- Investors are hopeful that a trade war can be averted.

- Dollar and Treasury yields slide ahead of tomorrow’s NFP.

- Yen rallies on BoJ hawkish remarks; BoE decides on rates.

- Wall Street gains, gold climbs to new record highs.

Can a Trade War Be Averted?

The

US dollar

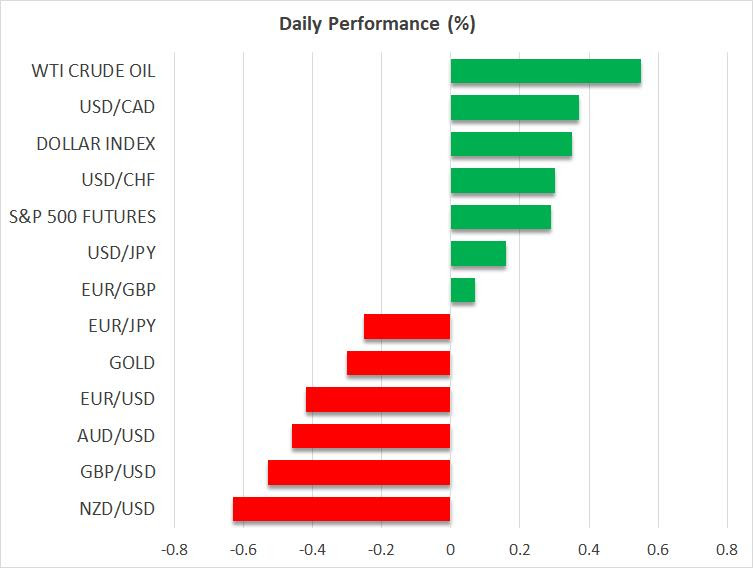

fell against all its major peers yesterday, extending its latest correction triggered by Trump’s decision to delay tariffs on Mexico and Canada. Today, the greenback is reclaiming some of the lost ground.

Although Trump imposed tariffs on China - with the world’s second-largest economy responding with retaliatory tariffs that are scheduled to kick in on February 10 - trading activity is suggesting that investors are likely optimistic that some kind of deal can be struck between the two nations before Monday’s deadline.

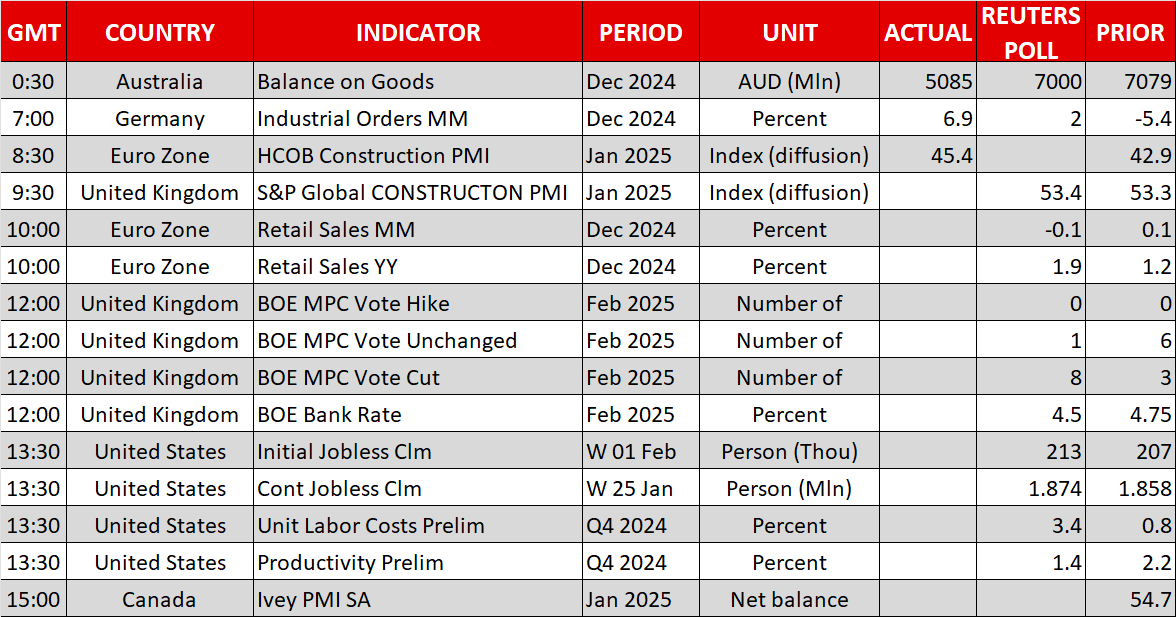

Hopes that a full-scale trade war can be averted are also reflected in Fed Funds futures, according to which investors have added some basis points worth of Fed rate cuts to their bets for this year. The unexpected slide in the ISM non-manufacturing PMI for January may have also played a role, but whether rate cut bets will be pushed further or come forward may largely depend on tomorrow’s NFP report.

Another month of strong job gains accompanied by robust wage growth may convince investors that the Fed can wait for a while longer before pressing the rate-cut button again, especially if Fed Governor Waller, who is scheduled to speak today, sounds a bit less dovish than he did last time.

Yen Rallies as BoJ Officials Signal More Hikes

The biggest gainer was the Japanese yen , getting an early boost from strong Japanese wage data as well as remarks from the director-general of the BoJ’s monetary affairs department, who told parliament that they will continue to raise interest rates if underlying inflation accelerates towards their target as projected. The rally extended overnight after BoJ member Tamura said that they must raise interest rates to at least 1% by the second half of the upcoming fiscal year.

The hawkish commentary prompted market participants to bring forward their rate hike expectations. From anticipating the next quarter-point increase by December, they now foresee it materializing by September.

Will the BoE Opt for a Hawkish Cut?

Today, the BoE holds its first monetary policy gathering for 2025, and market participants are widely expecting a 25bps reduction following December’s pause.

Having said that though, the pound’s decline due to concerns over the sustainability of the new government’s fiscal plans is posing upside risks to inflation. Therefore, if the anticipated rate cut is accompanied by upwardly revised inflation projections, those expecting two more reductions this year are likely to be disappointed, allowing the GBP/USD to gain some more ground.

Wall Street Gains on Tariff Relief, Gold Enters Uncharted Territory

Wall Street’s major indices closed higher on Wednesday due to a weakening dollar and sliding Treasury yields, also reflecting receding fears of an escalating trade war between the US and its main trading partners.

That said, market participants are likely to continue closely watching headlines about Trump’s plans to take over the Gaza Strip. Considering the tensions and the complexity of the conflict in the Middle East, investors may treat Trump’s intentions with a degree of cautiousness.

Amazon (NASDAQ: AMZN ) will announce its results today after the closing bell. However, with Trump stealing the spotlight, this earnings season seems to have taken a backseat.

Despite yesterday’s risk appetite, gold extended its rally to new record highs, as the slide in Treasury yields has reduced the opportunity cost for holding the precious metal. Once again, the continuation of

gold

’s steep rally confirms the notion that regardless of whether the dollar rises or retreats, the current environment is positive for gold, either through safe-haven inflows or due to increasing Fed rate cut bets.