What is DeepSeek

The announcement of DeepSeek shook the technology market this week, with many hardware companies down 20-30% after the announcement. For Background, Deep Seek is a Chinese artificial intelligence company that develops open-source large language models (LLMs).

Here is a summary of what happened in case you missed it:

- DeepSeek introduced a new AI Model called R1 based on a similar principle as Open AI's O1, which appears to be very competitive with more expensive US models.

- The company stated that it only costs $6M to make vs. hundreds of billions for competitors and that it was trained on low-end chips. While both of those statements appear questionable, as there were subsequent reports that the company did have access to H100s, the biggest point is that these innovations are only possible because US companies are innovating and spending $billions. This is very similar to the pharmaceutical industry, where new drugs are expensive to develop, but the costs significantly drop off for generic versions.

- Hardware companies were particularly hard hit, especially Nvidia (NASDAQ: NVDA ), as investors assumed that we would no longer need high-end hardware, but while companies will incorporate the "innovations" from the R1 Model, the only way to advance further will be to use more hardware. The edge that US companies have is access to hardware and this is likely to spur even more investment in hardware as companies will want to get ahead.

Here are our thoughts

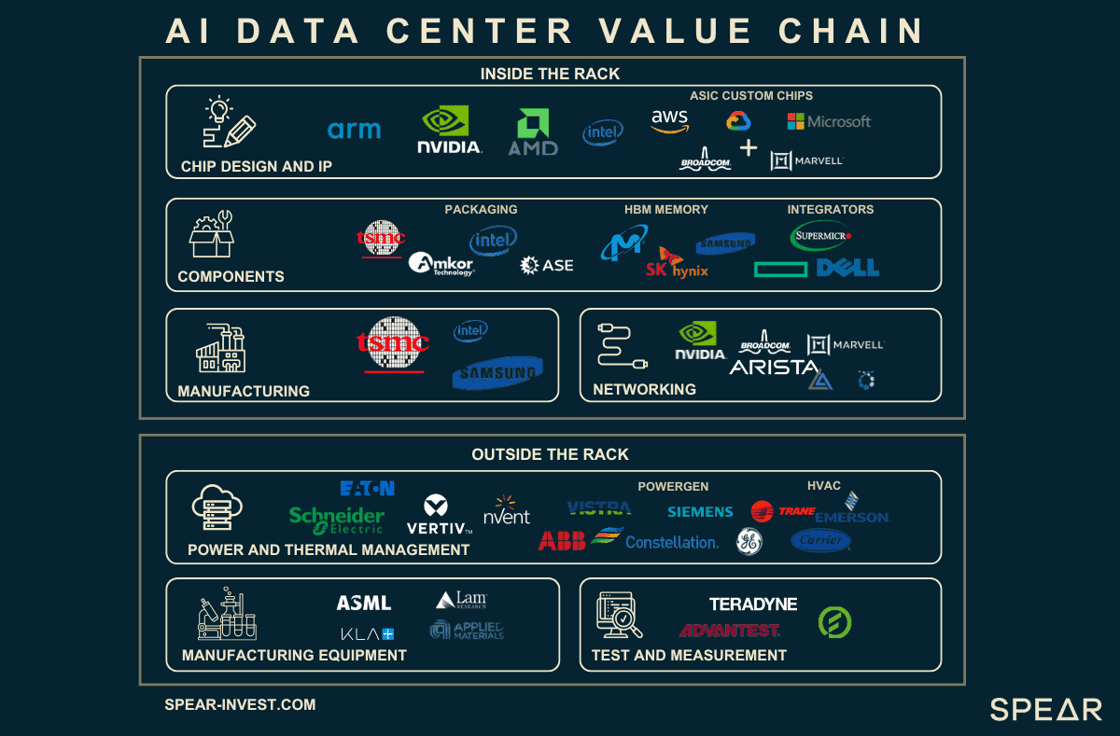

The Impact on the AI Value Chain

This announcement has implications for the entire value chain. The biggest point that investors missed is that the cheaper the models, the more possibilities there are for AI to enable a broader set of applications.

This concept is sometimes referred to as Jevon's Paradox, but it is not a paradox at all and makes a ton of intuitive sense. The cheaper the product, the more people will use it. What is the impact on each sub-sector?

AI Applications

The concept of the Jevons Paradox is most positive for AI Applications.

Both O1 (Open AI) and R1 (DeepSeek) are what are referred to as "test time scaling" models, where the model does some thinking before it responds. This new type of model training is particularly important for Agentic AI.

Agentic AI is similar to copilots used today, but unlike AI chatbots that use generative AI to provide responses based on a single interaction, Agentic AI can "think." Intro to Agentic AI in our prior report.

The potential applications of agentic AI are vast, covering nearly every service business function, ranging from customer service, content creation, cybersecurity, healthcare, etc. Companies with large installed bases of software customers will be the primary beneficiaries.

- Software development was the first area where Copilot started being used by companies like Gitlab (NASDAQ: GTLB ) and GitHub.

- Similarly, in productivity and sales, several companies have launched some co-pilot products with significant room for improvement e.g., Microsoft (NASDAQ: MSFT ), ServiceNow (NYSE: NOW ), and Salesforce (NYSE: CRM ).

- Cybersecurity and Observability companies such as CrowdStrike (NASDAQ: CRWD ), Datadog (NASDAQ: DDOG ), and Zscaler (NASDAQ: ZS ) also have AI Copilots and advancements on the LLM side would enhance those products.

Agentic AI can exceed one $ trillion in market size in the next 10 years. We covered this in more detail in our outlook webinar earlier this month

AI Models - Open-Source vs. Closed-Source

If this announcement was negative for somebody, it would be the companies that provide closed-source models. The open-source model is gaining significant steam, and closed-source models will have a very tough time competing.

All model companies now have access to the innovative features of the DeepSeek model and will likely incorporate them in their next version of models.

The way that Open Source companies are able to compete is that they have tangential ways of making money (e.g. Meta (NASDAQ: META ), xAI).

Even DeepSeek's owner has a side gig... apparently a quant hedge fund there may be a possibility that this hedge fund made a lot more than $6M on this announcement.

Compute Hardware and Power Generation

While AI Applications are likely to benefit from fundamental improvement, hardware is where most of the carnage occurred, and this is where most immediate opportunities are. More innovation will likely result in more hardware, and the stocks are now 20-30%+ cheaper.

There are three main opportunity sets:

- Compute — Nvidia is the leader, and custom chips are expected to gain steam in '25

- Networking — Meaningful innovation and upside for new entrants

- Power Generation — Underinvested for over 20+ years and is going through a cyclical upturn.

Every major tech company that reported yesterday is increasing their investment in hardware, even after a ganbusters year like '2024. Meta is increasing capex by 40-60% YOY.

Watch our CIO , Ivana Delevska, discuss the tech earnings with Jon Erlichman on BNN Bloomberg