EPS of $19.82 to grow 5.2%.

Key Takeaways from Amgen’s Q4 Results

We enjoyed seeing Amgen exceed analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance came in slightly higher than Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter was mixed with better-than-anticipated sales but mediocre profitability. The market seemed to focus on the profits, and the stock traded down 2.5% to $281.68 immediately after reporting.

Big picture, is Amgen a buy here and now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .