Video conferencing platform Zoom (NASDAQ:ZM) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 3.3% year on year to $1.18 billion. On the other hand, next quarter’s revenue guidance of $1.16 billion was less impressive, coming in 0.8% below analysts’ estimates. Its non-GAAP profit of $1.41 per share was 4.6% above analysts’ consensus estimates.

Is now the time to buy Zoom? Find out in our full research report .

Zoom (ZM) Q4 CY2024 Highlights:

“In FY25, Zoom AI Companion emerged as the driving force behind our transformation into an AI-first company, enabling our customers to discover enhanced productivity opportunities. As Zoom AI Companion becomes increasingly agentic, we look forward to continuing to help our customers fully realize the benefits of AI and discover what’s possible with AI agents,” said Eric S. Yuan, Zoom's founder and CEO.

Company Overview

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

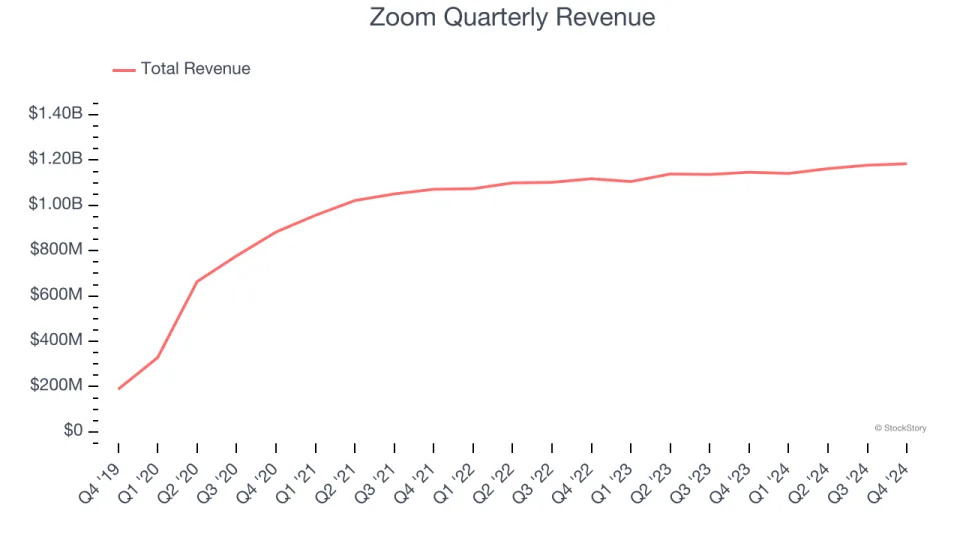

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Zoom’s sales grew at a weak 4.4% compounded annual growth rate over the last three years. This fell short of our benchmark for the software sector and is a tough starting point for our analysis.

This quarter, Zoom grew its revenue by 3.3% year on year, and its $1.18 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

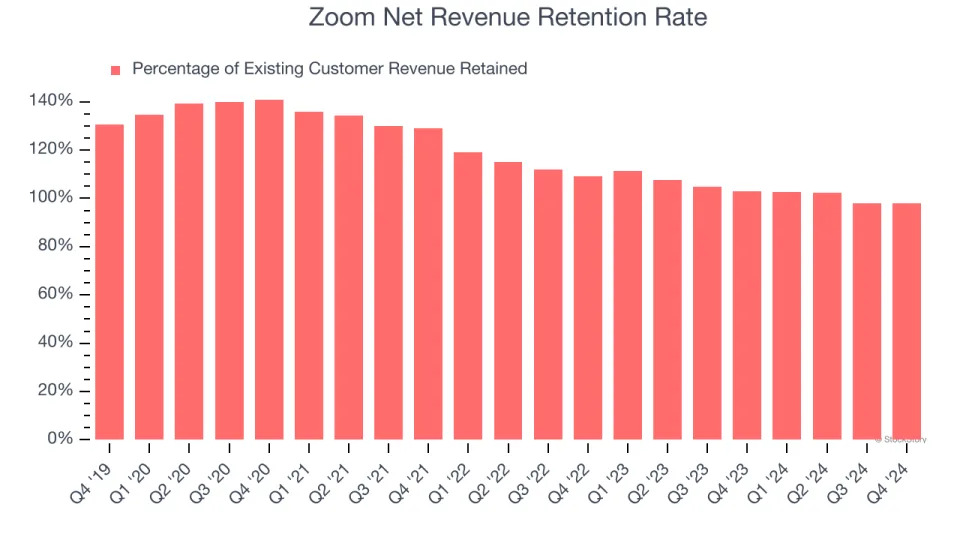

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Zoom’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 100% in Q4. This means Zoom would’ve grown its revenue by 0.2% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Zoom still has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from Zoom’s Q4 Results

Revenue was just in line, but EPS managed to exceed expectations. On the other hand, Zoom's full-year revenue and EPS guidance both missed Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.3% to $79.15 immediately after reporting.

Zoom didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .