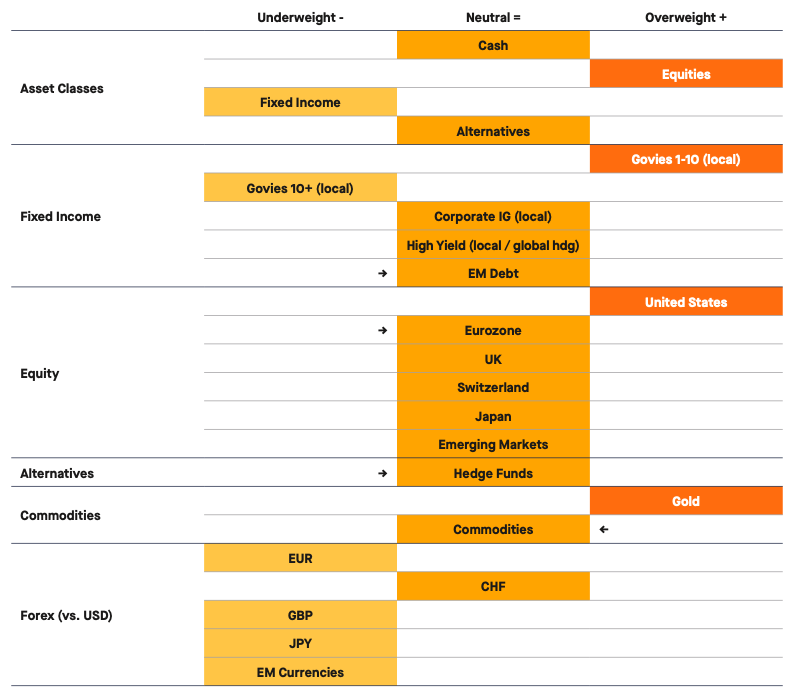

- Overall, the macro & liquidity conditions are still positive for risk assets. While equity market valuations are rich, especially in the US, earnings growth momentum is accelerating, and market dynamics remain favourable. Consequently, we maintain our overweight stance on equities and underweight on bonds.

- While we maintain our preference for US equities over the rest of the world, we are neutralising our stance on eurozone and emerging markets equities as the specific tariff risk seems to be already well priced in.

- Within rates, we continue to favour the 1-10 years segment over long-dated bonds.

- We maintain our gold and hedge funds exposure for diversification purposes. Our stance on currency (overweight dollar against major pairs except the Swiss Franc) is unchanged.

All of the US majors ended higher in January with the Dow Jones (+4.7%) outperforming both the Nasdaq 100 (+2.2%) and the Russell 2000 (+2.5%). All sectors ended the month green, with tech and staples lagging while financials and healthcare soared.

January was a Goldilocks month for macro data, with growth indicators exceeding expectations while inflation surprised to the downside—though recent figures suggest inflation remains stickier than many had hoped. U.S. Treasuries saw a wild ride in January, with yields initially surging on fears of Trump’s tariffs. As inflation data came in weaker than expected and DeepSeek’s shock drove safe-haven flows, yields reversed course and ended the month lower. Meanwhile, the dollar index weakened over the month but is now firming on the latest tariff news (see below).

In the rest of the world, European equities are off to a strong start of the year (+6.3% for the Stoxx Europe 600 and +8.7% for the SMI index ), outperforming US equities.

Similar to the 2024 playbook, the so-called “stores of value” were the best performers with Gold up +7.3% on the month and Bitcoin up+8.8%.

As a side note, equities, bonds and Forex were rather volatile during the month. During the last week of January, US equity markets experienced a particularly steep drop, driven by a sell-off in tech stocks in response to the emergence of DeepSeek. Several positive earnings surprises and upbeat forward guidance, particularly from some notable large-cap tech companies, provided a late week tailwind for stocks, helping the major indexes recover some of their earlier losses.

But as we start the month, a new risk is emerging: US tariffs.

From DeepSeek to Trade War

As January drew to a close, the White House announced that President Donald Trump would impose 25% tariffs on imports from Mexico and Canada, along with a 10% duty on Chinese goods. Energy resources from Canada would face a lower 10% tariff.

The tariffs are set to take effect on or after 12:01 a.m. ET on February 4 2025. Their removal is tied to improvements in immigration and fentanyl issues, though no clear criteria have been specified.

If the affected countries retaliate in any way, the tariffs will escalate. Trump has long favoured tariffs as a bargaining tool to push U.S. trading partners—including longstanding allies—toward meeting his demands. European Union imports could be targeted in the coming months, with the widely touted universal tariffs expected to take effect in April.

Prime Minister Justin Trudeau announced on February 1 that Canada would respond to President Trump’s decision to enact a 25% tariff on Canadian exports to the U.S. by implementing a 25% tariff against $155 billion in U.S. goods. Mexico also vowed retaliation following news of the tariffs, although President Claudia Sheinbaum did not share specifics. China, meanwhile, stopped short of an immediate escalation.

Our take

According to Strategas, Trump’s tariffs are expected to generate approximately $150 billion in annual revenue—equivalent to a 10-11% increase in the corporate tax rate. The effective tariff rate is projected to rise by 6%.

The scale of these tariffs far exceeds the 2018-19 increases on China, which totaled around $30 billion per year. Once fully implemented, the new tariffs will be 4-5 times larger than those imposed during that period.

As highlighted by Strategas, Mexico's tariffs were largely priced in, while Canada still has room to adjust. Treasury Secretary Scott Bessent recently noted that for every 10% increase in tariffs, a country's currency should depreciate by about 4%. Since August 1st, the Mexican peso has weakened by 9.4% against the US dollar , suggesting that most of the impact is already reflected. In contrast, the Canadian dollar has depreciated only about half as much, indicating further adjustment ahead.

Meanwhile, the yuan’s recent appreciation suggests it has yet to fully price in the 10% tariff increase, and we anticipate further supply chain shifts as a result. One potential upside of tariffs is that higher revenues could reduce Treasury issuance in 2025. Since tariff revenue functions like a tax increase, it is expected to help lower projected government borrowing.

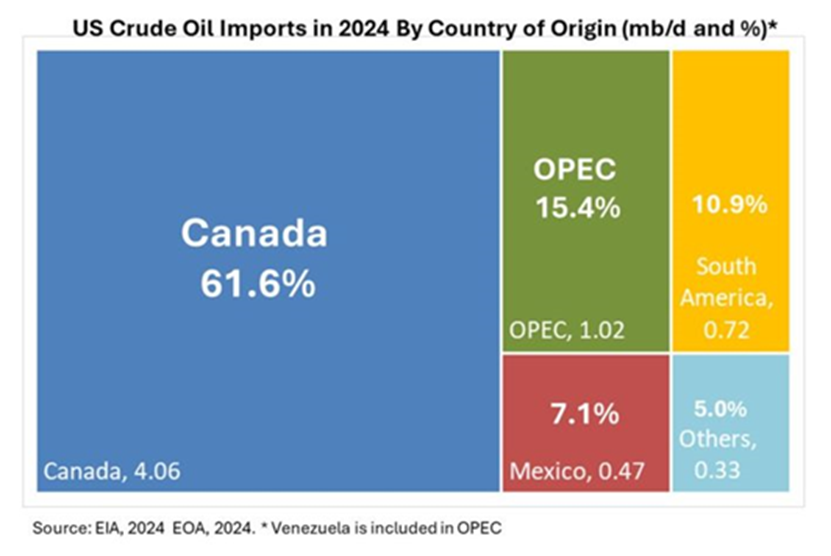

What could be the effects on risk assets? Clearly, the prospects of lower growth and higher inflation is not positive. About 7% of S&P 500 revenues is derived from Mexico, Canada and China. 62% of US crude imports come from Canada. The 10% tariff on oil imports from Canada starts on February 4, which means higher diesel prices with an impact on trucking, which is the backbone of the U.S. economy. President Trump said that Americans might feel “some pain” from the emerging trade war triggered by his tariffs against Canada, Mexico and China.

The Weight of Evidence

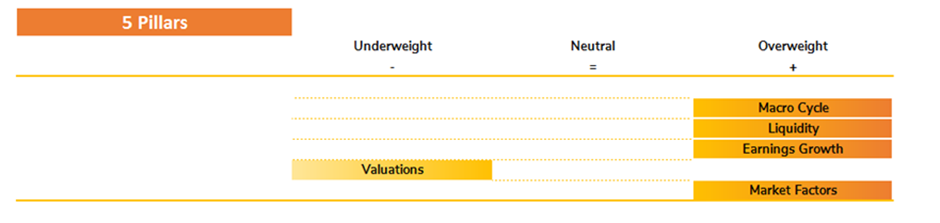

Our asset allocation preferences are based on 5 indicators, including 4 macro and fundamental indicators (leading) and 1 market dynamics (coincident). The weight of the evidence suggests to maintain an overweight allocation to equities. Below we review the positive and negative factors for each of them.

- Pillar 1: Macro cycle (POSITIVE)

Global economic growth is still positive when entering 2025, with diverging dynamics in key economic areas.

Prospects of solid nominal GDP growth in the US this year, tentative signs of improvement in China and stabilisation in Europe (even if at a low level), remain a favourable global backdrop for risk assets.

Inflation is no longer surprising to the downside and might face renewed upward pressures in DM. Inflationary pressures remain subdued in China. Wage dynamics in DM are key for the inflation outlook.

- Pillar 2: Liquidity (POSITIVE)

Gauges of global liquidity, measured in USD, have been under pressure due to the strength of the Greenback.

However, most central banks are still pursuing a path of monetary policy easing, although the size of future rate cuts may be smaller than expected in regions where fiscal policy is supporting growth and inflation. . Broad financial conditions remain generally accommodative.

Fiscal stimulus in the US and China will act as support to broad financial conditions in 2025 .

A debt ceiling crisis in the US could lead to a temporary liquidity injection if the US Treasury uses its cash balance to cover spendings and bond redemptions.

However, it’s important to consider the impact of the “Liquidity Bazooka” tied to the debt ceiling not being raised before August. This liquidity boost—estimated at over $300 billion in the next six weeks—is more than twice the annualised revenue from the newly imposed tariffs and could provide a cushion for financial markets as the tariffs take effect. .

Another important point: to justify imposing these tariffs, President Trump invoked the International Economic Emergency Powers Act (IEEPA), which has not previously been used in this context. Trump’s use of IEEPA brings significant legal liability, since the provisions have never been used or challenged previously. Impacted parties are expected to challenge the tariffs legally .

Last but not least, the likelihood that these tariffs will be temporary is quite high. Nevertheless, volatility is expected to stay elevated in the short run.

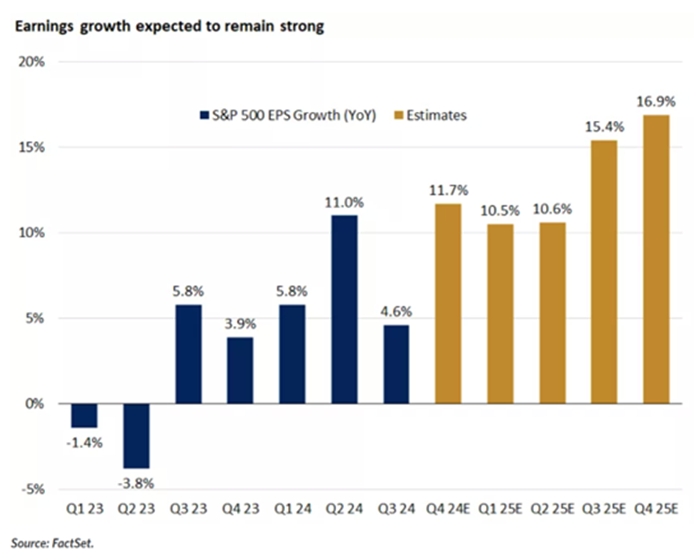

- Pillar 3: Earnings (POSITIVE)

Earnings are expected to accelerate in 2025 as more sectors are contributing to growth.

The US continues to outpace other regions, but Europe is also improving after a weak low single-digit growth in 2024.

- Pillar 4: Valuations (NEGATIVE)

Market valuation overall remains high as US equities are very expensive on every metric.

In other regions, including Europe, valuations are more reasonable.

- Pillar 5: Market Factors (POSITIVE)

Our proprietary indicators remain positive at 75% allocation to equity.

Continued pick-up from Europe with still 25% of the allocation.

INDICATORS REVIEW SUMMARY - OUR FIVE PILLARS

Overall, the weight of the evidence is slightly positive for equities with 4 pillars signalling an OVERWEIGHT stance in equities and one pillar (valuations) an underweight.

- Overall, the macro & liquidity conditions are still positive for risk assets. While equity market valuations are rich, especially in the US, earnings growth momentum is accelerating, and market dynamics remain favourable. Consequently, we maintain our overweight stance on equities and underweight on bonds.

- While we maintain our preference for US equities over the rest of the world, we are upgrading eurozone and emerging markets equities from underweight to neutral as the specific tariff risk seems to be already well priced in.

- Within rates, we continue to favour the 1-10 years segment over long-dated bonds. We are upgrading emerging markets debt from underweight to neutral.

- We maintain our gold and hedge funds exposure for diversification purposes. We downgraded commodities from overweight to neutral.

- Our stance on currency (overweight dollar against major pairs except the Swiss Franc ) is unchanged. Tariffs are bullish dollar at least in the short to medium-term.

TACTICAL ASSET ALLOCATION (TAA) DECISIONS

Equity (still OVERWEIGHT)

- Increase Europe back to neutral.

- Increase EM back to neutral.

- Lower weight allocated to US equities to fund the above two but remain overweight.

Bonds (still UNDERWEIGHT)

- Increase EM debt to neutral.

Commodities

Reduce commodities back to neutral

Asset Allocations:

Original Post