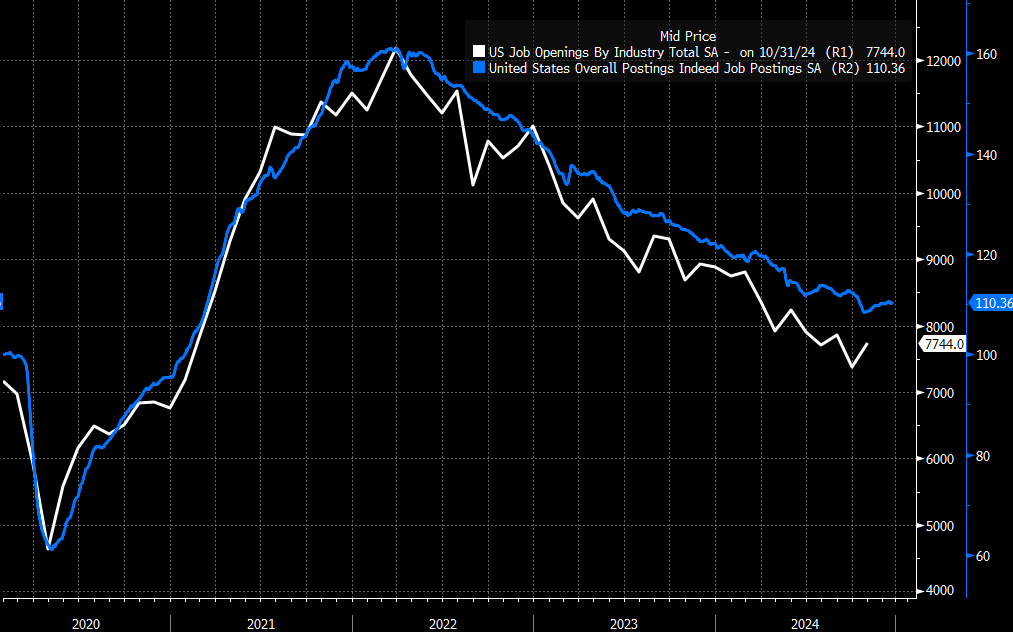

It’s a big week for US economic data, which could push long-term rates towards 5%, especially if the data comes in stronger than expected. On Tuesday at 10:00 AM, we’ll get the

JOLTS

report and ISM Services data. JOLTS is expected to show a flat reading of 7.745 million versus last month’s 7.744 million, essentially unchanged.

ISM Services

, however, is forecast to improve to 53.5 from 52.1, with the prices paid index likely edging down to 57.1 from 58.2.

On Wednesday, we’ll see

ADP

Employment Change, forecasted at 133,000 jobs versus last month’s 146,000.

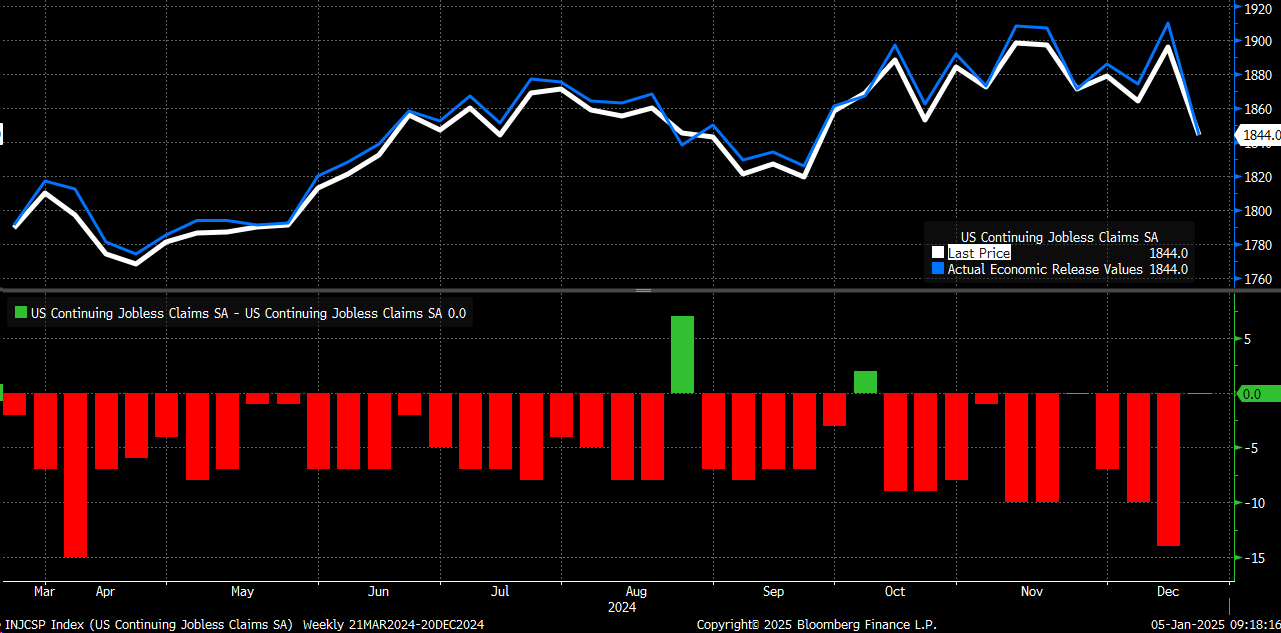

Initial jobless claims

will also come in earlier due to the market closure on January 9th for the observance of former President Jimmy Carter’s passing. Notably, last week’s continuing claims were revised sharply lower, which aligns with prior trends.

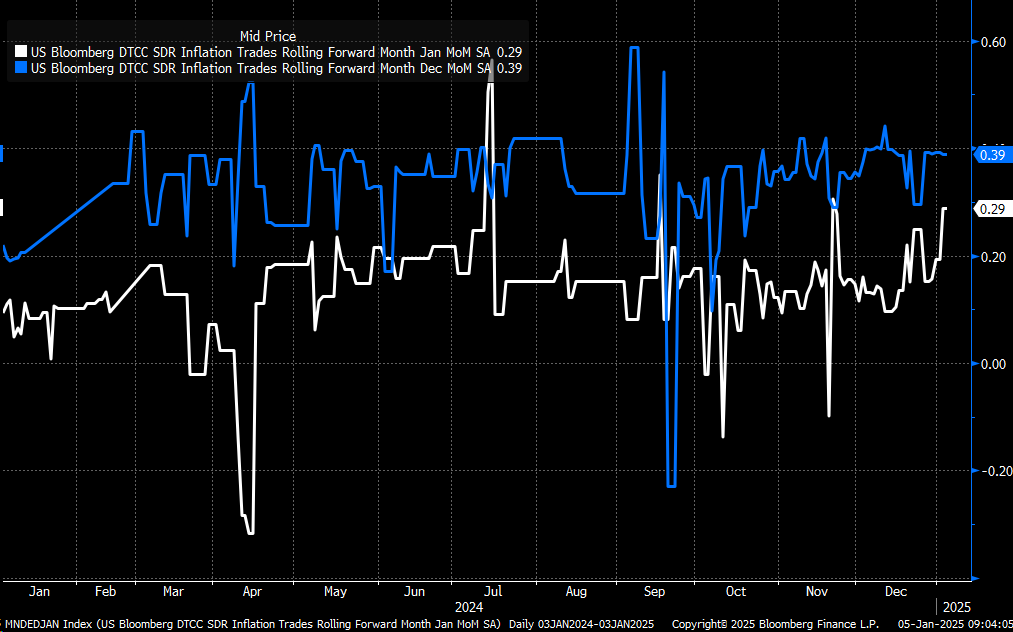

Wednesday afternoon brings the FOMC minutes. I anticipate these minutes will reinforce the message that rate cuts will be increasingly difficult given the resilient labor market and the recent reacceleration of inflation. December’s

CPI

is expected to show a 0.4% month-over-month increase, while January is tracking a 0.3% rise, according to CPI swaps. These numbers don’t align with a trajectory toward the Fed’s 2% inflation goal.

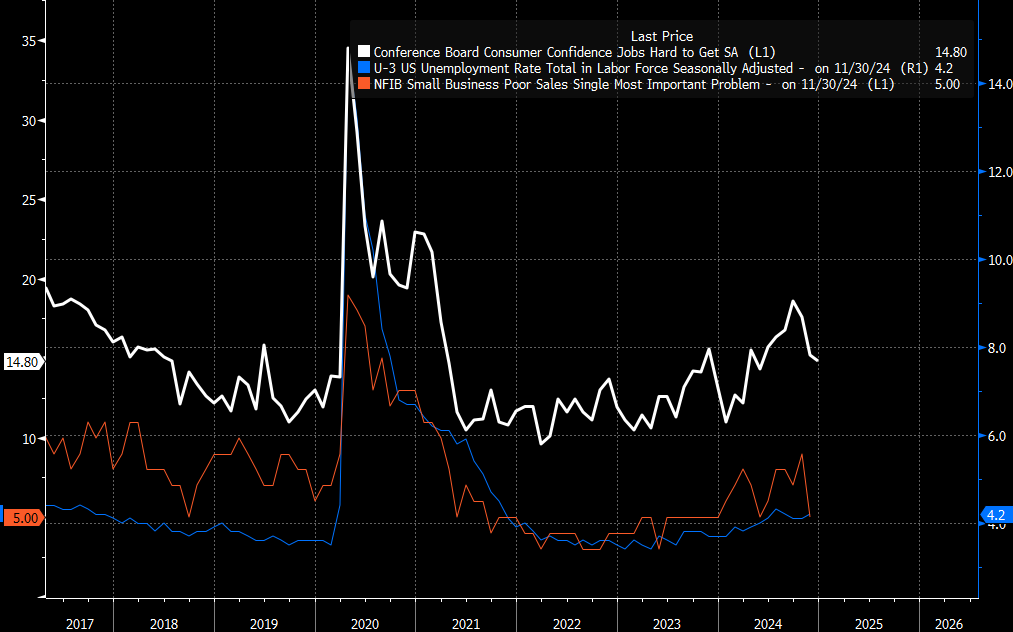

Friday will be a key day with the release of non-farm payrolls. Current estimates suggest 160,000 jobs were added in December, down from November’s 227,000, but analysts often underestimate these numbers. The unemployment rate is expected to remain steady at 4.2%. Anecdotal evidence, such as the Conference Board’s consumer confidence survey, suggests that the labor market remains robust. Average hourly earnings are forecasted to rise by 0.3% month over month. Year over year, growth is flat at 4%.

If the data broadly aligns with expectations, it could increase

US 10-year

and

30-year yields

.

German Rates Are Surging

Rates in the US are moving higher, but globally, rates are also moving higher.

Germany 10-Year

yields rose seven basis points on Friday, climbing from 2.05% in early December to 2.43%. The market is pricing fewer rate cuts from the ECB, further supporting higher yields.

10-Yr JGB Breaking Out

Even Japan, traditionally a rate outlier, has seen its 10-year yield rise to 1.08%, the upper end of its range, with signs of further upward pressure.

US 30-Yr Breaks Out

In the U.S., if the 30-year yield breaks above 4.85%, it could head toward 5.1%, while the 10-year yield may approach 5% if it surpasses 4.65%. Conversely, weaker-than-expected data could reverse this trend, pushing rates down and boosting risk assets.

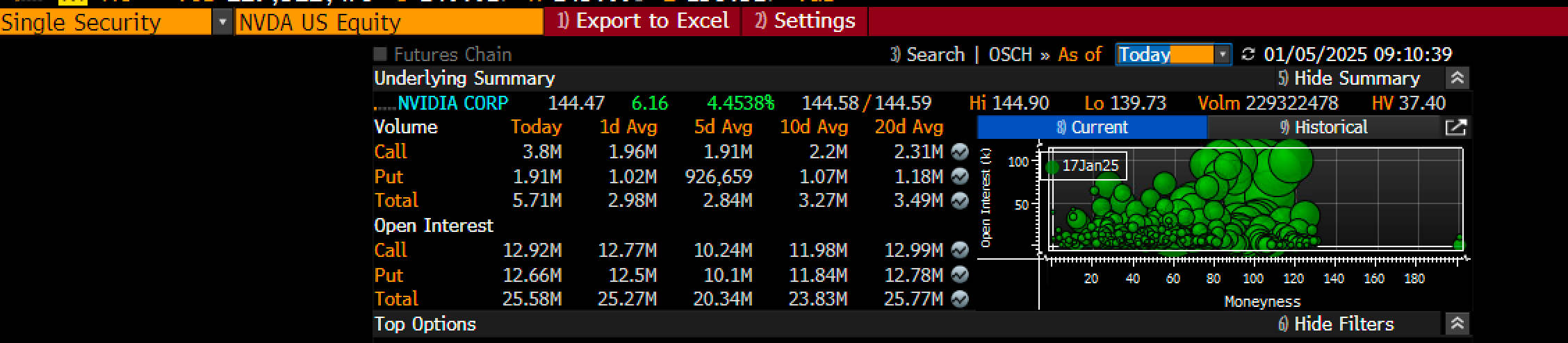

Nvidia To The Rescue, Again!

The rising

dollar

, which closed at 109.0 on Friday, reflects the higher rate environment, tightening financial conditions globally. Liquidity is also tightening, which has been evident in declining

equity valuations

since mid-December. Friday’s stock rally, mainly driven by options activity in Tesla (NASDAQ:

TSLA

) and Nvidia (NASDAQ:

NVDA

), seems more technical than fundamental.

This week will be critical in shaping rate expectations, the dollar’s trajectory, and equity performance. If credit spreads widen, multiple contraction could become a headwind for equities in 2025, mainly if earnings growth doesn’t materialize. The rally we’ve seen in the

S&P 500

has been built on multiple expansion, which may not be sustainable if spreads continue to widen.

Original Post