- Trump stays mum on tariffs and focuses on geopolitics.

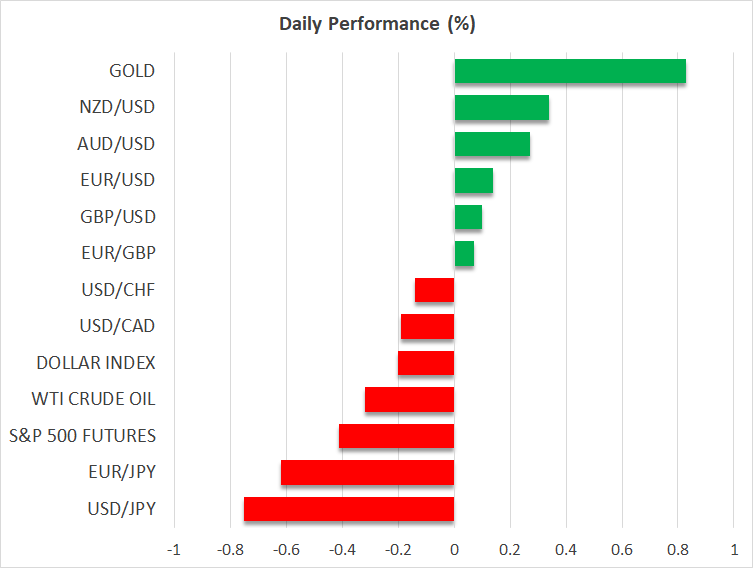

- Risk appetite remains fragile as gold skyrockets.

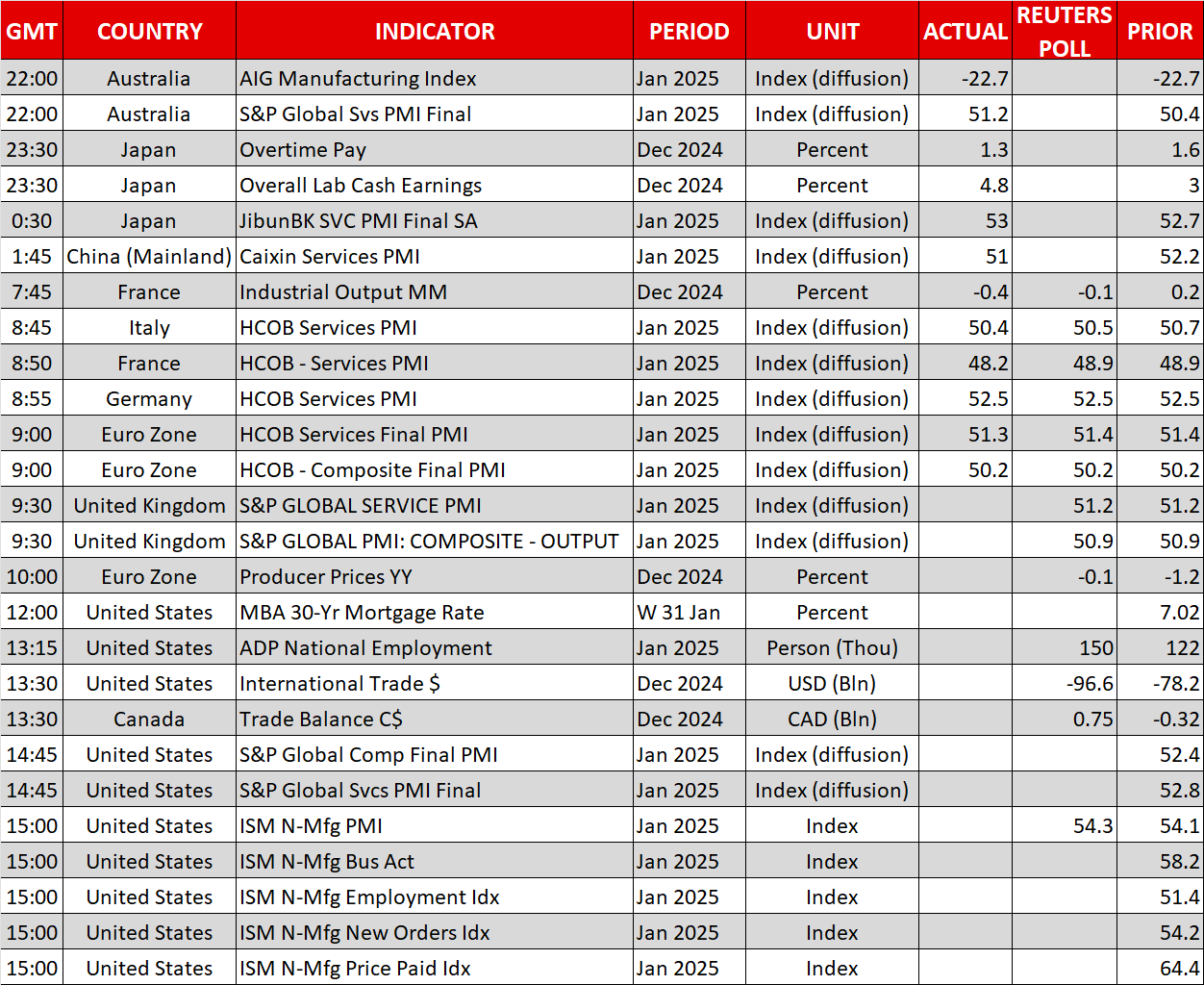

- A busy data calendar today that also includes Fed speakers.

- Yen benefits from strong data prints; oil fails to rally.

Trump Tunes into Geopolitics

Risk appetite is waning today, following Tuesday’s positive session in US equities that managed to recover most of Monday’s losses. US President Trump mostly avoided comments about tariffs on China or the European Union yesterday, but, instead, focused on geopolitics, and specifically Iran and the Gaza Strip.

While markets remember the US-Iran tensions during the 2018-2020 period and are aware of Trump’s animosity towards Iran, his comments about the US taking over and rebuilding the Gaza Strip were unexpected. Trump appears to have agreed on a plan already with Israeli PM Netanyahu. However, Gazans might not favor such a development, with Trump’s comments potentially endangering the current fragile ceasefire between Israel and Hamas.

From a market perspective, Trump has essentially brought two new reasons into the spotlight that could potentially result in severe risk-off episodes. At this juncture, the main beneficiary of Trump’s comments has been gold . At the time of writing, it is trading at $2,865, a new all-time high, as market participants are extremely concerned about Trump’s intentions regarding Iran.

Meanwhile, oil prices got a small boost yesterday, but the recent bearish trend remains intact.

A Busy Data Calendar Today

Amidst these geopolitical developments and with markets on their toes regarding additional comments from Trump about trade tariffs, a crammed data calendar might force market participants to refocus on the real economy. More specifically, the final prints of the January PMI Services surveys, the US ADP employment report and the ISM Services print for January are expected to monopolize today’s session.

Another set of positive US figures, particularly a 200k print in the ADP, might fuel expectations for another blockbuster employment report on Friday, despite the low correlation between the ADP figure and the nonfarm payroll number. Such an outcome could potentially further complicate the Fed’s outlook.

Markets are currently pricing in two 25bps rate cuts in 2025, with the first one expected at the July Fed meeting, assuming that inflation continues its gradual move lower. This is a rather difficult assumption to make considering the ongoing tariffs talk.

Interestingly, Fed Board members Jefferson and Bowman, and regional Fed Presidents Barkin and Goolsbee will be on the wires today, with a non-negligible risk of a tad more hawkish commentary from the known hawk Michelle Bowman, if today’s US data surprises on the upside.

Yen Continues to Strengthen

With Japan expected to avoid the imposition of US tariffs, solid Japanese data is fueling expectations for another BoJ rate hike soon.

Following the latest jump in labor cash earnings - the strongest year-on-year change since 1997 - and another decent PMI Services survey print, markets are pricing in 31bps of tightening in 2025, with the next 25bps rate hike fully priced in by October.

Consequently, dollar/yen has dropped below the busy 154.00 area, recording its strongest weekly loses since late November.

These yen gains might be under threat, though, as a strong series of US data this week could reenergize the

dollar

bulls.