Outerwear manufacturer Columbia Sportswear (NASDAQ:COLM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.5% year on year to $1.10 billion. On the other hand, next quarter’s revenue guidance of $756.5 million was less impressive, coming in 5.3% below analysts’ estimates. Its GAAP profit of $1.80 per share was 7.3% below analysts’ consensus estimates.

Is now the time to buy Columbia Sportswear? Find out in our full research report .

Columbia Sportswear (COLM) Q4 CY2024 Highlights:

Chairman, President and Chief Executive Officer Tim Boyle commented, “I’m encouraged that sales returned to growth in the fourth quarter, and we expect continued growth in 2025, across most brands and regions. During the year we made substantial progress on our inventory reduction efforts, achieved cost savings through our Profit Improvement Program, and returned meaningful cash to shareholders through share buybacks and dividends. We also laid the foundation for Columbia’s ACCELERATE Growth Strategy, which will come to life in the seasons ahead.

Company Overview

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

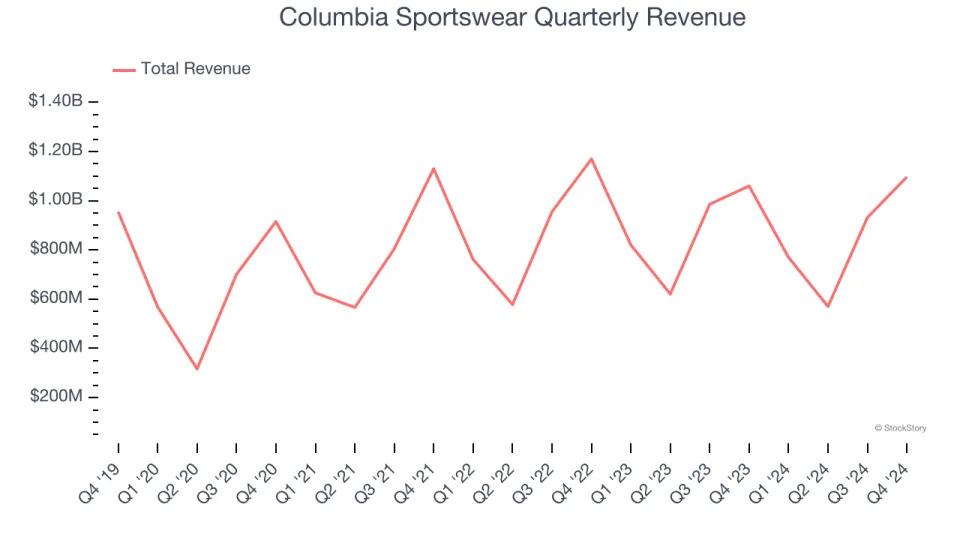

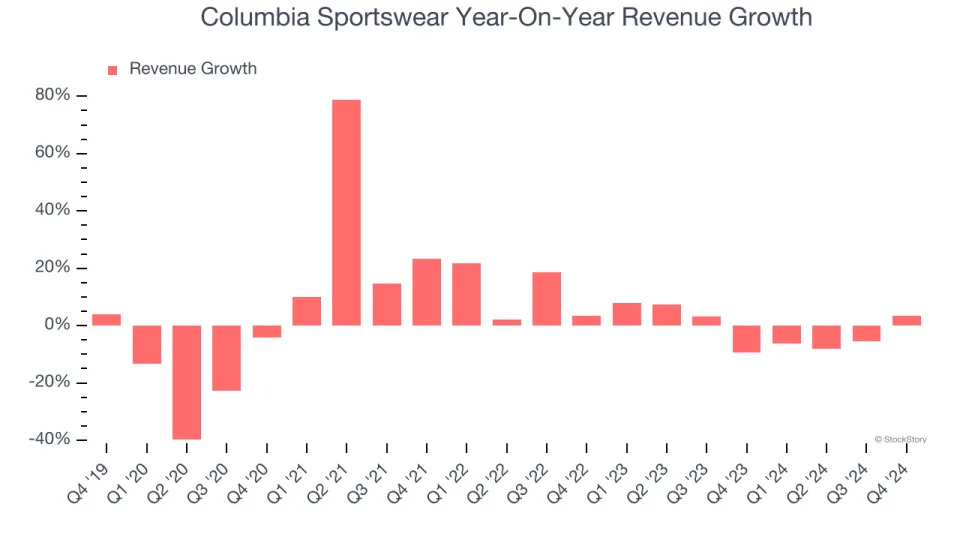

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Columbia Sportswear’s sales grew at a weak 2.1% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Columbia Sportswear’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.4% annually.

This quarter, Columbia Sportswear reported modest year-on-year revenue growth of 3.5% but beat Wall Street’s estimates by 1.4%. Company management is currently guiding for a 1.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Columbia Sportswear has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.6% over the last two years, better than the broader consumer discretionary sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Columbia Sportswear’s free cash flow clocked in at $609.4 million in Q4, equivalent to a 55.6% margin. The company’s cash profitability regressed as it was 1.1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

Over the next year, analysts predict Columbia Sportswear’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 14.6% for the last 12 months will decrease to 6.1%.

Key Takeaways from Columbia Sportswear’s Q4 Results

It was good to see Columbia Sportswear narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.6% to $79.37 immediately following the results.

Columbia Sportswear’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .