Online health insurance comparison site eHealth (NASDAQ:EHTH) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 27.3% year on year to $315.2 million. The company expects the full year’s revenue to be around $530 million, close to analysts’ estimates. Its GAAP profit of $2.51 per share was 10.8% above analysts’ consensus estimates.

Is now the time to buy eHealth? Find out in our full research report .

eHealth (EHTH) Q4 CY2024 Highlights:

Company Overview

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

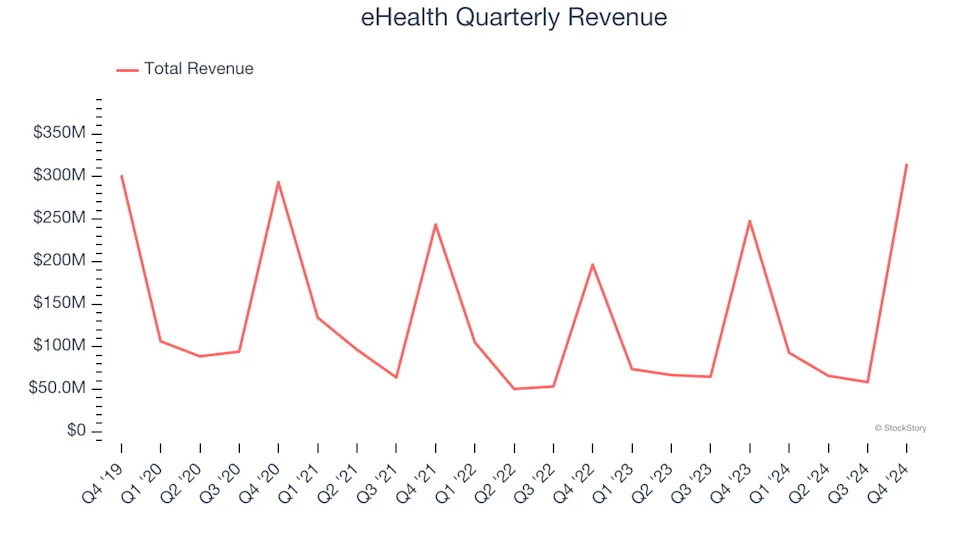

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, eHealth struggled to consistently increase demand as its $532.4 million of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and is a sign of lacking business quality.

This quarter, eHealth reported robust year-on-year revenue growth of 27.3%, and its $315.2 million of revenue topped Wall Street estimates by 11.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Key Takeaways from eHealth’s Q4 Results

We were impressed by how significantly eHealth blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 5.8% to $9.69 immediately after reporting.

eHealth had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .